Europe Biosimilar Market Size, Share, Demand, Key Players Analysis and Forecast 2025-2033

Europe Biosimilar Market Overview

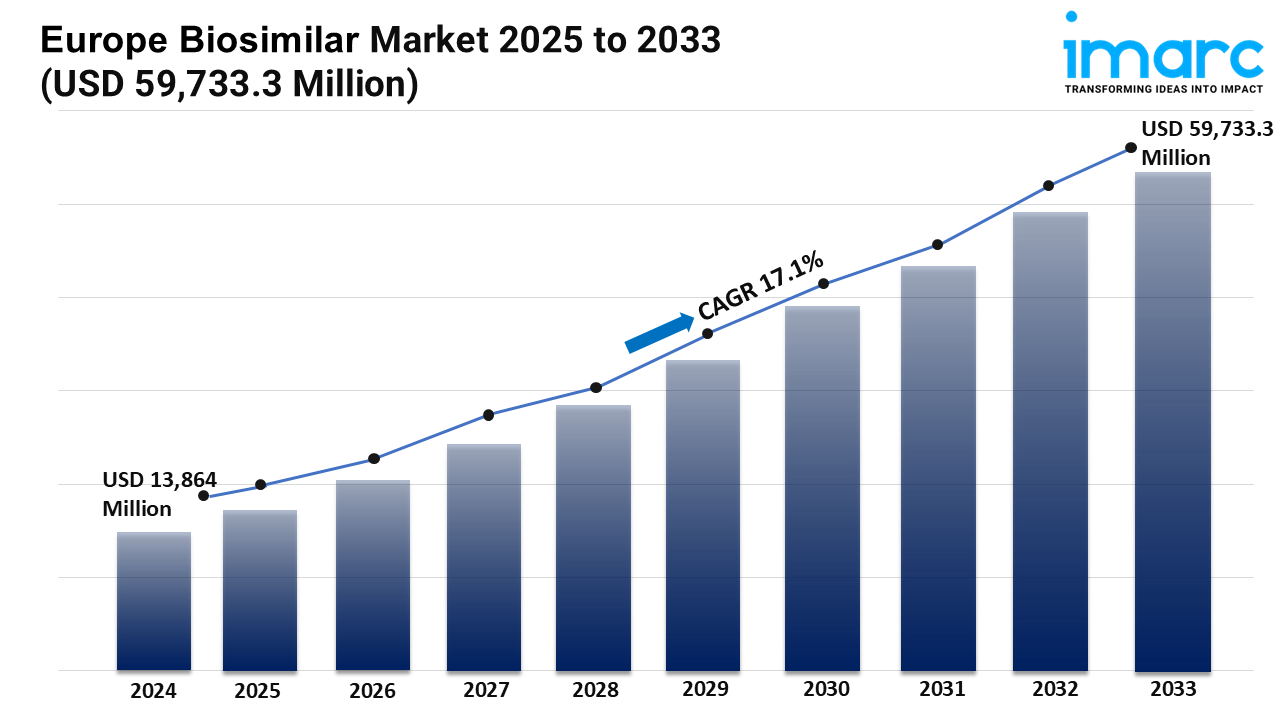

Market Size in 2024: USD 13,864 Million

Market Forecast in 2033: USD 59,733.3 Million

Market Growth Rate: 17.1% (2025-2033)

According to the latest report by IMARC Group, the Europe biosimilar market size was valued at USD 13,864 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 59,733.3 Million by 2033, exhibiting a CAGR of 17.1% from 2025-2033.

Europe Biosimilar Industry Trends and Drivers:

As healthcare systems give cheap access to biological medicines top priority in answer to the growing prevalence of chronic and life-threatening illnesses, the Europe biosimilar market is growing swiftly. Essential tools in lowering treatment expenses for diseases like cancer, autoimmune diseases, and diabetes are biosimilars. Biosimilars are entering in to offer affordable, high-quality choices that meet public health goals and payer budgets as patents on biological drugs expire. Leading regulatory systems the European Medicines Agency is simplifying market access and fostering clinical confidence by means of strict approval requirements. Encouragement for manufacturers to invest in biosimilar development across several therapeutic groups is being made possible by this supportive environment, which is also driving product variety. Moreover, greater clinical knowledge, physician confidence, and patient acceptance are supporting market maturity and hastening prescribing behavior, particularly inside hospital-based treatment programs.

Good performance is being aided by market segmentation across molecular classes, clinical applications, and production approaches. With uses in oncology, endocrinology, and immunology, monoclonal antibodies, insulin analogs, and growth hormones are seeing especially strong demand. With advances in cell line engineering and analytical methods, drug developers are trying to replicate complex biologics with great accuracy. Indication-specific expansion—especially in oncology and rheumatology—is propelling repeat demand via chronic dosing regimens and expanding patient eligibility. Simultaneously, businesses are improving upstream and downstream manufacturing methods to allow for scalable and cost-effective output that satisfies regulatory requirements. Accelerating time to market and guaranteeing regional supply chain resilience, contract manufacturing companies are assuming a crucial role. This holistic strategy is assisting Europe in maintaining its role as a center for biosimilar research and production by balancing quality, safety, and therapeutic effectiveness.

Italy is maintaining market dominance at the national level by proactively including biosimilars in reimbursement programs and public health regulations. Germany is encouraging competition through tendering procedures, guaranteeing fast market penetration for newly approved molecules. France is promoting physician education and prescription incentives, therefore supporting biosimilar use in both hospital and outpatient contexts. Health authorities in the United Kingdom are focusing on cost control techniques after Brexit, hence raising the significance of biosimilars in formulary listings. Spain and Nordic nations are improving institutional rules to promote interchangeability and substitute policies. Central and Eastern European markets are gaining momentum as awareness grows and infrastructure fits international manufacturing standards. Together, these different yet complementary national plans are guiding the Europe biosimilar market toward a dynamic and inclusive growth trajectory throughout the forecast horizon.

Download sample copy of the Report: https://www.imarcgroup.com/europe-biosimilar-market/requestsample

Europe Biosimilar Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Molecule:

- Infliximab

- Insulin Glargine

- Epoetin Alfa

- Etanercept

- Filgrastim

- Somatropin

- Rituximab

- Follitropin Alfa

- Adalimumab

Analysis by Indication:

- Auto-Immune Diseases

- Blood Disorder

- Diabetes

- Oncology

- Growth Deficiency

- Female Infertility

Analysis by Manufacturing Type:

- In-house Manufacturing

- Contract Manufacturing

Analysis by Country:

- Italy

- Germany

- United Kingdom

- France

- Spain

- Rest of Europe

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- Novartis

- Pfizer

- Teva

- Celltrion

- Merck Sharp & Dohme

- Samsung Bioepis

- Eli Lilly

- Accord Healthcare Ltd.

- Amgen

- Boehringer Ingelheim

- Hexal Ag

- Apotex

- Stada Arzneimittel Ag

- Ratiopharm

- Mylan

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- May 2025: Sandoz launched Pyzchiva, the first ustekinumab biosimilar in Europe available as an autoinjector, enhancing patient comfort and adherence. Developed by Samsung Bioepis, it treats conditions like psoriasis and Crohn’s disease. The rollout began in Spain.

- April 2025: Dong-A ST expanded the launch of its Stelara biosimilar, Imuldosa, to the UK and Ireland after its January debut in Germany. Approved by the European Commission in December 2024, Imuldosa targets autoimmune diseases, with further rollouts planned in France, Spain, and Italy, supporting broader European commercialization through Intas Pharmaceuticals.

- February 2025: Celltrion received EMA approval to initiate a Phase 3 clinical trial in Europe for CT-P55, its biosimilar to Cosentyx. The trial involves 375 plaque psoriasis patients to compare efficacy and safety with the reference drug. This move aims to expand Celltrion’s autoimmune treatment portfolio through global clinical validation.

- February 2025: Biocon launched its generic liraglutide products, Liraglutide Biocon and Biolide, in the UK to treat type 2 diabetes and obesity. This followed UK approval in March 2024 and EU approval with partner Zentiva in December 2024, marking Biocon’s expansion in the European biosimilar diabetes treatment market.

- January 2025: Teva partnered with Klinge Biopharma and Formycon to commercialize FYB203, a biosimilar to Eylea (aflibercept), across major European countries. Following positive regulatory recommendations, Teva plans to market FYB203 under the brand AHZANTIVE, expanding its ophthalmology biosimilar portfolio.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=1023&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness