Credit Balance Resolution

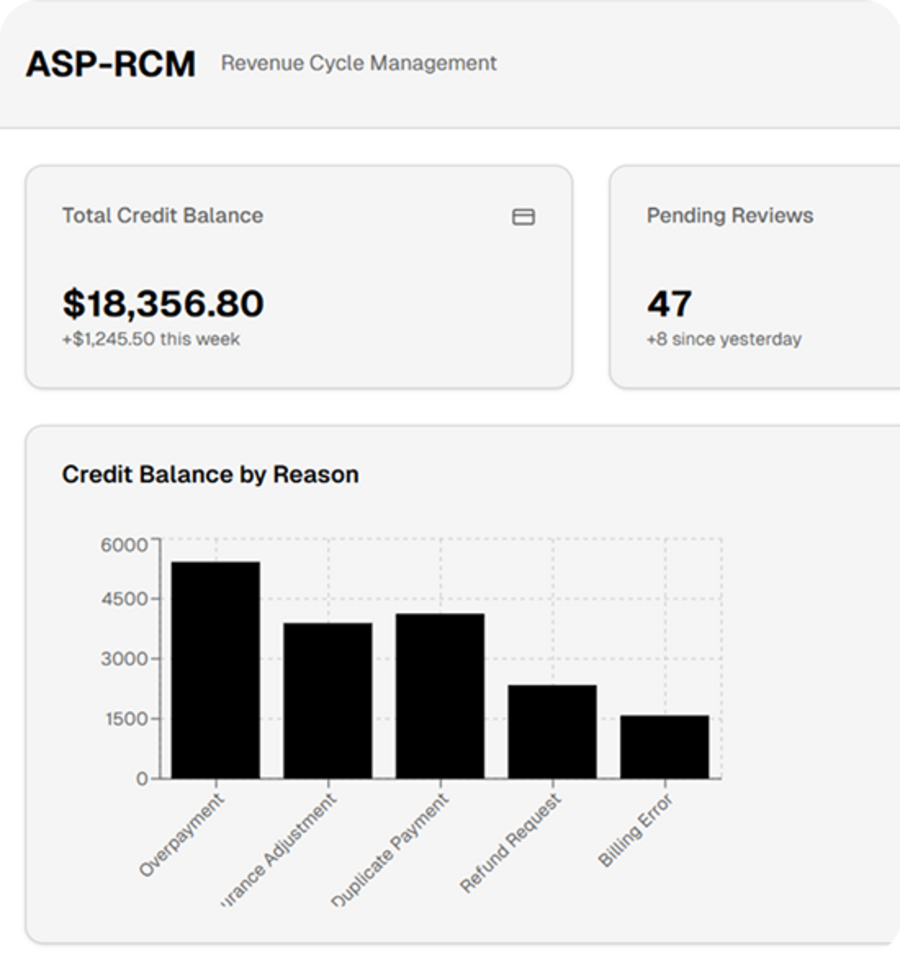

In the healthcare industry, managing finances accurately is critical. One common challenge that providers face is credit balances—overpayments, duplicate payments, or erroneous transactions in patient accounts. Unresolved credit balances can lead to compliance risks, cash flow issues, and increased administrative workload. This is where Credit Balance Resolution Services come in, helping organizations maintain accurate financial records and maximize revenue efficiency.

What is Credit Balance Resolution?

Credit Balance Resolution is the process of identifying, investigating, and resolving credit balances in patient accounts or insurance payments. It involves reviewing accounts for duplicate payments, overpayments, and erroneous billing, then applying the correct adjustments. The goal is to ensure accuracy, compliance, and timely recovery of funds.

Why Credit Balances Occur

Credit balances can happen due to several reasons, including:

-

Duplicate payments from insurance or patients

-

Overpayments due to billing errors

-

Refunds not applied correctly

-

Coordination of benefits issues

-

Claim adjustments or write-offs not recorded accurately

Unresolved credit balances can distort your financial statements and even lead to compliance issues with insurance audits.

Benefits of Credit Balance Resolution Services

Implementing professional credit balance resolution services offers several advantages:

-

Improved Cash Flow – Recover overpayments efficiently and reduce financial leakage.

-

Regulatory Compliance – Ensure adherence to payer guidelines and avoid penalties.

-

Reduced Administrative Burden – Outsourcing these services frees up your staff to focus on patient care.

-

Accurate Financial Reporting – Maintain clear records for audits and management reporting.

-

Enhanced Revenue Cycle Efficiency – Identify systemic billing issues and prevent future errors.

How Credit Balance Resolution Works

Professional services typically follow a structured process:

-

Account Review – Analyze patient accounts to identify credit balances.

-

Investigation – Determine the cause of the balance by checking billing, payments, and insurance claims.

-

Resolution – Apply adjustments, issue refunds, or transfer funds as needed.

-

Reporting – Provide detailed reports for management and compliance tracking.

-

Prevention – Identify patterns to minimize future credit balances.

Who Can Benefit from These Services?

-

Hospitals and Clinics – Large volumes of transactions make credit balance management complex.

-

Medical Billing Companies – Ensures client accounts remain accurate and compliant.

-

Physician Practices – Helps smaller practices avoid financial leakage and reduce administrative stress.

Conclusion

Credit Balance Resolution Services are essential for maintaining a healthy revenue cycle in healthcare. By identifying, investigating, and resolving credit balances accurately, organizations can improve cash flow, maintain compliance, and focus on delivering quality patient care. Partnering with experts ensures timely resolution and keeps your financial operations running smoothly.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness