Aquaculture Market Outlook: Balancing Profitability and Environment

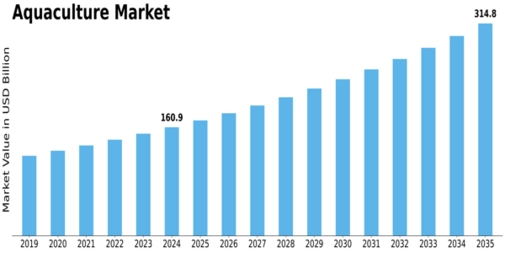

The aquaculture market is undergoing a dynamic transformation. With an estimated size of around USD 160.9 billion in 2024 and projections pointing toward roughly USD 314.8 billion by 2035, the industry is set to almost double over the coming decade. This outlook reflects growing global demand for aquatic food sources, technological innovation and sustainability imperatives.

Industry Overview

Aquaculture—essentially the farming of fish, crustaceans, molluscs and other aquatic species—is becoming a central component of global food production. Wild-catch fisheries face mounting pressure from overfishing and environmental limits; aquaculture offers an alternative path to supply protein-rich aquatic food while reducing pressure on wild stocks. In many regions, aquaculture operations are shifting from traditional pond systems to more advanced, intensive and monitored setups.

Key Players’ Role

Major companies are shaping the sector’s direction. For example, AquaBounty Technologies is characterized by its biotechnology‐driven approach, focusing on genetically-optimized fish that grow faster and more efficiently. Meanwhile, Dainichi Corporation contributes through high-quality aquafeed development, helping ensure farmed species grow healthily and sustainably. These and other players are investing in research & development, adopting sustainability protocols and forging partnerships to expand production capacity globally.

Segmentation Growth

Breaking down the market:

-

Environment-based segmentation shows that freshwater aquaculture holds the largest share (valued at around US $80 billion in 2024) and is projected to approach US $165 billion by 2035.Marine water and brackish water systems are also growing, though from a smaller base.

-

Type segmentation sees fishes dominating the spectrum, but crustaceans and molluscs are gaining traction—especially where consumers seek premium seafood options.

-

Regional segmentation reveals that the Asia-Pacific region was valued about US $70 billion in 2024, making it the largest contributor, while Europe, North America, South America and Middle East/Africa add diversity in growth patterns.

Market Outlook

Looking ahead, the market’s compound annual growth rate (CAGR) of about 6.29 % from 2025 to 2035 underpins a broad optimism. This growth is underpinned by:

-

rising global seafood demand as populations grow and dietary preferences shift toward proteins;

-

technological advancements like automated feeding, sensors and improved genetics that boost yield and efficiency;

-

increased government support and regulatory frameworks promoting sustainable aquaculture practices; and

-

sustainability concerns driving firms toward less resource-intensive, more traceable farming systems.

For companies active in aquaculture, the message is clear: invest in technology, focus on sustainable sourcing and enter high-growth niches (like premium crustaceans or molluscs) and emerging regions. As the market matures, there will be increasing pressure on operational efficiency, environmental credentials and supply-chain transparency. Those who move early will be well positioned in this evolving landscape.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness