The Halal Food Market: Current Landscape and Future Outlook (2024-2032)

Market Overview

Halal Food Market refers to products prepared in compliance with Islamic dietary laws, excluding prohibited ingredients like pork, alcohol, or unsanitary additives. The halal food market extends well beyond Muslim consumers: rising awareness about food safety, ethical sourcing, and perceived health benefits is drawing interest from non-Muslim consumers as well. The sector spans processed foods, dairy, meats, grains, confectionery, and ready-to-eat offerings.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/28343/

Market Size and Growth Projections

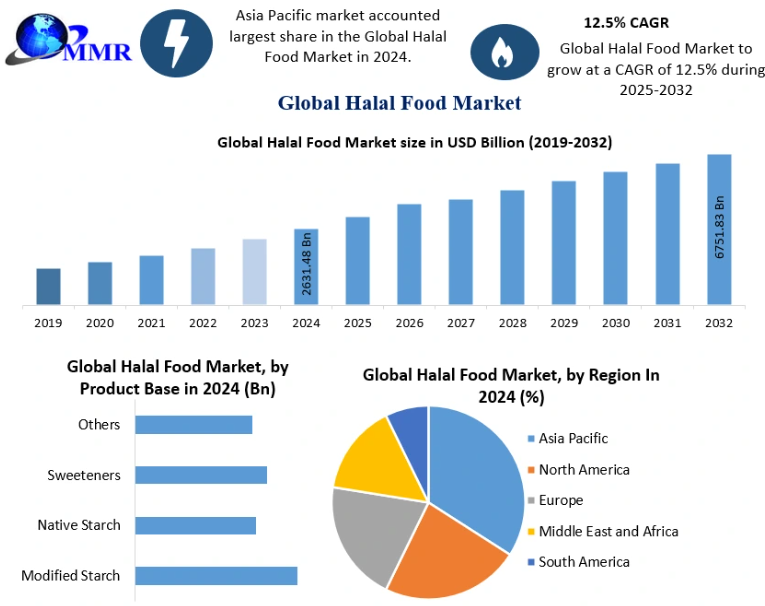

In 2024, the global halal food market was valued at approximately USD 2,631.48 billion. Over the forecast period of 2025–2032, the market is projected to grow at a compound annual growth rate (CAGR) of 12.5%, reaching about USD 6,751.83 billion by 2032. This strong growth signals both robust demand and expanding breadth of halal product offerings.

Key Market Drivers

-

Growing Muslim population & consumption base: The rise in the global Muslim population fuels baseline demand for halal-compliant products.

-

Health, safety & hygiene concerns: Halal certification is associated with stricter controls, which appeals to consumers prioritizing food safety and clean-label assurances.

-

Market diversification & product innovation: Producers are expanding into dairy, snacks, ready-to-eat items, and plant-based halal ingredients to capture broader consumption patterns.

-

Regulation & certification mandates: In certain countries, mandatory halal labeling regimes and regulatory frameworks push more products to adopt halal standards.

-

Distribution advances & e-commerce: The growth of online retail channels is helping halal brands reach new consumer segments in non-traditional markets.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/28343/

Market Segmentation

-

By Product Type: Key sub-segments include meat, poultry & seafood, fruits & vegetables, dairy products, cereals & grains, oils/fats, confectionery, and others.

-

By Distribution Channel: Channels include supermarkets & hypermarkets, convenience stores, specialty stores, e-commerce, and others. In 2024, supermarkets & hypermarkets commanded the largest share (~56%), followed by e-commerce (~21%).

-

By Product Base (ingredients): Includes native starch, modified starch, sweeteners, and other ingredient categories used in processed halal formulations.

Regional Insights

-

Asia Pacific dominates the halal food landscape, holding about 56.5% of global revenue share in 2024. The region benefits from large Muslim populations, strong halal certification systems, and rising consumer interest in safe and ethically sourced foods.

-

Europe ranks second, owing to increasing health and safety consciousness and growth in halal-certified product lines in Western Europe.

-

Middle East & Africa (MEA) also represent key markets, especially in Gulf countries where halal food is mainstream.

-

North America is an emerging region, with non-Muslim consumers driving niche demand for halal due to perceived quality and dietary considerations.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/28343/

Challenges

-

Lack of unified certification standards: Divergence across countries in halal certification criteria makes cross-border trade complex and costly.

-

Limited availability in non-Muslim regions: Retail penetration in many markets remains low, limiting consumer access.

-

High certification costs & logistical burden: For small or mid-size producers, obtaining halal accreditation and maintaining supply chain integrity is resource-intensive.

-

Consumer awareness & trust gaps: In some regions, lack of familiarity with halal concepts or skepticism around labeling can hamper adoption.

Key Players

Major global players in the halal sector include Nestlé S.A., Cargill, Inc., Al Islami Foods, BRF S.A., QL Foods, Yildiz Holding, Kawan Food Manufacturing, Saffron Road, and Midamar Corporation. These firms are expanding halal-certified product lines, investing in dedicated facilities, and forming partnerships to scale across regions.

Conclusion

The global halal food market is poised for significant expansion over the coming decade, driven by demographic trends, rising expectations around food safety, and broader consumer crossover demand. While challenges—especially around standardization, certification, and market access—persist, leading players and new entrants alike have opportunities to unlock value via innovation, regional expansion, and supply chain rigor. Success will hinge on maintaining authenticity, transparency, and adaptability in a dynamically evolving halal ecosystem.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness