Europe Wound Care Market Share, Industry Growth Analysis, Revenue, Size, Report 2025-2033

Europe Wound Care Market Overview

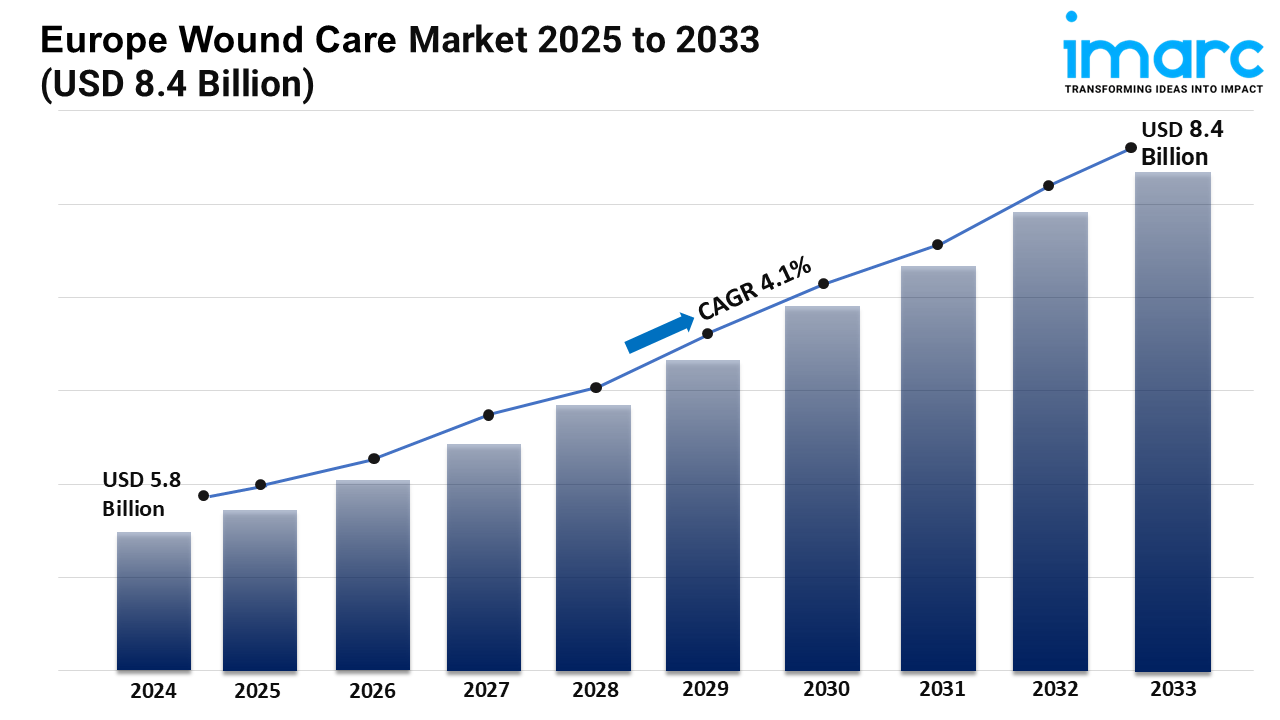

Market Size in 2024: USD 5.8 Billion

Market Forecast in 2033: USD 8.4 Billion

Market Growth Rate: 4.1% (2025-2033)

According to the latest report by IMARC Group, the Europe wound care market size was valued at USD 5.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.4 Billion by 2033, exhibiting a CAGR of 4.1% from 2025-2033.

Europe Wound Care Industry Trends and Drivers:

Driven by several connected elements ranging from product innovation, demographic changes, and developing healthcare infrastructure, the European wound care market is exhibiting strong upswing. Growing incidence of chronic wounds, including diabetic ulcers and pressure sores, is driving demand for sophisticated wound treatment solutions that improve healing results and lower clinical difficulties. Because of their capacity to actively stimulate tissue regeneration and infection control, bioactive dressings and wound healing equipment are becoming well-known and supplement conventional medical methods. Technological innovations in wound care, including intelligent dressings incorporating sensors and automated monitoring tools, are improving patient compliance and boosting individualized treatment paths. Particularly in Western Europe, where thorough healthcare systems support cutting-edge treatments, hospitals and specialized wound care clinics are increasingly embracing these creative solutions. Outpatient clinics and community health programs, on the other hand, are playing increasingly important part in treating acute wounds and opening up fresh avenues for product distribution. Greater acceptance of new wound care methods driven by the intersection of increased patient awareness and medical practitioner education strengthens market growth.

Market expansion is also grounded in policy backing and changing demographics across the continent. The increasing aging population, prone to chronic wounds and slower healing rates, is asking for customized wound care protocols and ongoing clinical monitoring. This demographic trend is pushing stakeholders to give faster healing and better quality of life through cutting-edge wound care products priority. In nations like Germany, France, and the United Kingdom, government programs and compensation rules are promoting innovation and accessibility, therefore facilitating widespread use of bioactive and gadget-based therapies. Furthermore driving the need for thorough wound care systems is growing healthcare spending on preventive care and rehabilitation services. Regional variations in healthcare delivery methods are driving companies to modify product lines, therefore balancing cost-effectiveness with technological sophistication to meet healthcare demands in both rural and urban areas. Cross-sector partnerships among medical device companies, pharmaceutical companies, and healthcare providers are boosting research and development efforts and enabling ongoing product pipeline expansion.

Strategic focus on end users is transforming the competitive scene. Hospitals are still the biggest segment because of their large volumes of surgical and trauma-related injuries. Specialized wound care departments in tertiary hospitals are leading the uptake of next-generation bandages and healing equipment, thereby mirroring a movement toward multidisciplinary treatment plans. Particularly in managing diabetic foot ulcers and venous leg ulcers in home care environments, community health service facilities and outpatient clinics are more and more becoming more proactive. This tendency fits with the wider decentralization of healthcare and the encouragement of outpatient care meant to shorten hospital stay durations. Market forces are changing to regional healthcare policies and population demands in several nations. While Southern Europe is seeing more investment in chronic wound management infrastructure, for instance, Scandinavian nations are highlighting telemedicine-enabled wound care solutions. Supported by technical developments, demographic trends, and changing healthcare delivery systems, the European wound care industry is experiencing rapid expansion as innovation shapes treatment choices.

Download sample copy of the Report: https://www.imarcgroup.com/europe-wound-care-market/requestsample

Europe Wound Care Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Product Type:

- Advance Wound Care Products

- Foam Dressing

- Hydrocolloid Dressing

- Film Dressing

- Alginate Dressing

- Hydrogel Dressing

- Collagen Dressing

- Others

- Surgical Wound Care Products

- Sutures

- Staplers

- Tissue Adhesive, Sealants and Hemostats

- Anti-effective Dressing

- Traditional Wound Care Products

- Medical Tapes

- Cleansing Agent

- Active Wound Care Products

- Biological Skin Substitutes

- Topical Agents

- Wound Therapy Devices Products

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Wound Assessment and Monitoring Devices

- Others

Analysis by Wound Type:

- Chronic Wounds

- Diabetic Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Others

- Acute Wounds

- Surgical Traumatic Wounds

- Burns

Analysis by End User:

- Hospitals and Clinics

- Long-Term Care Facilities

- Home Care Setting

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- In May 2024, Kerecis, a Europe-based company specializing in fish skin for wound care, announced plans to present industry-backed symposium on intact fish skin for chronic wound care applications at the European Wound Management Association (EWMA). This event highlights increasing advancements in wound care market.

- RELIEF THERAPEUTICS Holding SA, a Switzerland-based biopharmaceutical firm, announced the receival of Notice of Allowance from the European Patent Office (EPO) for its patent titled "Therapeutic Uses of Oxidizing Hypotonic Acid Solutions." The patent will cover the company's exclusive hypochlorous acid solutions, encompassing RLF‑TD011, an investigational drug formulated for treating wounds related to epidermolysis bullosa (EB), reflecting a significant advancement in wound care solutions.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=11055&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness