Antihyperlipidemic Drugs Market: Cardiovascular Risk Management and Therapy Adoption, 2025–2033

Market Overview

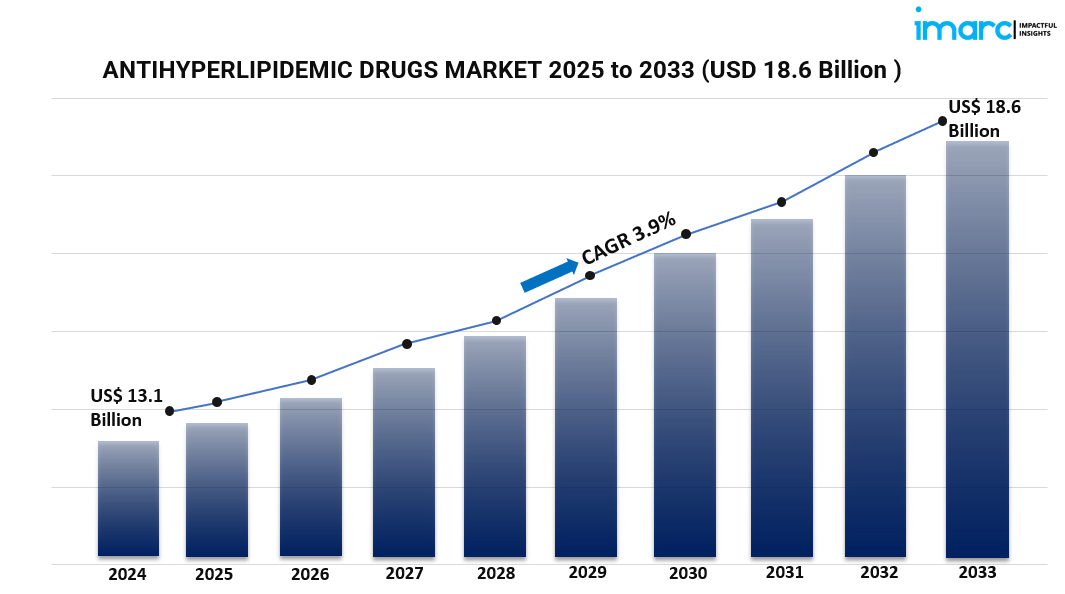

The global Antihyperlipidemic Drugs Market was valued at USD 13.1 Billion in 2024 and is projected to reach USD 18.6 Billion by 2033, exhibiting a CAGR of 3.9% from 2025 to 2033. Market growth is driven by increasing prevalence of hyperlipidemia and cardiovascular diseases, along with lifestyle factors like obesity and sedentary habits. Innovations in lipid-lowering therapies and supportive government initiatives further propel the market expansion.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Antihyperlipidemic Drugs Market Key Takeaways

- The global antihyperlipidemic drugs market size was USD 13.1 Billion in 2024.

- The market is expected to grow at a CAGR of 3.9% during 2025-2033.

- North America dominates the market with over 32.7% share in 2024.

- Rising hyperlipidemia and cardiovascular diseases drive the market demand.

- Statins hold the largest drug class share of around 38.7% in 2024.

- Oral route of administration dominates due to ease and high patient compliance.

- Hospital pharmacies are the leading distribution channel.

Sample Request Link: https://www.imarcgroup.com/antihyperlipidemic-drugs-market/requestsample

Market Growth Factors

The global antihyperlipidemic drugs market is significantly driven by the rising prevalence of hyperlipidemia and cardiovascular diseases, which remain leading causes of mortality worldwide. In 2024, over one billion people are estimated to be obese globally, including approximately 880 million adults and 159 million children and adolescents aged 5 to 19, data released by the NCD Risk Factor Collaboration (NCD-RisC) reveals. Around 3 billion people are overweight or obese, as per World Obesity Federation data, leading to increased cholesterol levels and demand for lipid-lowering drugs. Unhealthy diet, sedentary lifestyle, and genetic predisposition further contribute to elevated cholesterol, pushing healthcare providers to adopt statins, PCSK9 inhibitors, and other therapies. Government cholesterol management programs also promote market growth.

Continuous R&D and innovation foster the development of novel lipid-lowering therapies such as PCSK9 inhibitors (evolocumab, alirocumab), bempedoic acid, and combination treatments. Statins dominate due to cost-effectiveness and efficacy, while newer therapies address statin intolerance and high-risk lipid profiles. Gene-based treatments and biologics enhance patient compliance and efficacy. FDA approvals for new agents, such as the recent authorization of Ctexli (chenodiol) for cerebrotendinous xanthomatosis in 2025, and clinical trials for next-generation therapies sustain competitive dynamics. Pharmaceutical investments in AI-driven drug discovery and precision medicine also boost innovation.

Government initiatives bolster demand through preventive healthcare programs, cholesterol screening guidelines, reimbursement policies, and public awareness campaigns. Regions such as North America and Europe benefit from strong insurance coverage and prescription plans facilitating access to both generic and advanced lipid-lowering drugs. Regulatory agencies like FDA and EMA encourage cost-effective generics and research in cardiovascular prevention, enhancing market outlook. For example, in November 2024, Esperion filed an NDA for bempedoic acid in Japan, supporting expanded treatment options.

Market Segmentation

Analysis by Drug Class:

- Statins: The largest segment with about 38.7% market share in 2024, favored for LDL cholesterol reduction, cardiovascular risk prevention, and broad clinical support. Atorvastatin, rosuvastatin, and simvastatin are prominent drugs. They are favored due to extensive clinical backing, affordability, generic availability, and insurance coverage.

- Bile Acid Sequestrants

- Cholesterol Absorption Inhibitors

- Fibric Acid Derivatives

- PCSK9 Inhibitors

- Combination

- Others

Analysis by Route of Administration:

- Oral: Dominant route due to ease of administration, high compliance, and widespread availability. Most statins and other drugs like ezetimibe and fibrates are oral, aided by affordability and generic availability.

- Intravenous: Gains significance with demand for PCSK9 inhibitors such as evolocumab and alirocumab, often used for patients with statin intolerance or severe hypercholesterolemia. Preferred in hospitals for rapid cholesterol control.

Analysis by Distribution Channel:

- Hospital Pharmacies: Hold the major share due to high prescription volume for cardiovascular patients in hospital settings. Provide immediate access, consistent supply, and integrated insurance and reimbursement facilitation.

- Retail Stores

- Online Retailers

Regional Insights

North America dominates the global antihyperlipidemic drugs market with over 32.7% share in 2024. The region benefits from high hyperlipidemia, obesity, and cardiovascular disease prevalence, advanced healthcare infrastructure, strong pharmaceutical R&D investment, and widespread adoption of statins and novel therapies. Government initiatives, insurance coverage, and preventive health programs further support growth. Clinical advancements, regulatory approvals, and collaborations also fuel market expansion in the United States and Canada.

Recent Developments & News

- February 2025: Hansoh Pharmaceutical and Shanghai Hansoh Biomedical introduced new PCSK9 inhibitors targeting LDL cholesterol reduction for stroke, dyslipidemia, and coronary artery disease treatment.

- January 2025: FDA-approved monoclonal antibodies alirocumab and evolocumab continue to show cardiovascular benefits; a third FDA-approved agent under evaluation.

- November 2024: Innovent Biologics included SINTBILO® (tafolecimab injection) in China’s National Reimbursement Drug List, effective January 1, 2025.

- May 2024: Esperion Therapeutics markets NEXLETOL® (bempedoic acid) and NEXLIZET® (bempedoic acid/ezetimibe) to lower LDL cholesterol.

- January 2024: Inclisiran, a two-dose annual gene-silencing drug, launched in India, reducing LDL-C by 50-60%, priced at ₹1.2 lakh per dose.

Key Players

- Amgen Inc.

- AstraZeneca plc

- Daiichi Sankyo Company Limited

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5622&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness