Europe Bancassurance Market Share, Size, Trends, Revenue, Analysis Report 2025-2033

Europe Bancassurance Market Overview

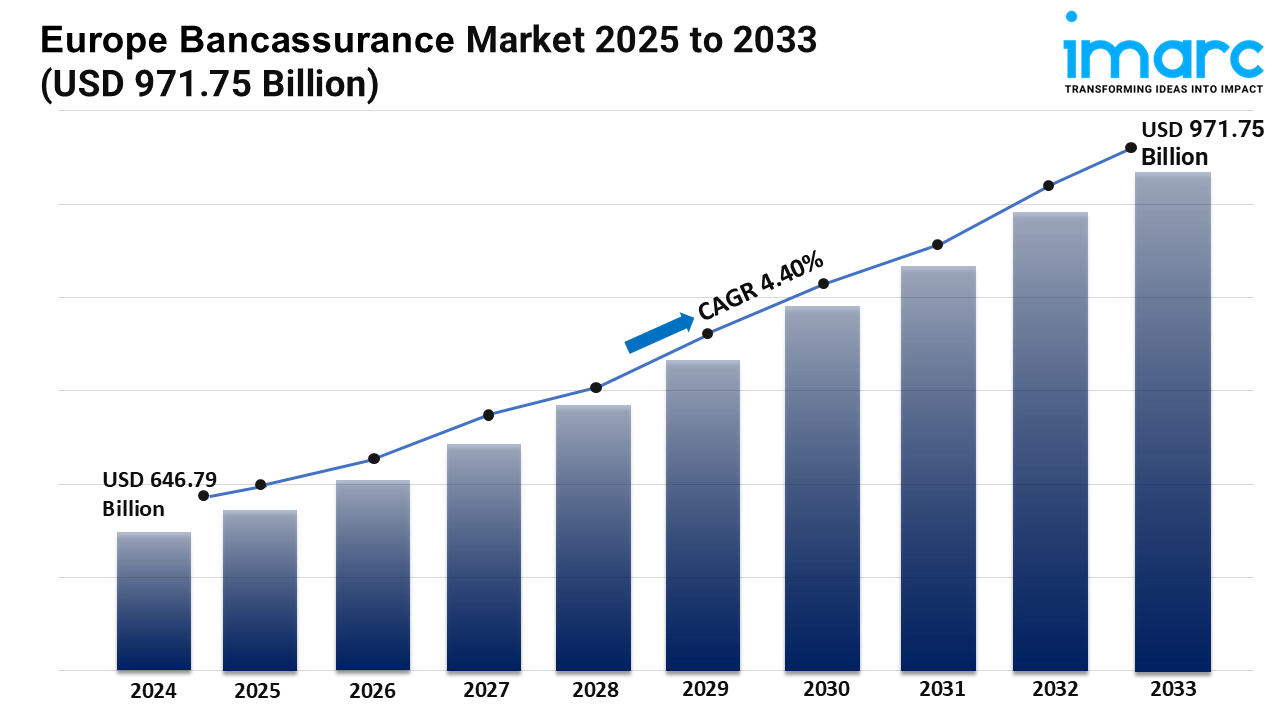

Market Size in 2024: USD 646.79 Billion

Market Forecast in 2033: USD 971.75 Billion

Market Growth Rate: 4.40% (2025-2033)

According to the latest report by IMARC Group, the Europe bancassurance market size was valued at USD 646.79 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 971.75 Billion by 2033, exhibiting a CAGR of 4.40% from 2025-2033.

Europe Bancassurance Industry Trends and Drivers:

Strong expansion is being seen in the Europe bancassurance market right now as a result of a number of major forces transforming the financial services environment. The increasing digitizing trend inside the business is among the most potent forces. Customers have easier access to a great variety of services, including banking and insurance, as financial companies and insurance companies increasingly use digital platforms. The ease of internet channels is improving customer experience and simplifying the purchase of insurance solutions combined with their banking products. Moreover, the growth of mobile banking apps and digital wallets is helping banking and insurance products to be easily integrated. This move toward digital channels not only improves market access but also raises consumer involvement and opens up cross-selling possibilities for financial institutions. Moreover, programs designed to raise financial knowledge are enabling consumers all throughout Europe to make more educated decisions, hence stimulating demand for bancassurance goods satisfying their changing financial demands.

The evolving customer preferences and expectations are another major driver of the expansion of the bancassurance industry. Individuals are becoming more and more drawn to the packaged products offered by bancassurance systems as they look for more convenience and customized services. Particularly for time-conscious tech-savvy consumers, the chance to use both banking and insurance services under one platform is getting very tempting. Financial institutions are able to serve a wider spectrum of customer needs thanks to the combination of insurance products—life, health, and home insurance among them—with banking services. Banks are concurrently seeing the strategic advantages of including insurance in their portfolios as a means to diversify revenue sources and improve customer relationships. In nations with increasing financial inclusion and more digital penetration, these changes are especially obvious; they propel bancassurance product growth.

Looking forward, the European bancassurance sector is projected to maintain its upward path driven by ongoing developments in customer-focused services as well as technology. The market is seeing developments in product offers as insurance companies and banks improve their digital capabilities. These include customized insurance plans that more closely fit with clients' financial profiles. Furthermore helping the growth of bancassurance is changing legal systems throughout Europe, which lets companies provide more adaptable and varied products. The market is becoming more competitive as financial institutions and insurance companies work together more often, therefore promoting better product development and consumer happiness. These changes point to the continued prosperity of the European bancassurance market, which presents fresh possibilities for both customers and financial services providers in the next years together with the increasing focus on customized financial solutions.

Download sample copy of the Report: https://www.imarcgroup.com/europe-bancassurance-market/requestsample

Europe Bancassurance Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product Type:

- Life Bancassurance

- Non-Life Bancassurance

Analysis by Model Type:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- BNP Paribas

- Banco Santander

- ING Group

- Lloyds Banking Group

- Barclays Bank Plc

- Intesa Sanpaolo

- ABN AMRO

- Banco Bradesco Europa

- American Express Company

- Wells Fargo

Latest News and Developments:

- April 2025: Hellenic Bank Public Company Limited completed the acquisition of CNP Cyprus Insurance Holdings Ltd. from CNP Assurances SA. The deal was valued at approximately €180 million and expands Hellenic Bank’s insurance portfolio in Cyprus.

- March 2025: Crédit Mutuel Alliance Fédérale announced plans to acquire 100% of German bank Oldenburgische Landesbank (OLB) through its subsidiary TARGOBANK, marking a major expansion in Germany, Europe’s largest economy. This strategic move accelerates TARGOBANK’s transformation into a universal bancassurer, combining retail banking, corporate financing for Mittelstand companies, and wealth management. The combined group will become Germany’s tenth largest bank, serving 4.8 million customers with €79 billion in assets.

- March 2025: Piraeus Bank signed an agreement to acquire a 90.01% stake in Ethniki Insurance, a leading Greek insurer, from CVC Capital Partners for €600 million. The acquisition will diversify Piraeus’ revenue, enhance product offerings, and improve earnings.

- November 11, 2024: AXA Switzerland and additiv recently announced the launch of a new digital bancassurance solution called addProtect. This offers banks the opportunity to easily protect mortgage customers with low setups. Additionally, it provides death and payment protection insurance for higher financial protection and value for clients.

- September 2024: UniCredit announced the internalization of its life bancassurance business in Italy, acquiring full control of CNP UniCredit Vita and UniCredit Allianz Vita to enhance growth and synergies.

- June 13, 2023: Admiral Seguros and ING Spain unveiled the 100% digital bancassurance product, ING Orange Auto Insurance, which was meant to change the auto insurance industry. It combines the insurance capabilities of Admiral Group with the banking service capabilities of ING to create flexible, digitally-integrated solutions for customers. The partnership is one of the key steps in the digital transformation of bancassurance.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=4633&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness