Mobile Money Market Expands Rapidly as Digital Payments Transform Financial Access

"Executive Summary Mobile Money Market Size and Share Analysis Report

CAGR Value

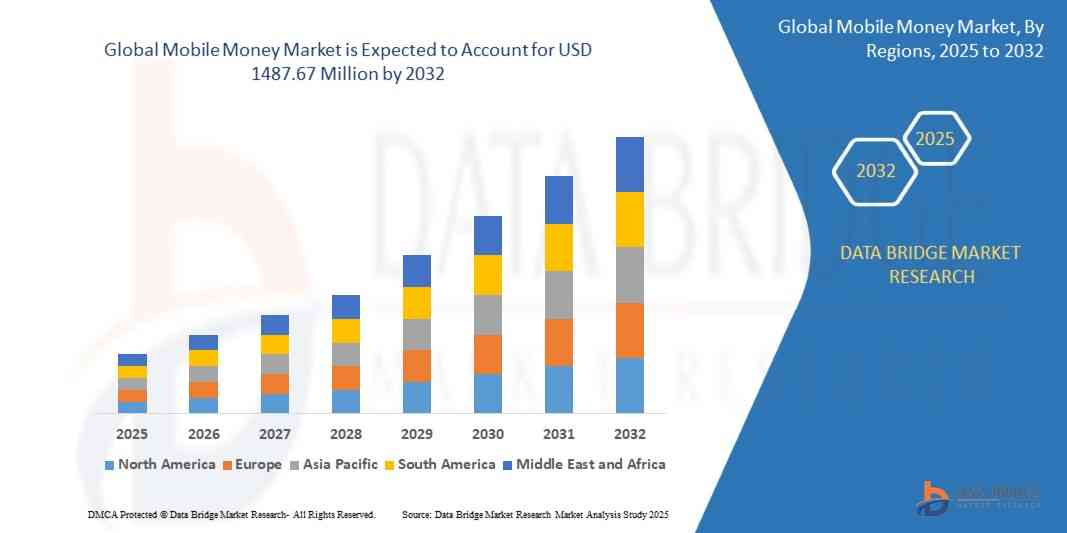

- The global mobile money market was valued at USD 139.73 million in 2024 and is expected to reach USD 1487.67 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 34.40%, primarily driven by the rapid penetration of smartphones and internet connectivity

the Mobile Money Market analysis report, the strength and weakness of the competitors can be assessed. The dimensions of the marketing problems can be identified with the report. It helps in ascertaining the distribution methods suited to the product and estimating the market share and probable sales volume of a firm. The report is an aid to assess the reaction of the consumers to the packaging of the firm and to make packaging as attractive as possible. This global Mobile Money Market report makes it easy to know the transportation, storage, and supply requirements of its products.

The report is very helpful for the firm in exploring new uses for its existing products and thereby, increasing the demand for its products. It guides the business in making sales forecasts for its products and thereby, establishing harmonious adjustment between demand and supply of its products. This Mobile Money Market document also assists the firm in exploring new markets for its products. With such high quality, in-depth market research studies, clients can obtain granular level clarity on current business trends and expected future developments. The document satisfies client’s needs, providing custom solutions that best fit for strategy development and implementation to extract tangible results.

Explore emerging trends, key drivers, and market strategies in our in-depth Mobile Money Market analysis. Get the full report: https://www.databridgemarketresearch.com/reports/global-mobile-money-market

Mobile Money Market Insights:

Segments

- Based on transaction mode, the global mobile money market can be segmented into mobile applications, SMS, and USSD.

- By nature of payment, the market can be classified into person to person, business to person, and person to business.

- Considering location, the market can be divided into domestic mobile money and international mobile money.

- On the basis of type of purchase, the market can be segmented into airtime transfers and top-ups, money transfers and payments, merchandise and coupons, and travel and ticketing.

Market Players

- Vodafone Group

- Gemalto

- FIS

- Google

- Mastercard

- PayPal

- Bharti Airtel

- Orange S.A.

- Monitise

- Mahindra Comviva

The global mobile money market is witnessing significant growth and is expected to continue expanding in the coming years. The rise in the adoption of smartphones, increasing internet penetration, and the growing trend towards cashless transactions are some of the key factors driving the market. Mobile money offers convenience, security, and accessibility, making it a preferred choice for a wide range of financial transactions.

The market segments provide a comprehensive view of the different aspects of mobile money services. Mobile applications are gaining popularity due to their user-friendly interface and ease of access. SMS and USSD-based transactions cater to a wider audience, including those with feature phones or limited internet connectivity. Person to person transactions dominate the nature of payments segment, while business to person and person to business transactions are also gaining traction.

Domestic mobile money services are prevalent in mature markets, whereas international mobile money transactions are becoming more common with the rise of globalization and cross-border commerce. Airtime transfers and top-ups are a popular type of purchase, especially in regions with limited banking infrastructure. Money transfers and payments are the core of mobile money services, facilitating seamless transactions for individuals and businesses alike. Merchandise and coupons, as well as travel and ticketing services, are also on the rise, offering users a wide range of options for utilizing mobile money.

Key players in the market include telecom companies like Vodafone and Bharti Airtel, technology firms like Gemalto and Google, as well as financial service providers like FIS and Mastercard. Digital payment giants such as PayPal are also actively involved in shaping the mobile money landscape. Companies like Orange S.A., Monitise, and Mahindra Comviva are driving innovation in mobile money solutions, offering a diverse range of services to cater to the evolving needs of consumers.

Overall, the global mobile money market is poised for substantial growth, fueled by technological advancements, changing consumer preferences, and increasing partnerships between key industry players. As the market continues to evolve, we can expect to see more innovative mobile money services, enhanced security features, and expanded accessibility for users worldwide.

The global mobile money market is experiencing a paradigm shift driven by factors such as evolving consumer behavior, technological advancements, and regulatory changes. One emerging trend is the integration of mobile money services with other financial products, such as savings accounts and insurance, creating a more comprehensive financial ecosystem for users. This convergence of traditional banking services with mobile money solutions is set to redefine the landscape of financial inclusion, particularly in emerging economies where access to formal banking services is limited.

Moreover, the market is witnessing a surge in demand for mobile money services that offer seamless cross-border transactions at competitive rates. This trend is fueled by the increasing globalization of businesses and the growing need for cost-effective and efficient remittance solutions. Companies in the mobile money space are exploring partnerships and collaborations to enhance their international reach and provide users with a seamless experience for conducting transactions across different geographies.

Another key development in the mobile money market is the rising focus on enhancing security measures to address concerns around data privacy and fraud prevention. As mobile money transactions become more prevalent, ensuring the integrity and confidentiality of user information is paramount to building trust and credibility in the market. Companies are investing in robust cybersecurity infrastructure and leveraging technologies like biometrics and encryption to fortify their platforms against potential security risks.

Furthermore, the market is witnessing a shift towards personalized and tailored mobile money solutions that cater to specific user needs and preferences. Customized offerings, such as loyalty programs, cashback incentives, and targeted promotions, are being increasingly deployed to enhance user engagement and drive adoption of mobile money services. By leveraging data analytics and artificial intelligence, companies can gain deeper insights into user behavior and deliver more targeted and relevant services.

Overall, the global mobile money market is at a critical juncture, poised for rapid expansion and innovation. As technology continues to advance and consumer expectations evolve, companies in the mobile money space will need to stay agile and responsive to emerging trends to capitalize on the vast opportunities presented by this dynamic market. By aligning their strategies with the evolving needs of users and leveraging partnerships and technological advancements, players in the mobile money ecosystem can position themselves for sustainable growth and success in the years to come.The global mobile money market is currently experiencing a transformative phase driven by various factors that are reshaping the industry landscape. One notable trend is the convergence of mobile money services with traditional banking products, such as savings accounts and insurance. This integration is creating a more holistic financial ecosystem for users, especially in emerging economies where access to formal banking services is limited. By offering a wider range of financial products through mobile platforms, companies are enhancing financial inclusion and providing users with comprehensive solutions to meet their diverse needs.

Another significant trend in the mobile money market is the increasing demand for cross-border transaction capabilities at competitive rates. With businesses becoming more globalized and the need for efficient remittance solutions growing, mobile money service providers are focusing on seamless cross-border transactions to cater to the international financial needs of users. Through strategic partnerships and collaborations, companies are expanding their reach and offering users a convenient way to conduct transactions across different regions, further driving the adoption of mobile money services on a global scale.

Security remains a top priority in the mobile money market, with companies intensifying their efforts to enhance data privacy and fraud prevention measures. As mobile transactions become more prevalent, ensuring the security and confidentiality of user information is crucial to building trust and credibility among users. By investing in robust cybersecurity infrastructure and leveraging advanced technologies such as biometrics and encryption, companies are fortifying their platforms against potential security threats and boosting user confidence in mobile money services.

Personalization is also emerging as a key focus area in the mobile money market, with companies developing tailored solutions to meet specific user preferences and needs. Customized offerings like loyalty programs, cashback incentives, and targeted promotions are being leveraged to enhance user engagement and increase the adoption of mobile money services. By harnessing the power of data analytics and artificial intelligence, companies can gain valuable insights into user behavior and deliver more personalized and relevant services, ultimately driving user satisfaction and loyalty in the competitive mobile money landscape.

In conclusion, the global mobile money market is poised for rapid growth and innovation, fueled by evolving consumer demands, technological advancements, and strategic collaborations. By staying agile and responsive to market trends, companies in the mobile money ecosystem can position themselves for long-term success and capitalize on the vast opportunities presented by this dynamic and fast-growing industry.

Explore the company's market share breakdown

https://www.databridgemarketresearch.com/reports/global-mobile-money-market/companies

Comprehensive Question Bank for Mobile Money Market Research

- What is the current valuation of the global Mobile Money Market?

- How fast is the Mobile Money Market expected to expand in the coming years?

- Which segments are highlighted in the Mobile Money Bags market study?

- Which companies hold the largest market share in Mobile Money Market?

- What geographic breakdown is included in the Mobile Money Market analysis?

- Who are the prominent stakeholders in the global Mobile Money Market?

Browse More Reports:

Global Plant-Based Food Market

Global Aromatherapy Market

Global Eyewear Market

Global Kimchi Market

Global Smart Farming Market

Global Tomatoes Market

North America Japanese Restaurant Market

Global Automotive AfterMarket

Global Cataracts Market

Global Electronic Paper (E-Paper) Display Market

Global 2,5-Furandicarboxylic Acid (FDCA) Market

Global Hypochlorous Acid Market

Global Pickup Truck Market

Global Wearable Devices Market

Europe Electric Bike (E-Bike) Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness