Smart Pole Market: Growth, Segmentation & Regional Dynamics (2025‑2031)

The smart pole market is poised for robust growth over the next several years, with an expected compound annual growth rate (CAGR) of 20.2% between 2025 and 2031. As cities seek to modernize infrastructure, improve public safety and deploy digital services, smart poles are emerging as vital nodes integrating lighting, communications, sensing, and services. This report-style overview examines the market by Offering (Components / Software / Services), Type (New Installation / Retrofit), Application (Highways & Roadways; Public Places; Railways & Harbors; Others), and Geography (North America; Europe; Asia‑Pacific; South & Central America).

1. Market by Offering: Components, Software, Services

Components (Hardware)

The hardware (or component) segment remains the largest contributor to smart pole market revenues, owing to the need for physical infrastructure: pole bodies and brackets, lighting fixtures (especially LED), sensors (environmental, traffic, surveillance), communication modules (WiFi, cellular, LPWAN), controllers, and related physical components. In 2025, hardware is expected to account for the majority share of the market in dollar terms.

Driving growth in hardware are improvements in LED, reduced manufacturing costs, and multi‑functionality (e.g. poles that host lighting + sensors + antennas + possibly EV charging). Also, advances in communication devices (especially 5G small cells, NB‑IoT/LPWAN) are pushing hardware innovations. The controllers — the “brains†managing sensors, lighting, data flows — are central, and their demand is rising.

Software

Software is the fast‑growing segment. Once smart poles are installed, it is the software layers that unlock higher value: device / sensor management, dashboard / control centers, analytics (traffic, safety, environmental data), predictive maintenance, energy management, and APIs for third‑party integrations (e.g. for smart city platforms). As municipalities and stakeholders realize that data is as important as hardware, budget allocation is increasingly shifting toward software platforms and recurring revenue models (licensing, subscriptions, maintenance, support).

Services

Services encompass system integration, deployment, installation, maintenance, repair, remote monitoring, upgrades, and sometimes consulting or design. Also cybersecurity, ensuring connectivity reliability, and operations services (e.g. managing lighting schedules, firmware updates) are part of this. The services segment is expected to grow steadily alongside hardware and software, often bolstered by after‑sales contracts and long‑term maintenance agreements. As hardware proliferates, the demand for services increases, especially in retrofit contexts where integration and compatibility pose challenges.

2. Market by Type: New Installation vs Retrofit

New Installation

New installations cover smart poles in greenfield developments (new urban zones, expanding cities, newly built highways, new industrial or commercial complexes) or entirely new systems being deployed. These tend to command higher upfront cost per unit, since everything (foundation, power, connectivity, pole design) is built from scratch. However, because they allow full integration (lighting, communication, sensors, sometimes EV charging), they often command premium features and can be more efficient in the long term.

With infrastructure development pushed by governments (especially in developing countries), new installation will see strong growth. Also driven by smart city projects, new freeways & expressways, and major public works, particularly in Asia‑Pacific and parts of Latin America.

Retrofit

Retrofitting involves upgrading existing pole infrastructure: replacing traditional lighting with LED, adding sensors or communication modules, integrating control systems, but reusing existing poles / foundations / power where feasible. Retrofit tends to have lower initial capital expenditure, faster deployment, less civil works, fewer regulatory hurdles than new installation. This makes retrofit especially attractive for municipalities with budget constraints or existing streetlight / pole inventories.

In many markets, retrofit may dominate in volume in early years, although new installations may catch up in terms of revenue value per unit. Also, retrofits often offer faster payback (via energy savings, reduced maintenance, improved safety) which helps justify expenditure in public budgets.

3. Market by Application

Smart pole applications vary depending on use case, environment, and regulatory priorities. Here are key application segments and their expected performance during 2025‑2031:

Highways & Roadways

This is likely to remain one of the largest application segments, both in terms of revenue and strategic importance. Smart poles alongside highways and major roadways serve functions including adaptive lighting (dimming / brightening depending on traffic), traffic sensing, vehicle‑to‑infrastructure (V2X) communication, emergency call boxes or notification, environmental monitoring, and surveillance. Given the scale of road networks, the capital investment is significant. With growing concerns over road safety, congestion, and the drive to reduce energy costs, highways & roadways will see sustained demand.

Public Places

Public places include parks, plazas, pedestrian zones, downtown areas, campuses (university, business), and malls. In these settings, smart poles deliver multiple services: lighting, WiFi / connectivity, digital signage, surveillance, environmental sensors, public safety. Because of foot traffic and visibility, features like aesthetics, integrated sensors, real‑time services, user experience are more emphasized. This segment is likely to exhibit high growth, especially in urban cores, driven by tourism, city beautification, smart city amenities, and public safety concerns.

Railways & Harbors

These are specialized deployments associated with transport infrastructure. Key uses include lighting (for safety and visibility), surveillance, environmental sensing, communication (for operations or public announcements), possibly WiFi / connectivity services. Harbors also may need weather / tide sensors, safety monitoring, and camera systems. While this segment is smaller in overall volume compared to highways and public places, it is important due to higher safety and regulatory requirements. Growth here depends on investments in transport infrastructure, port modernization, and integration of smart city / smart transport plans.

Others

“Others†can include commercial & industrial zones, campuses, parking lots, advertisement / signage poles, EV charging stations integrated into poles, smart lighting in residential zones, etc. This segment offers opportunities for niche innovation, modular designs, customized solutions. While revenue per unit may be lower in some sub‑segments, the number of deployable units is large, especially as urbanization spreads and demand for smart infrastructure escalates in less central areas.

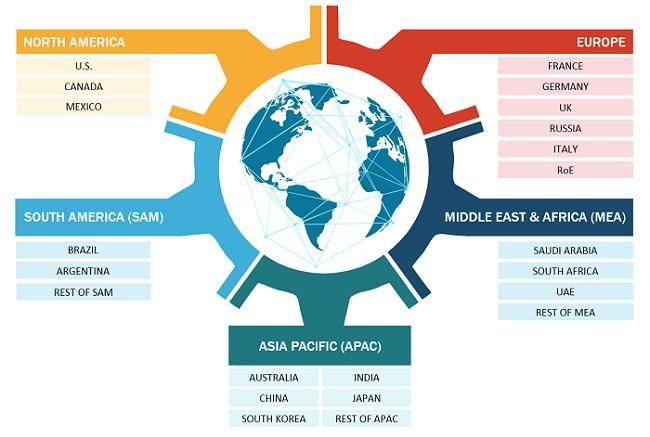

4. Geography: Regional Trends & Growth

North America

North America (principally the United States and Canada) is expected to continue being one of the leading markets by revenue. Key drivers include:

- Strong municipal budgets and public infrastructure expenditure.

- Push for energy efficiency (LED retrofits), environmental monitoring, sustainability goals.

- Early adoption of 5G and demand for densification (small cells on street poles).

- Smart city initiatives at city and state levels; regulatory support.

However, growth may be moderated by high labor / installation costs, regulatory / permitting processes, and existing infrastructure saturation. Still, over 2025‑31, North America is likely to capture a sizable share of smart pole revenues, particularly in hardware + software bundles, with retrofit being strong in older infrastructure.

Europe

Europe has multiple enablers: regulatory frameworks pushing for carbon neutrality, EU funding / grants for smart infrastructure, strong interest in public safety and environmental concerns. Countries like Germany, UK, France, Nordics are particularly active. Key challenges include fragmented markets (many countries, languages, regulatory regimes), sometimes higher capital cost, and ensuring interoperability / standards compliance (e.g. for data, communications). Europe is expected to grow at a healthy CAGR (perhaps slightly below Asia‑Pacific but still strong), especially in urban retrofits, public places, and applications combining lighting + sensors + air‑quality / environmental monitoring.

Asia Pacific

Probably the fastest growing region under a 20.2% CAGR scenario. Key drivers:

- Rapid urbanization and large populations in China, India, Southeast Asia.

- Government smart city programmes (China, India, South Korea, etc.).

- Demand for infrastructure upgrades, public safety, air‑quality monitoring, connectivity.

- Lower cost of manufacturing and hardware in the region; potential for large‑scale deployments.

- Rising demand for 5G deployment, small cell hosting, integration with EV infrastructure.

Challenges include power and grid constraints in some developing areas, higher maintenance difficulties in harsh environments, and ensuring connectivity / network backhaul in rural or semi‑urban zones. But overall, Asia Pacific is likely to see a leading share of growth through 2025‑31.

South & Central America

This region is likely to lag somewhat in per‑unit sophistication compared to North America, Europe, Asia‑Pacific, but offers strong growth potential. Drivers include urbanization, increasing demand for public safety, pressure to improve energy efficiency, tourism, modernization of public spaces. Key obstacles may be budget constraints, slower regulatory or municipal adoption, infrastructure gaps, and maintenance / operational costs. But smart pole projects with simpler functionality (lighting, basic sensors, surveillance) can scale, and public‑private partnerships may drive growth. Growth in retrofit installations (upgrading existing light poles) may dominate early on; newer installations may later follow as cities modernize.

5. Growth Drivers & Challenges

While the above segmentation shows where growth is likely, it's also worth pointing out what’s pushing growth and what might hold it back.

Drivers

- Smart city initiatives & public policy: Many governments are setting targets for urban sustainability, reducing carbon emissions, improving public safety, enhancing connectivity. Smart poles neatly tie into several policy goals (energy efficiency, IoT infrastructure, data collection).

- LED lighting efficiency & energy cost savings: Lighting is often one of the biggest energy draws in city budgets; replacing older lamps with LEDs, using adaptive lighting, scheduling, dimming yields savings.

- 5G deployment & need for densification: Telecom operator drive to get 5G small cells closer to users leads them to use poles as host structures. Smart poles that integrate communication devices become more valuable.

- IoT / sensor cost declines: Sensors, cameras, environmental monitors are becoming cheaper, more durable, lower power. Edge computing, analytics platforms improve.

- Public safety / environmental awareness: Demand for surveillance, traffic monitoring, emergency response, air quality measurement etc.

Challenges

- High upfront capital cost: Hardware + infrastructure + installation is expensive. Municipal budgets may be constrained.

- Operational & maintenance complexity: Smart poles combine mechanical, electrical, communications systems; failures in one component can reduce utility; maintenance requires skilled personnel.

- Connectivity / network issues: Need robust backhaul, sometimes in remote or dense urban areas; latency, reliability matter especially for safety or real‑time applications.

- Standardization, regulation, data/privacy issues: Ensuring interoperability, data security, citizen privacy; coordinating between utilities, municipalities, telecoms; permitting / zoning.

- Power / infrastructure constraints (in developing regions): Existing power supply, grid stability, foundation availability etc.

6. Outlook & Projections (2025‑2031) under 20.2% CAGR

Assuming the market grows at 20.2% CAGR from 2025 to 2031:

- The global market size in 2025 is often estimated in reports (depending on source) in the low‑to‑mid tens of billions USD. Under this CAGR, by 2031 the market would multiply by a factor of approximately (1.202)^6 ≈ 2.99, i.e. nearly triple in value.

- Hardware will continue to contribute the larger share of value early, but software + services will grow faster in percentage terms, gradually increasing their proportion of total revenue. For example, software platforms and analytics may go from, say, ~20‑25% of spend to 30‑40+%, especially in regions with higher willingness to pay for data / performance.

- Retrofit installations, which are cheaper per unit but many more in number, will dominate in volume (number of poles), while new installations may dominate in revenue per unit in growth areas (greenfield smart cities, new roads).

- Among applications, highways & roadways will be steady and large; public places will likely exhibit higher growth rates because of multipurpose functions; others will scale gradually.

- Regionally, Asia Pacific likely will outpace others in CAGR; North America and Europe will be large in absolute terms; South & Central America will have strong growth, but from a smaller base.

7. Implications & Strategic Recommendations

For companies, municipalities, investors, and stakeholders in the smart pole market, the following considerations are strategic:

- Focus on software & services: While hardware is necessary, profitability and growth opportunities are increasingly in software platforms, data analytics, connectivity services, and maintenance. Building recurring revenue models can make business more sustainable.

- Modular, upgradable designs: Given the pace of technology change (communication standards, sensor tech, energy sources), designs that allow for retrofit / module upgrade will be advantageous.

- Partnerships & collaboration: Telecom operators, utilities, local governments must collaborate—e.g. to host small cells, share infrastructure costs, ensure regulatory compliance.

- Addressing regional challenges: In developing regions, solutions must be cost‑effective, durable (against weather, vandalism), low maintenance, possibly off‑grid or solar powered. Also, local supply‑chain presence reduces cost.

- Data & privacy governance: As surveillance, sensors, connected infrastructure proliferate, focus on cybersecurity, data privacy, clear regulations, citizen acceptance will be critical.

- Financing models: Public‑private partnerships, government grants/subsidies, performance‑based contracts (where savings pay for installation), might be required especially for retrofits or lower income regions.

8. Conclusion

In summary, the smart pole market between 2025‑2031 is set for strong growth—with a CAGR around 20.2%—driven by the confluence of smart city policies, 5G and connectivity demands, energy efficiency requirements, and evolving public safety/environmental priorities. While hardware remains the foundation, the rising importance of software and services cannot be understated. Geographically, Asia‑Pacific is likely to be the growth engine, with North America and Europe providing large, relatively mature markets. Retrofit and new installation both have important roles; highways, public places, and transport infrastructure are key application arenas.

Stakeholders who plan carefully—aligning with regional characteristics, embracing modularity, data governance, partnerships, and innovative business models—are likely to capture a large share of the upside in this rapidly expanding sector.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness