Specialty Insurance Market Size, Share, Trends and Forecast by Distribution Channel, Risk Type, and Region, 2025–2033

Market Overview

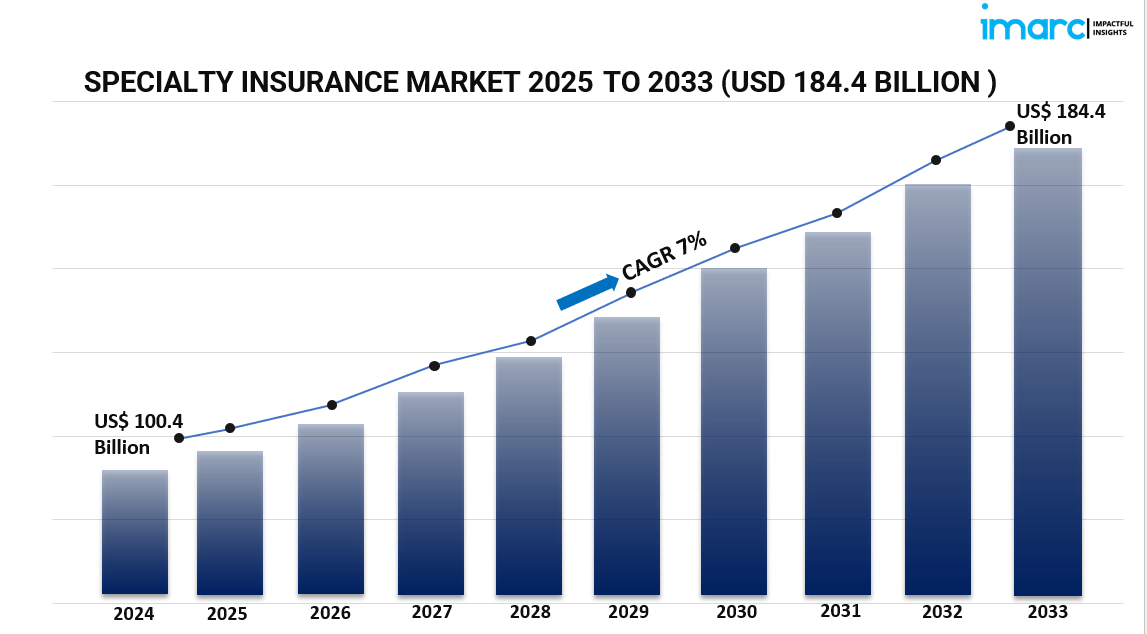

The global specialty insurance market was valued at USD 100.4 Billion in 2024 and is forecast to reach USD 184.4 Billion by 2033, growing at a CAGR of 7% during the period 2025-2033. Specialty insurance provides coverage for unique risks not typically covered by standard policies, including marine, aviation, political risk, entertainment, and other niche sectors. Major growth drivers include increasing complex risk exposure, technological advances, and rising construction activity globally.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Specialty Insurance Market Key Takeaways

- The global specialty insurance market size was USD 100.4 Billion in 2024.

- The market is expected to grow at a CAGR of 7% during 2025-2033.

- Forecast period covers 2025 to 2033.

- Increasing complexity of risks across jurisdictions is propelling demand.

- Digital transformation utilizing AI, ML, blockchain, and IoT is enabling precise risk assessments.

- Strategic partnerships, mergers, and acquisitions support innovative product offerings and global reach.

- Advancements in healthcare and medical technologies are expanding specialty insurance needs.

Sample Request Link: https://www.imarcgroup.com/specialty-insurance-market/requestsample

Market Growth Factors

The rising exposure of businesses to varied and complex risks across different jurisdictions fuels the need for specialty insurance to manage legal, regulatory, and cultural differences effectively. The rapid pace of technological innovation also creates new types of risks, including cyber threats, which specialty insurance addresses. Additionally, the rise in unpredictable and extreme weather events increases demand for specialty insurance products covering natural disasters.

Governments worldwide are implementing stricter regulatory and compliance requirements, which specialty insurance helps businesses navigate by ensuring legal adherence. Trade agreements increase the necessity for insurance policies for cross-border transactions. The continuous evolution of industry standards combined with uncertainty in legal environments for enterprises, especially SMEs, supports the demand for tailored specialty insurance solutions.

Economic growth, rising income levels, and expansion of SMEs encourage investment in valuable assets requiring specialized coverage. Rapid urbanization and infrastructure projects introduce new risks that are managed via specialty insurance. The growth across various industries—automotive, healthcare, construction, pharmaceuticals—and the development of financial products drive the need for specialized risk management solutions.

Market Segmentation

Breakup by Type:

- Marine, Aviation and Transport (MAT): This segment holds the largest market share, driven by increasing cross-border trade necessitating robust services for shipping, passengers, and goods. Innovations in efficiency, safety, and environment-friendly transport raise demand.

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Others

Breakup by Distribution Channel:

- Brokers: Represent the largest segment due to their specialized risk management expertise, access to broad insurer networks, personalized client relationships, compliance assistance, and agility in adapting to emerging risks.

- Non-Brokers

Breakup by End User:

- Business: Holds the largest market share, targeting industry-specific risks with tailor-made policies enhancing business confidence and market competitiveness.

- Individuals

Regional Insights

Europe is the dominant region in the global specialty insurance market, accounting for the largest market share. This leadership is attributed to Europe's robust regulatory framework, presence of major financial hubs like London, economic stability, and focus on sustainability, which aligns with demand for green and sustainable insurance products.

Recent Developments & News

In January 2023, The Hanover Insurance Group Inc added SimpliSafe, a leading smart home security system maker, to its Partners in Protection program aimed at risk management and loss prevention. In April 2022, RenaissanceRe Holdings Ltd. launched Fontana Holdings, a joint venture focusing on Casualty and Specialty risks with $475 million capital aimed at institutional investors.

Key Players

- American International Group Inc.

- Assicurazioni Generali S.P.A.

- Axa XL (Axa S.A)

- Hiscox Ltd.

- Manulife Financial Corporation

- Mapfre S.A.

- Munich Reinsurance Company

- Nationwide Mutual Insurance Company

- RenaissanceRe Holdings Ltd.

- Selective Insurance Group Inc.

- The Hanover Insurance Group Inc

- Zurich Insurance Group Ltd.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5085&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness