Stearyl Alcohol Market Size, Growth & Trends Report 2025-2033

Market Overview:

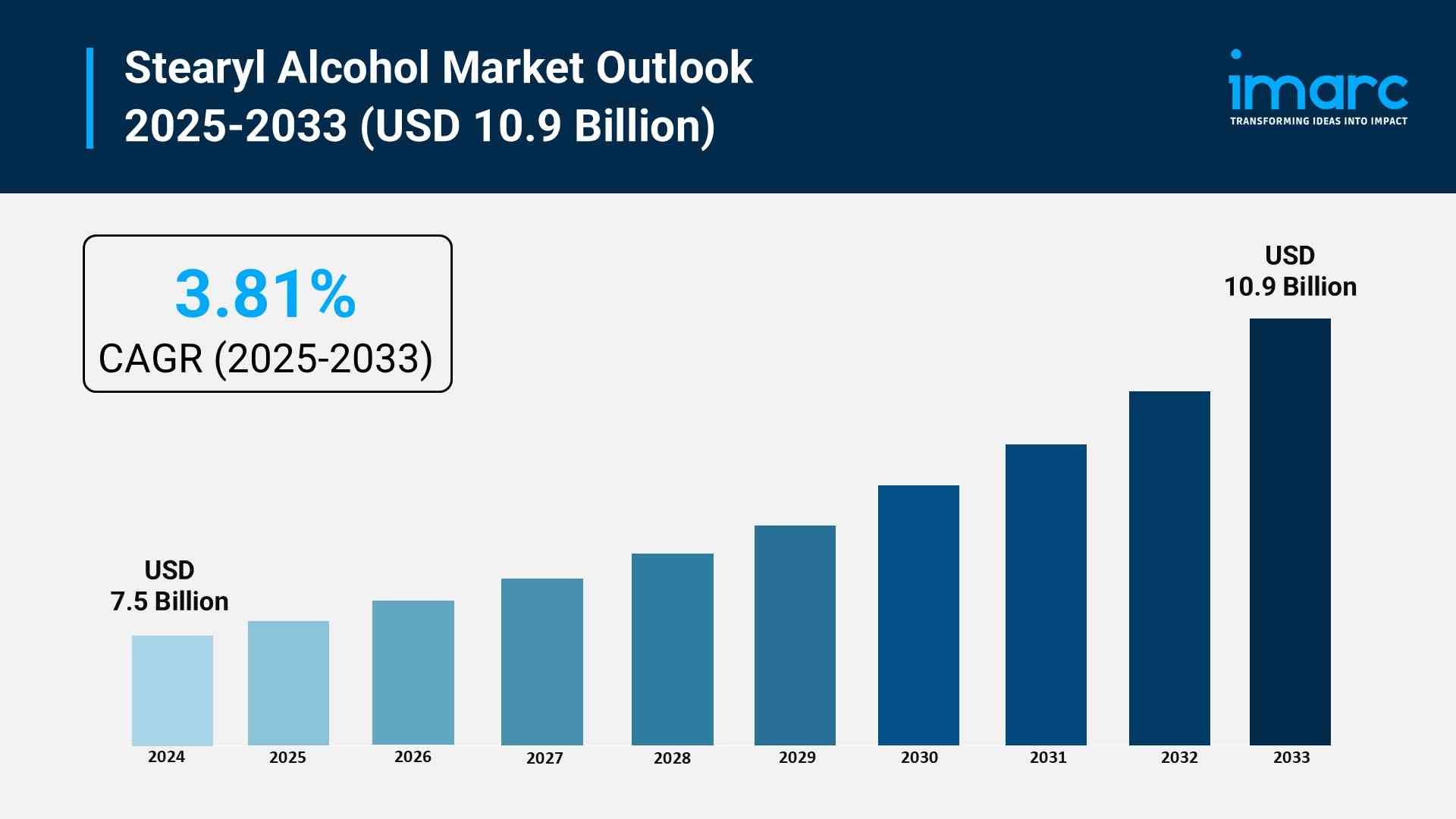

The stearyl alcohol market is experiencing rapid growth, driven by surging demand in the personal care and cosmetics sector, expansion of pharmaceutical and medical applications, and strategic shift toward sustainable oleochemical feedstocks. According to IMARC Group's latest research publication, "Stearyl Alcohol Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global stearyl alcohol market size reached USD 7.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.81% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/stearyl-alcohol-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Stearyl Alcohol Market

- Surging Demand in the Personal Care and Cosmetics Sector

The primary engine for growth in the stearyl alcohol market is its widespread adoption in the beauty and personal care industry. As a key fatty alcohol, it is utilized in approximately 40% to 50% of all skincare products, including moisturizers, lotions, and creams. Consumer preferences have shifted toward products that offer enhanced sensory experiences, where stearyl alcohol provides the necessary creamy texture and stability. In 2023, data from the Japan Cosmetic Industry Association indicated that this ingredient was present in 65% of all new skincare launches. This demand is further amplified by the rising middle-class population in Asia-Pacific, particularly in China and India, where per capita spending on grooming and dermatological products continues to rise. Major industry players like L'Oréal and Unilever integrate these alcohols to ensure phase stability and product shelf-life in diverse climates.

- Expansion of Pharmaceutical and Medical Applications

The pharmaceutical industry is increasingly relying on high-purity stearyl alcohol as a critical excipient and rheology modifier. It is essential in the production of ointments, tablets, and controlled-release drug delivery systems. The World Health Organization notes that by 2030, one in six people worldwide will be aged 60 or older, leading to a surge in demand for chronic disease treatments and topical medications that require stable emulsion bases. Furthermore, the global emphasis on hygiene has solidified the role of stearyl alcohol in manufacturing hand sanitizers and medical-grade disinfection pads. Government initiatives to bolster domestic pharmaceutical manufacturing, such as India’s Production Linked Incentive (PLI) schemes, have encouraged local chemical production. Companies like Merck KGaA and BASF SE are focusing on high-purity grades to meet the stringent safety standards required for advanced dermatological applications.

- Strategic Shift Toward Sustainable Oleochemical Feedstocks

A significant transition from petroleum-based chemicals to renewable, plant-derived alternatives is propelling the market forward. Stearyl alcohol is increasingly sourced from vegetable oils such as palm and coconut oil, aligning with global sustainability mandates. The US Department of Commerce reported a 5% increase in the shipments of fatty alcohols in 2023, reflecting this transition toward bio-based materials. Additionally, the European Union's "Green Deal" and various "Clean Beauty" regulations have pressured manufacturers to adopt biodegradable ingredients. This shift is supported by massive investments in oleochemical complexes in Southeast Asia, where companies take advantage of abundant raw material availability to produce cost-effective, eco-friendly alcohols. This focus on "green" chemistry not only reduces the carbon footprint but also meets the growing consumer demand for transparent, clean-label ingredients across the industrial spectrum.

Key Trends in the Stearyl Alcohol Market

- Integration of Artificial Intelligence in Production

Manufacturers are increasingly deploying artificial intelligence and generative AI to optimize the stearyl alcohol production process. For example, Sumitomo Chemical launched "ChatSCC," a generative AI service designed to streamline chemical operations and molecular modeling. AI-driven analytics allow companies to monitor real-time purity levels and energy consumption in distillation units, ensuring a more consistent yield of high-purity grades. These smart plants use predictive maintenance to reduce downtime, which is vital for maintaining the complex supply chain of fatty alcohols. By utilizing machine learning, producers can also simulate how stearyl alcohol will react in new cosmetic formulations, significantly reducing the time required for research and development while ensuring product safety.

- Growth of High-Purity Grades for Premiumization

There is a distinct trend toward "premiumization" within the market, where companies are prioritizing high-purity stearyl alcohol over regular industrial grades. High-purity variants are essential for premium skincare and "dermaceuticals" where skin irritation must be minimized. Recent market insights suggest that the regular grade segment still holds a massive market value of approximately $4.4 billion, but the high-purity segment is catching up as brands like Estée Lauder and Clinique demand ingredients with fewer impurities to cater to sensitive skin types. This trend is driving chemical manufacturers to invest in advanced fractionation and distillation technologies that can achieve purity levels exceeding 99%, allowing them to command higher price points in a competitive global landscape.

- Utilization in Advanced Industrial and Automotive Sectors

Beyond personal care, stearyl alcohol is finding novel applications as an industrial lubricant and evaporation suppressant. In the automotive sector, it is used in the production of specialized resins and lubricants that improve vehicle efficiency. A unique and growing trend is the use of stearyl alcohol in large-scale water conservation; it is applied to the surface of swimming pools and reservoirs as a "liquid solar blanket." This thin, monomolecular layer can significantly slow down water evaporation rates without affecting water quality. As water scarcity becomes a global concern, government-led water conservation projects are exploring these chemical barriers. This expansion into the automotive and environmental sectors showcases the alcohol’s transition from a simple cosmetic additive to a multifunctional industrial tool.

Leading Companies Operating in the Global Stearyl Alcohol Industry:

- BASF SE

- Berg + Schmidt GmbH & Co. KG (Stern-Wywiol Gruppe GmbH & Co. KG)

- Biesterfeld AG

- Godrej Industries Limited

- Kao Corporation

- KLK Oleo

- Kokyu Alcohol Kogyo Co. Ltd.

- Merck KGaA

- New Japan Chemical Co Ltd

- P&G Chemicals (Procter & Gamble Company)

- VVF Group

Stearyl Alcohol Market Report Segmentation:

By Form:

- Liquid

- Waxy Solid

Liquid represents the largest market segment due to easier incorporation into formulations, enhanced versatility, and efficient processing during manufacturing.

By Application:

- Emulsion Stabilizer

- Fragrance Ingredient

- Emulsifying Agent

- Foam Booster

- Viscosity Modifier

- Emollient

- Others

Emulsion stabilizer accounts for the majority of shares due to vital role in maintaining stability and consistency of oil-water mixtures across cosmetics and pharmaceutical formulations.

By End User:

- Cosmetics and Personal Care

- Pharmaceuticals

- Food and Beverages

- Others

Cosmetics and personal care holds the biggest market share due to diverse properties enhancing product performance, providing smooth texture, and ensuring uniform distribution of ingredients.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to expanding industrial base, rising demand across personal care, pharmaceutical, and F&B sectors, abundant raw material availability, and competitive manufacturing costs.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

The Asia Pacific region dominates the market with over 43.8% share in 2024, driven by significant industrial growth and high talc consumption in countries like China and India, particularly in automotive, construction, and cosmetics sectors.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness