India Personal Loan market Report, Size, Trends, Growth & Forecast 2033

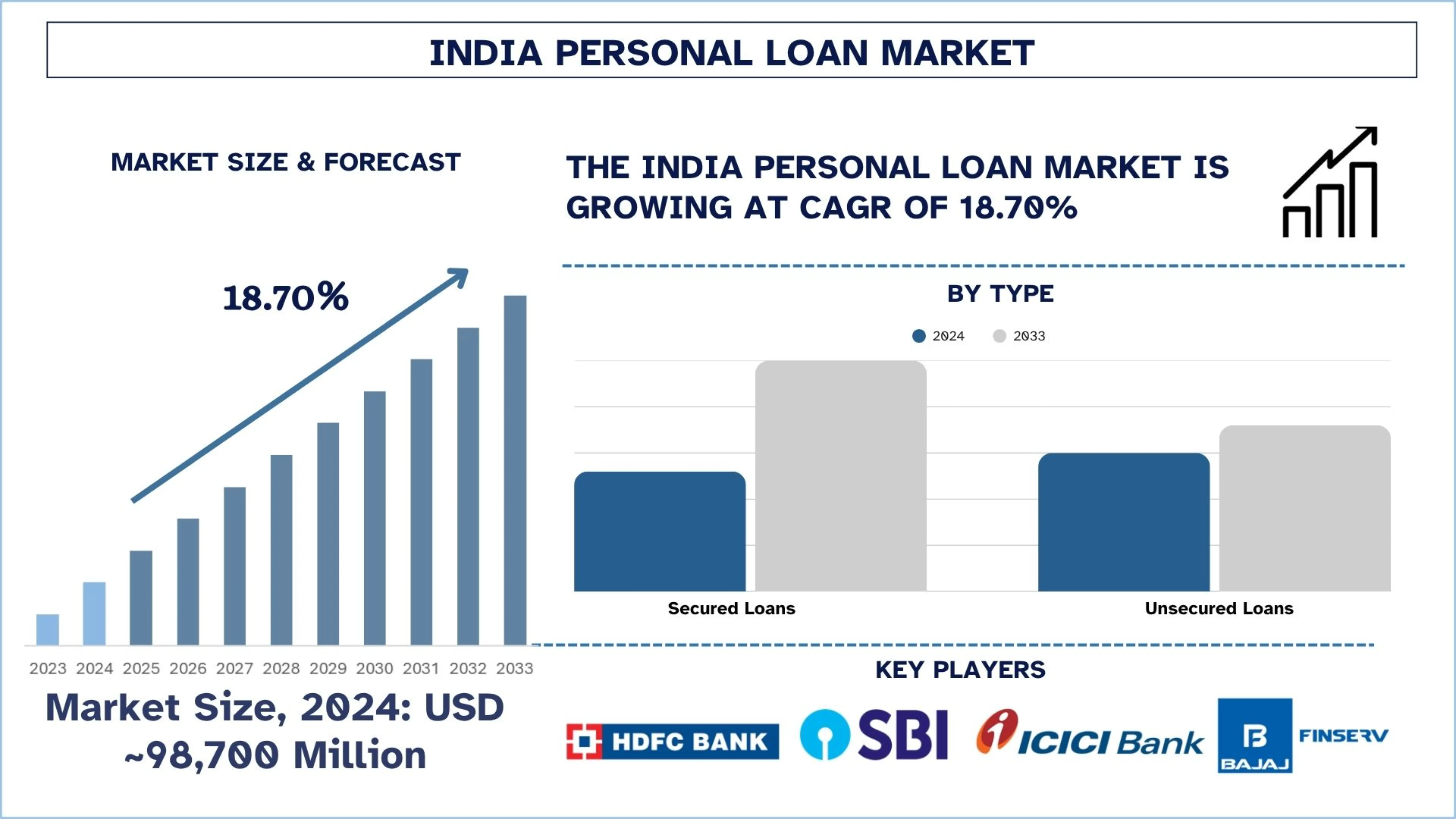

The India Personal Loan Market was valued at USD ~98,700 million in 2024 and is expected to grow to a strong CAGR of around 18.70% during the forecast period 2025-2033

Public sector banks dominate in volume, but private banks, as well as NBFCs, are capturing market share quickly through a heavy emphasis on personalized digital offerings. Salaried borrowers are still the main borrowers, while self-employed and gig economy workers are becoming key target borrowers.

Over 70% of new personal loan applications in Tier I and II cities are processed digitally, facilitated by an AI capable of integrating e-KYC, real-time underwriting, and instant disbursal into mobile apps, increasing customer acquisition and decreasing turnaround time.

Buy Now Pay Later and embedded lending models are picking up pace a lot with Millennials, skyrocketing BNPL transactions in India are expected to surpass INR 1.2 lakh CR by 2026, opening new vistas of growth for FinTech (Fintech) Lenders.

Furthermore, the regulatory and credit ecosystem, via RBI's push for financial inclusion as well as digital lending guidelines and a strengthening of the credit bureau ecosystem, has brought in greater transparency, borrower protection, and access to improve sustainability for future long-term market growth.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-personal-loan-market?popup=report-enquiry

A rapidly rising middle class and growing consumer spending in India are driving the demand for personal loans, as more people are turning to quick and flexible financing solutions. With lending going digital and a paperless loan process taken up, credit has become easier and faster to access for tech-savvy users. Moreover, with higher levels of financial inclusion and deeper mobile penetration in Tier II and Tier III cities, the lenders can cater to markets which otherwise were not served before. These factors, complemented by low interest rates and an improving credit infrastructure, are collectively steering steady and widespread growth in the Indian personal loan market.

According to RBI data, the personal loans to total credit stood at 32.6% in February 2024 from 30.6% in 2023, for eg. Further, in 2023, home loans accounted for about 47.2% of total retail loans in India.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-personal-loan-market

According to the report, the impact of Personal Loan has been identified to be high for the North India area. Some of how this impact has been felt include:

North India is expected to grow with a significant CAGR during the forecast period (2025-2033). With more people becoming computer literate and fintech stepping in, personal loans are spreading quickly among people in both Delhi-NCR and many Tier 2 cities like Jaipur and Lucknow. Ever more people employed and running their businesses are leading to an increase in originations with NBFCs and private banks. The increased growth in this region comes from special lending, more branches, and more awareness of credit.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Type, By Type of Lender, By Purpose of Loan, By End-Use, and By Region/Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness