MENA Card Payment Market, Analysis, Trends, Growth and Forecast (2023-2030)

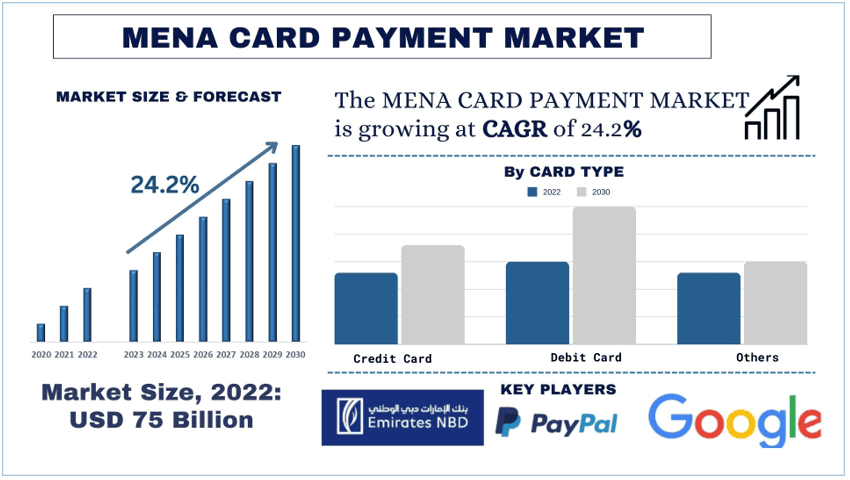

According to the UnivDatos, the MENA Card Payment Market was valued at USD 75,132.17 million in 2022, growing at a CAGR of 24.2% during the forecast period from 2023 - 2030 to reach USD million by 2030.

Saudi Arabia stands out as a key player in the MENA card payment market. With ambitious economic reforms under Vision 2030, the country is witnessing a significant digital transformation. The government's initiatives to enhance financial infrastructure, coupled with a growing tech-savvy population, are driving the adoption of card payments. Mobile wallet usage is gaining traction, supported by the proliferation of smartphones and advanced payment technologies.

Growth Trajectory of Card Payments:

In recent years, Saudi Arabia has experienced a significant uptick in card payment adoption, fueled by factors such as urbanization, digitization, and a young and tech-savvy population. According to recent statistics, the volume and value of card transactions in the kingdom have been steadily increasing, reflecting a growing preference for cashless payments among consumers and businesses. With the government's push towards diversifying the economy and promoting a cashless society, the card payment market in Saudi Arabia is poised for continued growth and innovation.

Access sample report (including graphs, charts, and figures) - https://univdatos.com/reports/mena-card-payment-market?popup=report-enquiry

Shift towards Contactless Payments:

Contactless payments have gained notable traction in Saudi Arabia, particularly in light of the COVID-19 pandemic, which underscored the importance of hygienic payment methods. Consumers are increasingly embracing contactless transactions, leveraging the convenience and speed offered by tap-and-go technology. Merchants across the kingdom are swiftly adopting contactless-enabled POS terminals, while banks are rolling out contactless cards to meet the rising demand. This trend not only enhances the overall payment experience but also aligns with Saudi Arabia's vision of leveraging technology to drive economic diversification and growth.

Government Regulations and Initiatives:

The Saudi Arabian Monetary Authority (SAMA), the kingdom's central bank, plays a pivotal role in regulating the card payment market and ensuring its stability and integrity. SAMA has implemented several regulations and initiatives to promote transparency, consumer protection, and innovation within the payment ecosystem. For instance, the introduction of the Saudi Payment Network (MADA) has facilitated interoperability among banks and payment service providers, streamlining card transactions and enhancing efficiency. Additionally, SAMA has issued guidelines on cybersecurity and data protection to safeguard the integrity of card payment systems and mitigate the risk of fraud and cyberattacks.

Emphasis on Financial Inclusion:

Financial inclusion remains a key priority for the Saudi government, as it seeks to empower all segments of society with access to formal financial services. In line with this objective, initiatives such as the Financial Sector Development Program (FSDP) aim to enhance financial literacy, expand access to banking services, and promote digital payments among underserved populations. Furthermore, the launch of the Fintech Saudi initiative has fostered collaboration between regulators, financial institutions, and fintech startups to drive innovation and inclusion within the payment ecosystem.

Conclusion

In conclusion, the card payment market in Saudi Arabia is experiencing a period of rapid transformation, driven by technological innovation, regulatory reforms, and shifting consumer preferences. As contactless payments gain prominence and government regulations promote transparency and financial inclusion, the kingdom's payment landscape is poised for further growth and evolution. By embracing these trends and fostering collaboration between stakeholders, Saudi Arabia is well-positioned to capitalize on the opportunities presented by the burgeoning card payment market, driving economic development and enhancing the overall payment experience for its citizens and businesses. According to the Universal Data Solutions analysis, the MENA market was valued at USD 75,132.17 million in 2022, growing at a CAGR of 24.2% during the forecast period from 2023 - 2030 to reach USD XX million by 2030.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness