SPARK Matrix™ Guide to the Best Digital Wealth Management Solutions

The wealth management industry is undergoing one of the most significant transformations in its history, driven by shifting investor expectations, regulatory pressures, digital innovation, and the democratization of financial services. At the center of this transformation is the evolution of Digital Wealth Management Platforms, which now serve as the backbone of modern advisory, portfolio management, and client engagement ecosystems.

According to QKS Group’s definition, Digital Wealth Management Platforms are comprehensive technology systems that provide digital tools for investment advisory, financial planning, portfolio management, client onboarding, compliance, reporting, and investor engagement. These platforms combine automation, analytics, and AI-driven insights to deliver personalized wealth experiences at scale while maintaining strict regulatory compliance. As investor demographics shift and wealth becomes increasingly distributed across global markets, digital platforms are essential to driving both operational efficiency and differentiated advisory value.

Click Here For More Information: https://qksgroup.com/market-research/spark-matrix-digital-wealth-management-platforms-q4-2024-8267

Why Digital Wealth Management Platforms Are Becoming Critical

Historically, wealth management has depended on human advisors, face-to-face interactions, and manual workflows. Today, investors expect seamless digital experiences, instant access to financial information, hyper-personalized recommendations, and frictionless onboarding. This shift is accelerating due to:

- Rising adoption of robo-advisory

- Growing millennial and Gen Z investor base

- Demand for hyper-personalized investment strategies

- Pressure to reduce advisory costs

- Digitization of compliance and KYC

- Need for scalable portfolio operations

Digital Wealth Management Platforms address these needs through integrated tools that support hybrid advisory models—blending digital automation with human expertise.

What Makes Modern Wealth Platforms Intelligent?

Next-generation platforms are not merely digital versions of legacy systems. They introduce intelligence layers across the wealth lifecycle, including:

1. AI-Powered Advisory

- Predictive investment insights

- Behavioral analytics for investor profiling

- Automated rebalancing and optimization

2. Frictionless Client Onboarding

- Digital KYC

- Instant compliance verification

- Streamlined risk assessment

3. Hyper-Personalized Engagement

- Real-time market signals

- Customized content and advisory nudges

- Multi-channel communication

4. Regulatory Automation

- MiFID II, SEC, and SEBI compliance workflows

- Digital audit trails

- Risk and suitability checks

5. Portfolio Management Intelligence

- Cross-asset analytics

- Tax optimization

- ESG integration

As a result, Digital Wealth Management Platforms have evolved from back-office tools to strategic engines powering differentiated investor experiences.

The Evaluation Gap — Why Choosing a Wealth Platform Is Difficult

Despite rapid innovation, selecting the right wealth platform has become increasingly complex. QKS Group identifies several gaps that create challenges for financial institutions, wealth managers, and fintechs.

1. Highly Diverse Use Cases

Traditional analyst evaluations often compare vendors at a broad level, overlooking nuanced needs such as:

- Hybrid advisory vs. fully automated advisory

- HNI/UHNI wealth management

- Retail mass-affluent models

- Global compliance variations

This makes generic rankings inadequate for specific business models.

2. Lack of Real-World Performance Evidence

Wealth platforms must be tested in live environments, where factors like:

- Onboarding speed

- User adoption

- Portfolio performance analytics

- Integration complexity

…vary significantly and are rarely captured in traditional reports.

3. Visibility Challenges for Specialized Vendors

Smaller fintech providers often excel in niche areas such as hybrid advisory or ESG investing but remain overshadowed by larger brands.

4. Trust Gap Between Analyst View and Peer Evidence

Financial institutions increasingly seek peer feedback—actual experiences from similar organizations deploying these platforms.

These gaps create uncertainty and slow decision-making, highlighting the need for a unified evaluation model that blends analyst rigor with real-world validation.

Download Sample Report Here: https://qksgroup.com/download-sample-form/%20?id=8267

SPARK Plus™ — Closing the Gap Between Analyst Insights and User Experiences

To address the industry’s evaluation challenges, QKS Group introduced SPARK Plus™, the world’s first hybrid model that integrates structured analyst intelligence with unfiltered user reviews. For Digital Wealth Management Platforms, SPARK Plus™ provides the most comprehensive and contextual evaluation available today.

Key SPARK Plus™ Value Differentiators:

1. Contextual Comparisons by Segment & Region

Buyers can filter vendor evaluations by:

- Wealth segment (mass-affluent, HNI, UHNI, hybrid advisory, robo-advisory)

- Geographic region

- Business scale

This ensures vendor scoring reflects real-world deployment environments.

2. Real-World Deployment Insights

SPARK Plus™ incorporates verified customer feedback on:

- Platform reliability

- Ease of integration with PMS, CRM, custodians, and trading systems

- User experience quality

- Reporting accuracy

- Actual ROI timeframes

This reduces the risk associated with vendor selection.

3. Transparent Analyst Commentary

Unlike traditional reports, SPARK Plus™ reveals parameter-level scoring details across categories such as:

- Portfolio intelligence

- Advisory automation

- Multichannel engagement

- Security & compliance

- API and platform extensibility

4. Visibility Boost for Innovators

Emerging fintech vendors gain exposure in segments where they perform exceptionally, leveling the playing field.

Together, these capabilities make SPARK Plus™ a high-trust decision engine for wealth platform buyers.

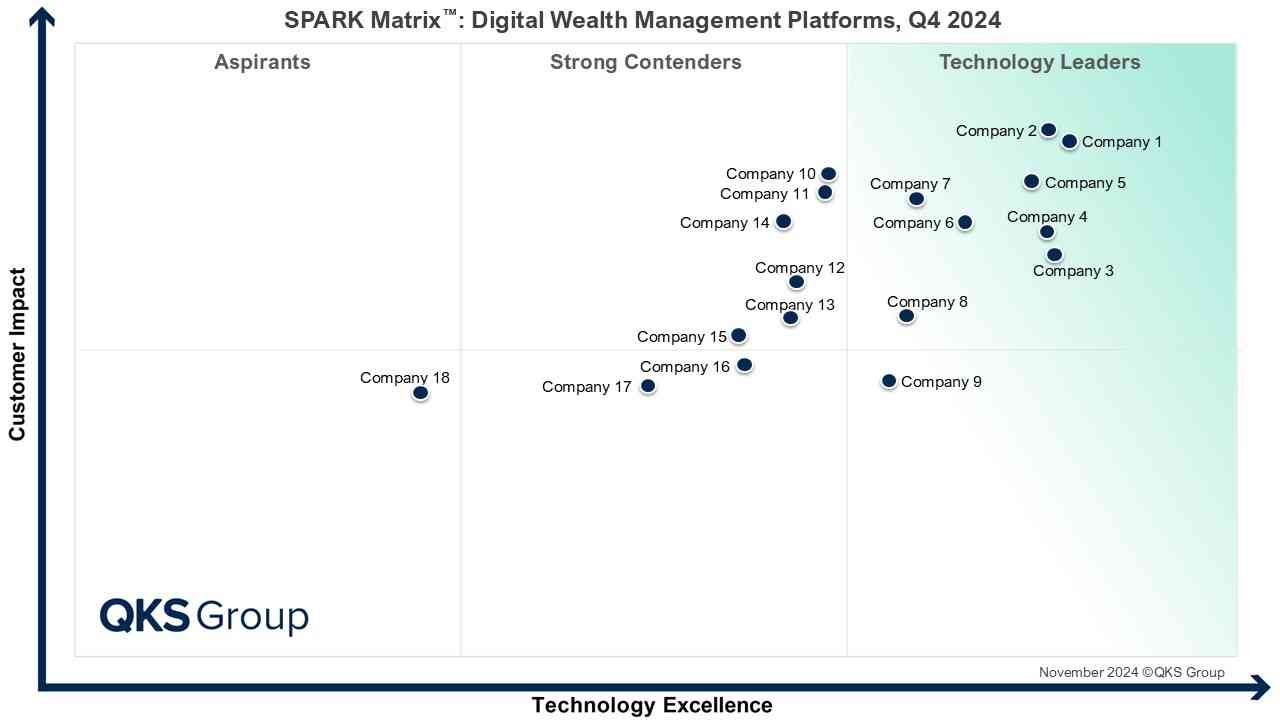

SPARK Matrix™ for Digital Wealth Management Platforms

QKS Group’s SPARK Matrix™ benchmarking evaluates vendors on two axes:

- Technology Excellence

- Customer Impact

Each vendor is assessed across key parameters including:

- Advisory intelligence

- Portfolio analytics depth

- Client personalization tools

- Automation capabilities

- Compliance & risk automation

- User experience (UX) sophistication

- Scalability and architecture

This creates a precise, evidence-based mapping of vendor strengths and differentiators.

Become A Client: https://qksgroup.com/become-client

Conclusion

The rise of Digital Wealth Management Platforms marks a fundamental shift in how financial institutions deliver advisory services, engage investors, and scale operations. As wealth ecosystems evolve and investor expectations heighten, these platforms will become indispensable for firms seeking to differentiate through intelligence, personalization, and operational efficiency.

Yet the challenge remains: selecting the right vendor in an increasingly crowded landscape. SPARK Plus™ by QKS Group resolves this by merging expert analyst evaluation with transparent user feedback, ultimately enabling more confident, data-driven technology decisions.

As the industry moves toward hybrid advisory, AI-led insights, and global digital-first wealth experiences, Digital Wealth Management Platforms—validated through SPARK Matrix™ and SPARK Plus™—will play a pivotal role in shaping the future of wealth.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness