Europe Commercial Printing Market Trends, Share Analysis, and Growth Outlook to 2033

Market Overview

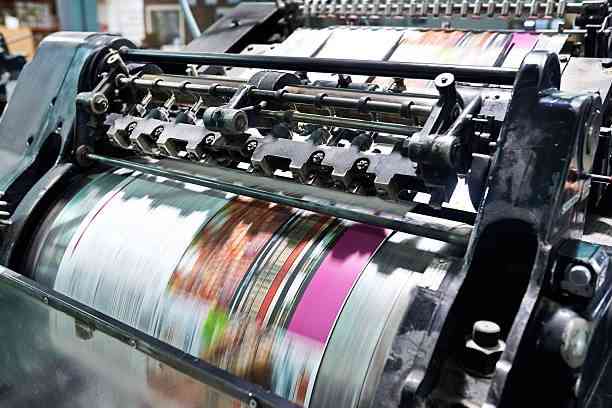

The Europe commercial printing market was valued at USD 231.0 Billion in 2024 and is projected to reach USD 240.0 Billion by 2033, expanding at a CAGR of 0.40% during the forecast period of 2025-2033. Germany leads the market due to its strong industrial base and demand across packaging, advertising, and publishing industries. Key drivers include the rising packaging industry, digital printing advancements, eco-friendly initiatives, and increasing adoption of automation enhancing printing efficiency.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Europe Commercial Printing Market Key Takeaways

- The market size was USD 231.0 Billion in 2024.

- The market CAGR is 0.40% during 2025-2033.

- Forecast market size is USD 240.0 Billion by 2033.

- Germany dominates the market in 2024 with a strong industrial base and sophisticated printing technologies.

- The packaging industry expansion is a major growth driver, fueled by e-commerce and food & beverage sectors.

- Sustainability efforts include eco-friendly inks, recyclable materials, and energy-efficient processes aligning with EU goals.

- Digitization and automation, including AI-driven workflows, are enhancing production efficiency and reducing costs.

Sample Request Link: https://www.imarcgroup.com/Europe-Commercial-Printing-Market/requestsample

Market Growth Factors

Demand for packaging grows due to global e-commerce and food and beverage industries which drives the Europe commercial printing market. Aesthetic and durable packaging attracts consumers toward investment, prompting commercial printers to invest in high-speed and high-resolution printing technologies. The demand for short-run and variable printing that supports branding applications has also contributed to market growth.

Sustainability worries grow so green inks, recyclable substrates and energy-efficient printing processes are used more often to meet the European Union's sustainability goals. To comply with regulations and sustain operations is key for improvements to competitiveness by the EU printing industry. This industry includes about 120,000 companies with 770,000 employees.

Digital transformation of e-commerce, education, healthcare and the financial service sector has resulted in a continuous need for printed items like brochures, manuals and marketing collateral. Increasingly hybrid work patterns are driving the demand for professional printing services across various locations. Automation and workflow management systems integrated with artificial intelligence, along with digital printing and finishing, are reducing cycle times and costs, making commercial printing more accessible to businesses of all sizes. More on-demand production and web to print services are improving the customer experience and improving opportunities for revenue.

Market Segmentation

Analysis by Technology:

- Lithographic Printing: Dominated the market in 2024 due to high-quality output, cost-efficiency for large volumes, versatility, and advances in automation enhancing speed and reducing labor costs. Ideal for marketing materials, packaging, books, and newspapers.

- Digital Printing: Increasingly adopted due to precision, flexibility, and growing market demand.

- Flexographic Printing: Gaining traction for cost-effective and versatile packaging applications.

Analysis by Print Type:

- Image: Led the market in 2024 because of demand for visually rich advertising, packaging, and promotional materials. Advances in high-resolution printing and digital workflows facilitate faster, cost-effective image reproduction.

Analysis by Application:

- Packaging: Dominated the market in 2024 driven by demand from food and beverage, pharmaceuticals, cosmetics, and e-commerce sectors. Innovations include recyclable materials and eco-friendly inks, aligned with regulatory and consumer sustainability preferences.

Regional Insights

Germany dominated the Europe commercial printing market in 2024, supported by its advanced industrial infrastructure and strong economic base. It hosts leading printing press manufacturers and packaging firms contributing to a well-developed supply chain and high-tech production capabilities. Innovations such as Heidelberg’s Jetfire range combine offset and digital printing to boost efficiency. Germany’s commitment to sustainability, automation, and digital printing solutions solidify its leadership. The country benefits from skilled workforce, supportive policies, and an export-driven economy, maintaining its market dominance.

Recent Developments & News

In April 2025, AstroNova announced the launch of two digital label presses and a direct-to-package printer at the FESPA Global Print Expo in Berlin to enhance speed and flexibility. InkTec reported its first European sale of the Jetrix XAR320-Hybrid large-format printer in April 2025. In October 2024, Ricoh established Ricoh Printing Solutions Europe Limited in the UK to consolidate its industrial printing operations focused on inkjet technology and digitization. SATO launched the LR4NX print and apply labeling machines in 38 European countries for high-volume labeling. In November 2024, Impossible Objects introduced the CBAM 25 3D printer in Europe, notable for its rapid printing speed and precision.

Key Players

- Heidelberg

- Kyocera

- AstroNova

- InkTec

- Ricoh

- SATO

- Impossible Objects

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness