10 Biggest Payroll Headaches Indian HR Teams Face Without Software

India now has the world’s third-largest startup ecosystem and over 65 million formal-sector employees. Yet, lakhs of businesses—especially SMEs, factories, and early-stage companies—still calculate salaries using Excel sheets, WhatsApp groups, and prayer.

The result? HR teams drowning in compliance notices, employees chasing payslips, and founders paying lakhs in completely avoidable penalties.

Managing payroll without proper payroll software in 2025 is like driving a Formula-1 car with a flat tyre—you might reach the finish line, but you’ll damage everything on the way.

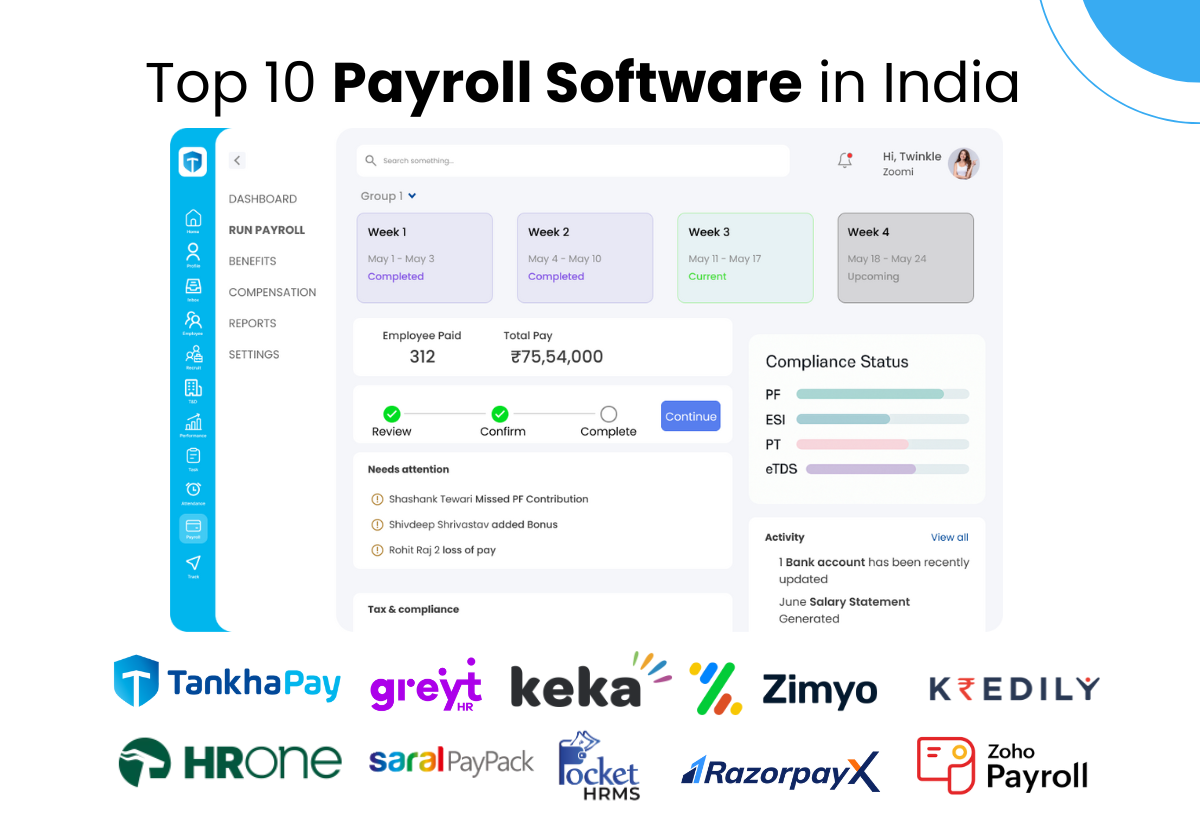

Here are the ten most painful challenges HR faces without automation—and how modern Indian payroll platforms like TankhaPay fix them in minutes.

1. Living in Fear of the Next TDS Rule Change

Every Union Budget (and sometimes mini-budgets) brings new tax slabs, surcharge rules, and rebate limits. One missed circular means the entire year’s TDS is wrong.

A Mumbai logistics company paid ₹6.3 lakh in interest and penalties because they continued using 2023-24 slabs for half of 2024-25.

TankhaPay and other smart payroll software in India push real-time tax updates—no manual downloads, no human error.

2. PF & ESI Deadlines That Feel Like Final Exams

15th of every month = panic stations.

- ECR format changes without warning

- Aadhaar seeding pending for 37 employees

- Someone on leave forgot to upload the file

One day late = 12% penal interest + damages up to 25%. Many small factories have paid more in damages than actual PF contributions.

TankhaPay generates ECR 2.0 files in one click and lets you pay PF & ESI directly from the dashboard—no login to multiple government portals required.

3. Leave Balance Disputes That Never End

“Ma’am, I had 18 leaves, why only 9 showing?” “Sir, I worked on Republic Day, where is my comp-off?”

Without a central system, HR ends up playing detective between biometric reports, email trails, and handwritten applications. Wrong balances → wrong FnF → labour court visits.

TankhaPay’s built-in attendance + leave module applies your exact policy (sandwich rules, carry-forward limits, encashment caps) automatically.

4. Bonus and Gratuity Calculations Gone Wrong

Which allowances are part of “wages” under the Bonus Act? Which employees fall under the new ₹21,000 gratuity ceiling? Most HR executives guess—and guess wrong.

One wrong bonus percentage can turn festive season joy into labour commissioner complaints.

TankhaPay follows the exact legal definitions and calculates everything accurately, every single time.

5. The Contract Worker & Gig Worker Chaos

Delivery riders, site supervisors, consultants, trainees, apprentices—each has different minimum wages, overtime rules, and PF eligibility.

After the ₹15,000 wage ceiling was scrapped, even high-paid consultants became PF-mandatory in many cases. Tracking this manually is impossible beyond 20–30 workers.

TankhaPay manages every worker type—permanent, fixed-term, or gig—on the same platform while staying 100% compliant with the four Labour Codes.

6. Professional Tax: 23 Different Nightmares

Karnataka: ₹200 flat from April 2024 Maharashtra: full year deducted in February Tamil Nadu, Kerala, West Bengal—each has its own slabs and deadlines.

Using a single slab for a pan-India workforce is the fastest way to get notices from state labour departments.

Good payroll software in India detects the employee’s work state and applies the exact PT rule automatically.

7. Payslips That Reach After the Salary

Employees need payslips the same day for home loan applications, visa processing, or just peace of mind. Manual companies send them after 5–10 days—if at all.

TankhaPay sends password-protected payslips via WhatsApp and email the second payroll is processed. Employees can download any month’s payslip 24×7.

8. The Annual Form-16 Heart Attack

March–May = 300 emails saying “My Form 16 is wrong” or “Where is my Form 16?”

Collating rent receipts, 80C proofs, and previous employer TDS manually guarantees mistakes.

TankhaPay generates legally perfect Form 16 (Part A + Part B) with one click—zero stress.

9. Salary Data Lying Around Like an Open Secret

Excel files emailed around, pen drives lost in cabs, sheets saved on personal laptops. One angry exit and the entire company’s salary structure is on Instagram.

The DPDP Act 2023 now imposes heavy fines for such negligence.

TankhaPay is ISO 27001 certified with 256-bit encryption. Your data never leaves a secure Indian data centre.

10. Scaling Becomes a Nightmare

What took two days for 80 employees suddenly takes two weeks for 800. Companies start hiring “payroll executives” whose only job is copy-paste.

Businesses using TankhaPay report that going from 200 to 2,000 employees barely moves the payroll workload needle.

The Silent Killer: Hidden Cost of Manual Payroll

A 250-employee Bengaluru company did the math:

- 110 hours/month on payroll (= ₹2.2 lakh at ₹2,000/hr)

- ₹5.8 lakh in penalties over 24 months

- 4 resignations directly linked to salary delays/errors (replacement cost ~₹20 lakh)

Total leakage: over ₹40 lakh in two years—enough to run premium payroll software for decades.

The New Normal in Indian Startups & SMEs

Series A investors now ask for compliance scores before term sheets. Factories losing export orders because of labour law violations. Employees rating companies 1-star on Glassdoor over “salary never comes on time”.

Smart founders are making payroll automation a non-negotiable from Month 1.

Why TankhaPay is Winning the Trust of Indian Businesses

Built exclusively for India’s complex laws:

- Real-time TDS, PF, ESI, PT, Bonus, Gratuity, Labour Codes compliance

- Direct government portal integrations

- Supports permanent + contract + gig workers on one dashboard

- Geo-fenced mobile attendance with selfie + location verification

- Instant payslips on WhatsApp

- One-click Form 16, ECR, registers

- Onboarding in 48 hours, no data entry pain

- Pricing that even 20-employee startups love

- Hindi + English support 365 days

Time to Stop Suffering

Every month you continue with manual payroll is another month of:

- Penalty interest eating your profits

- Good employees quietly updating their resumes

- You doing data entry instead of strategy

Switching to proper payroll software in India is no longer a “nice-to-have”. It is basic business hygiene in 2025.

Your employees want their salary on the 30th—not excuses on the 10th. Your CFO wants zero penalty notices—not surprises. You want to build a 1000-cr company—not fight Excel.

TankhaPay and other modern platforms can take over your entire payroll in under two days.

Make the leap. Close the Excel sheet forever. Focus on growth, not compliance panic.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness