Specialty Insurance Market | Exposure Complexity, Niche Policies and Regulatory Trajectory, 2025–2033

Market Overview

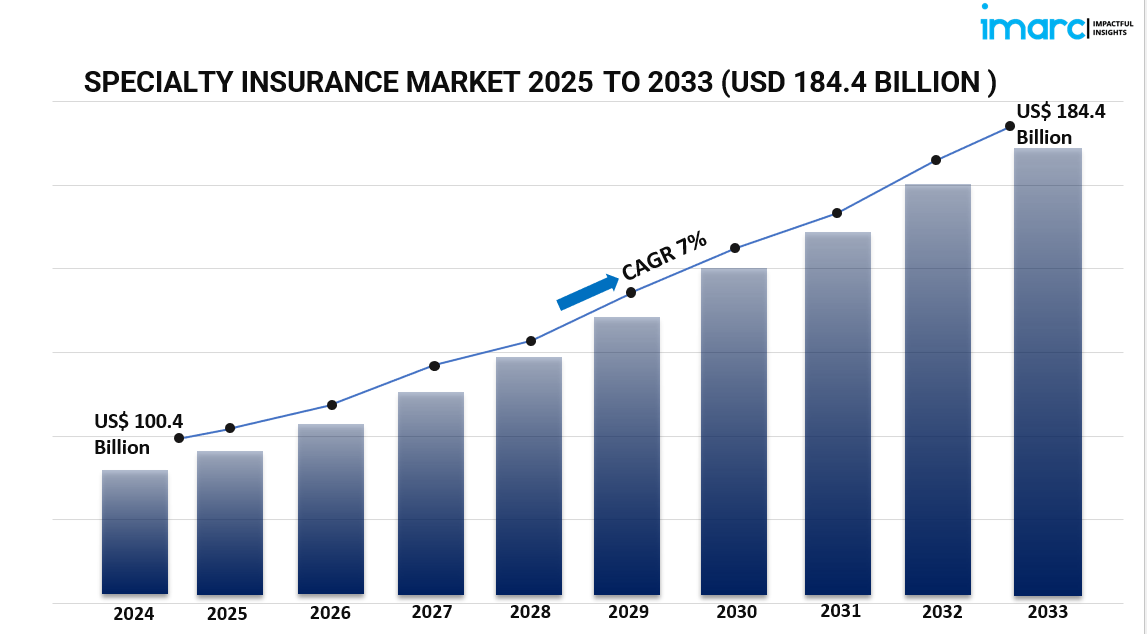

The global specialty insurance market was valued at USD 100.4 Billion in 2024 and is projected to reach USD 184.4 Billion by 2033, growing at a CAGR of 7% between 2025 and 2033. This growth is driven by the increasing exposure of businesses to complex and varied risks, advancements in healthcare, and rising construction activities. The market encompasses customizable coverage for specialized and unique risks not covered in standard policies. More info at Specialty Insurance Market

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Specialty Insurance Market Key Takeaways

- The global specialty insurance market size was USD 100.4 Billion in 2024.

- The market is expected to grow at a CAGR of 7% during 2025-2033.

- The forecast period for the market growth is from 2025 to 2033.

- Marine, Aviation and Transport (MAT) holds the largest market share among types.

- Brokers represent the largest segment in the distribution channel.

- Business end users account for the largest market share compared to individuals.

- Europe accounts for the largest specialty insurance market share globally.

Sample Request Link: https://www.imarcgroup.com/specialty-insurance-market/requestsample

Market Growth Factors

The rising exposure of businesses to varied and complex risks across different jurisdictions is propelling the demand for specialty insurance. These insurance products help manage legal, regulatory, and cultural risk differences. Additionally, rapid technological innovation, including new cyber threats, drives the market outlook. Niche sector growth and increased unpredictable weather events also raise demand for specialty insurance that covers natural disasters and unique risks.

Governments worldwide are imposing stricter regulations and compliance standards, encouraging businesses to use specialty insurance for navigating complex legal environments and ensuring adherence to industry standards. The rise of trade agreements and uncertainties faced by enterprises due to varying regional legal frameworks further bolster the demand for specialty insurance that offers tailored risk solutions.

Economic growth and development are significant drivers as increasing income levels prompt individuals to acquire valuable assets needing specialized coverage. The expansion of SMEs and infrastructure projects increase exposure to risks, demanding targeted insurance solutions. Growth across sectors such as automotive, healthcare, construction, and pharmaceuticals further support a favorable market outlook, highlighting the need for specialized risk management and insurance offerings.

Market Segmentation

By Type:

- Marine, Aviation and Transport (MAT): Includes marine insurance and aviation insurance, accounting for the largest market share due to cross-border trade, shipping, and tourism growth. Technological advancements improve efficiency and environmental compliance in this segment.

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Others

By Distribution Channel:

- Brokers: Hold the largest segment; brokers provide expert risk assessment, have broad insurer networks, build strong client relationships, assist in compliance, and adapt quickly to emerging risks.

- Non-Brokers

By End User:

- Business: Holds the largest share; specialty insurance offers customized policies protecting specific industry risks such as technology, manufacturing, healthcare, and construction, addressing intellectual property, cybersecurity, and environmental liabilities.

- Individuals

By Region:

- North America: USA and Canada

- Asia Pacific: China, Japan, India, South Korea, Australia, Indonesia, Others

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Others

- Latin America: Brazil, Mexico, Others

- Middle East and Africa

Regional Insights

Europe dominates the global specialty insurance market with the largest market share. This leadership is attributed to its robust regulatory framework in financial services, presence of global financial hubs like London, economic stability, and focus on sustainability and environmentally responsible insurance products.

Recent Developments & News

In January 2023, The Hanover Insurance Group Inc added SimpliSafe, a smart home security system maker, to its Partners in Protection risk management program. In April 2022, RenaissanceRe Holdings Ltd launched Fontana Holdings, a joint venture focusing on Casualty and Specialty risks backed by $475 million capital to target institutional investors.

Key Players

- American International Group Inc.

- Assicurazioni Generali S.P.A.

- Axa XL (Axa S.A)

- Hiscox Ltd.

- Manulife Financial Corporation

- Mapfre S.A.

- Munich Reinsurance Company

- Nationwide Mutual Insurance Company

- RenaissanceRe Holdings Ltd.

- Selective Insurance Group Inc.

- The Hanover Insurance Group Inc

- Zurich Insurance Group Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5085&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness