MENA Crypto Wallet Market, Analysis, Trends, Growth and Forecast (2024-2032)

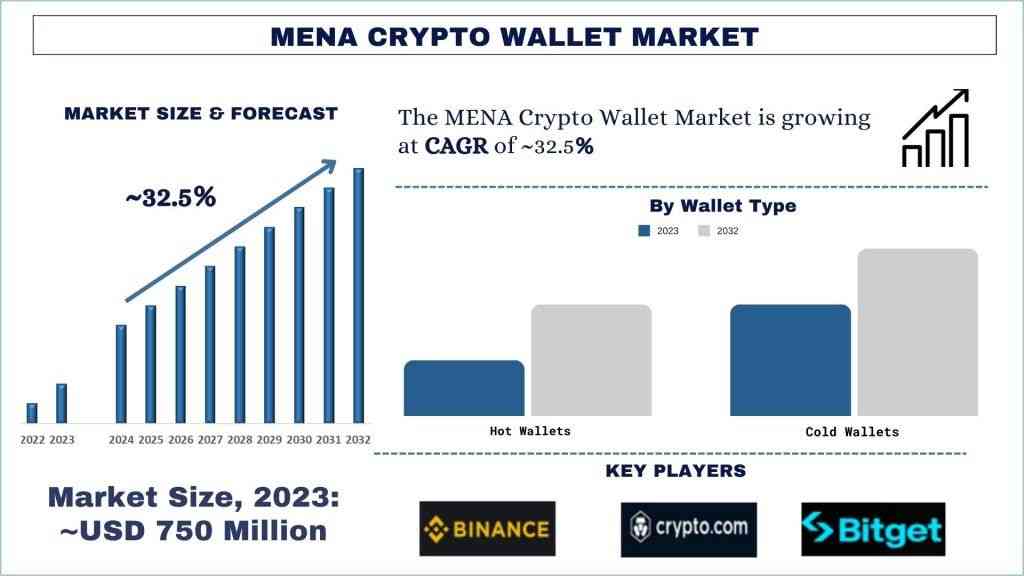

According to the UnivDatos, the potential for cryptocurrencies to facilitate financial transactions and investments in a digitally interconnected world has been a primary driver of the Crypto Wallet Market. As per their “MENA Crypto Wallet Market” report, the global Market was valued at USD 750 Million in 2023, growing at a CAGR of 32.5% during the forecast period from 2024 - 2032 to reach USD Million by 2032.

The Middle East and North Africa (MENA) region is increasingly becoming a focal point in the global cryptocurrency landscape. As traditional financial systems evolve and digital transformation accelerates, MENA countries embrace cryptocurrencies and blockchain technology with remarkable enthusiasm and innovation. This blog delves into the burgeoning MENA cryptocurrency market, highlighting key trends, growth drivers, and the transformative impact on the region's financial ecosystem.

Rapid Adoption and Growth

In recent years, MENA has witnessed a significant surge in cryptocurrency adoption. Countries like Egypt have reported staggering growth rates, with platforms such as Bitget Wallet experiencing a threefold increase in users. This trend underscores a fundamental shift in financial behavior, as more individuals and institutions turn to digital assets for investment, remittances, and as a hedge against economic uncertainties.

Driving Factors

Several factors are driving the growth of the MENA cryptocurrency market:

· Youthful Population and Tech Savviness: The region boasts a large population of tech-savvy youth eager to embrace new technologies, including cryptocurrencies. This demographic's openness to digital innovation has spurred widespread adoption across various sectors.

· Financial Inclusion: Cryptocurrencies offer a gateway to financial inclusion in regions with limited traditional banking services. Blockchain technology enables faster, cheaper, and more accessible financial transactions benefiting urban and rural populations.

· Government Support and Regulatory Clarity: Governments in countries like the UAE and Bahrain are actively exploring blockchain applications and digital currencies. Clear regulatory frameworks provide stability and foster investor confidence, paving the way for sustainable growth in the cryptocurrency sector.

· Economic Instability and Inflation: Cryptocurrencies hedge against economic volatility and inflation, offering an alternative store of value and investment diversification.

Impact on Traditional Banking Systems

The rise of cryptocurrencies in MENA signifies a paradigm shift in financial services. Blockchain technology is reshaping traditional banking systems by enhancing transparency, reducing transaction costs, and improving efficiency. As more individuals and businesses opt for decentralized financial solutions, the demand for innovative blockchain applications and secure cryptocurrency wallets grows.

Access sample report (including graphs, charts, and figures) - https://univdatos.com/reports/mena-crypto-wallet-market-current-analysis-and-forecast-2024-2032?popup=report-enquiry

Challenges and Opportunities

While the MENA cryptocurrency market holds immense promise, it also presents challenges. Regulatory frameworks must evolve to address consumer protection, cybersecurity risks, and financial stability concerns. Educating the public about the benefits and risks of cryptocurrencies is crucial for fostering a sustainable and resilient digital economy.

Looking Ahead

The future of the MENA cryptocurrency market is bright and full of potential. Egypt and other countries are responsible for adopting digital currencies, so they set a precedent for regional peers. Continued collaboration between governments, financial institutions, and technology providers will drive innovation, enhance financial inclusivity, and unlock new opportunities for economic growth.

Conclusion

The MENA cryptocurrency market is at a pivotal juncture, poised to redefine the future of finance in the region. With proactive strategies, regulatory clarity, and technological advancements, MENA countries can harness the transformative power of blockchain technology to build a more inclusive and resilient financial ecosystem.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness