SPARK Matrix™ 2024: Merchant Payment Platform Market Leader Insights

QKS Group SPARK Matrix™: Merchant Payment Platform research presents a comprehensive and forward-looking evaluation of the global payment technology landscape. As digital payments become increasingly central to modern commerce, the merchant payment platform ecosystem continues to expand rapidly, driven by innovation, rising consumer expectations, and the growing need for frictionless, secure, and omnichannel payment experiences. This research provides an extensive analysis of both short-term growth opportunities and long-term market evolution, offering stakeholders a deep understanding of emerging technologies, shifting market forces, and the strategic direction of the industry.

The study is designed to equip technology providers with the actionable insights they need to refine their offerings, strengthen competitive positioning, and address the constantly evolving demands of merchants across industries. Through a detailed exploration of product capabilities, market differentiation strategies, and customer impact, the report serves as an essential guide for payment solution vendors seeking to expand customer reach and accelerate innovation. For enterprise users and merchants, the research helps evaluate the diverse set of available platforms based on vendor strengths, technological capabilities, pricing flexibility, and scalability, enabling them to select the solution that best aligns with their payment operations, digital transformation goals, and long-term business strategy.

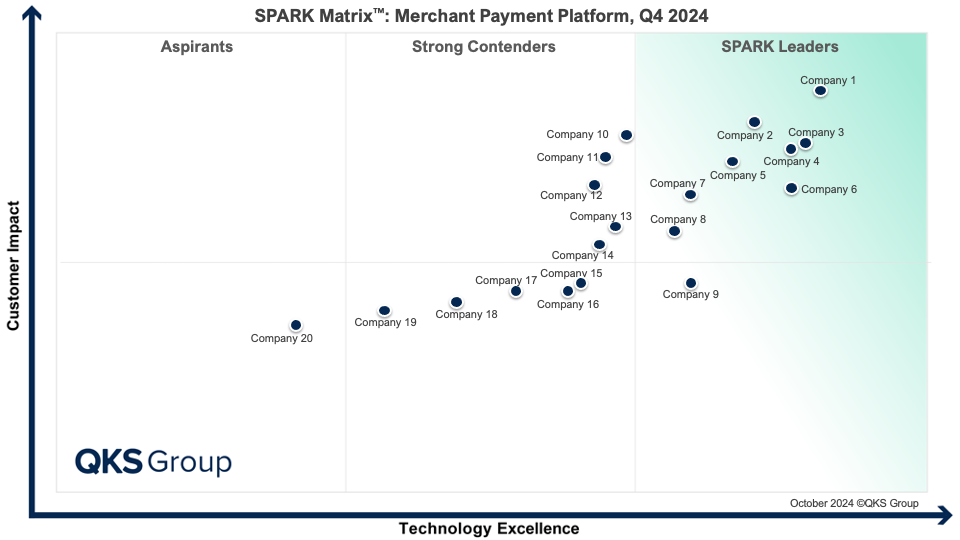

A central component of the research is the vendor assessment conducted through Quadrant’s proprietary SPARK Matrix™ framework. This analytical model offers a holistic snapshot of the competitive landscape by positioning global vendors across two dimensions: Technology Excellence and Customer Impact. SPARK Matrix™ not only highlights leaders with strong innovation capabilities and market penetration but also identifies specialized vendors that demonstrate significant potential in niche areas. This visual representation of the competitive market helps stakeholders quickly understand where each vendor stands and how their strengths compare in a rapidly evolving industry.

The 2024 SPARK Matrix™: Merchant Payment Platform study features a detailed evaluation of leading global vendors known for their robust technology capabilities, market presence, and customer value propositions. These include well-established payment giants and innovative disruptors such as Adyen, Aurus, BlueSnap, BPC, Cardknox, Checkout.com, Comviva, CSG, Fiserv, Global Payments, HPS, J.P. Morgan, Nets, OpenWay, PayPal, RS Software, Stripe, Visa, Worldline, and Worldpay. Each vendor is assessed based on platform architecture, scalability, payment orchestration, settlement processes, risk and fraud management, compliance capabilities, and omnichannel support.

These vendors have played a pivotal role in shaping the merchant payments landscape by offering advanced payment solutions designed to streamline operations, reduce friction, and enhance customer experiences. Many providers are expanding into value-added services such as intelligent payment routing, tokenization, analytics-driven insights, subscription billing, alternative payment method (APM) enablement, and integrated merchant dashboards. The SPARK Matrix™ analysis captures these differentiators, providing clarity on how each vendor positions itself within the increasingly competitive global market.

SPARK Matrix™: Merchant Payment Platform serves as the backbone of modern commerce. She explains that MPP solutions enable merchants to accept and manage the end-to-end payment lifecycle, including payment acceptance, authorization, routing, settlement, reconciliation, disbursements, and refunds, while ensuring compliance with global regulations and regional payment standards. These platforms have significantly evolved from basic payment gateways to comprehensive orchestration layers capable of unifying online, in-store, and mobile payments under a single intelligent infrastructure.

These technologies enable more accurate fraud detection, dynamic risk scoring, and real-time anomaly detection, which help merchants mitigate financial risks and ensure secure transactions. AI-powered tools support model training, optimize transaction approval rates, and enhance customer personalization throughout the payment journey. NLP-driven chatbots and virtual assistants automate routine merchant queries, simplify onboarding, and streamline customer support operations.

Automation capabilities within modern platforms play an increasingly important role in driving operational efficiency. By automating manual and repetitive tasks such as payment reconciliation, chargeback processing, reporting, dispute resolution workflows, and settlement tracking, merchants can reduce operational overhead while maintaining accuracy and compliance. Intelligent workflows also support real-time decision-making and event-triggered actions, allowing merchants to quickly adapt to payment failures, routing changes, or customer-specific rules.

The report further emphasizes several macro trends shaping the growth outlook of the merchant payment platform market:

1. Rise of Omnichannel Commerce

Consumers expect seamless transitions between physical stores, mobile apps, and online platforms. Merchant payment platforms are evolving into unified solutions that support omnichannel acceptance, providing consistent experiences and centralized visibility into transactions.

2. Expansion of Alternative Payment Methods (APMs)

With growing demand for digital wallets, BNPL services, bank transfers, and local payment options, vendors are increasingly focusing on global APM integrations to support merchant expansion into new markets.

3. Embedded Payments & API-Driven Integrations

The shift toward embedded finance is fueling platform adoption as merchants seek tightly integrated payment solutions within business software, commerce platforms, and ERP systems.

4. Global Regulatory Compliance

Regulations such as PSD2, PCI DSS, AML rules, and local payment authorizations require platforms to continuously evolve their security and compliance capabilities, making regulatory adaptability a key competitive differentiator.

5. Greater Focus on Data Intelligence

Merchants are prioritizing platforms that provide rich analytics, real-time insights, and customer-level transaction intelligence to drive smarter decision-making and revenue optimization.

By integrating these technological advancements, leading vendors are enhancing their ability to deliver high-performing, secure, and scalable payment ecosystems. Quadrant Knowledge Solutions’ research concludes that as the global digital payments landscape grows increasingly competitive, SPARK Matrix™: Merchant Payment Platform must continue to innovate across areas such as fraud prevention, AI-driven automation, payment orchestration, global compliance, and seamless customer experiences.

The SPARK Matrix™ analysis provides crucial clarity for stakeholders by showcasing where each vendor stands today and how well-positioned they are to address the future needs of the global merchant payments market. This research ultimately serves as a critical resource for merchants, technology providers, and investors seeking to navigate the fast-evolving payment ecosystem and capitalize on new opportunities for growth.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness