Short Takeoff and Landing (STOL) Aircraft Market Report, Size, Overview, Trends & Analysis 2033

Key Highlights of the Report:

Ø Growing Demand for Regional Connectivity & Remote Access – Increased investments in regional air mobility and infrastructure development in remote areas are pushing STOL aircraft adoption. Countries with difficult terrains, such as Canada, Indonesia, and Brazil, are expanding STOL operations to improve access to transport.

Ø Advancements in Hybrid & Electric STOL Technologies – With the development of hybrid-electric and hydrogen-powered STOL aircraft, the industry is seeing a pivot toward sustainability in aviation. Electra and ZeroAvia are both leaders in the electrified STOL field for low-emission, short-runway operations.

Ø Defense & Humanitarian Missions Driving Growth – Governments and defense agencies are stepping up their STOL aircraft procurement to allow rapid deployment, surveillance, and cargo transport in conflict zones and disaster areas. The U.S. Air Force and its NATO allies actively modernize their fleets with STOL-capable aircraft.

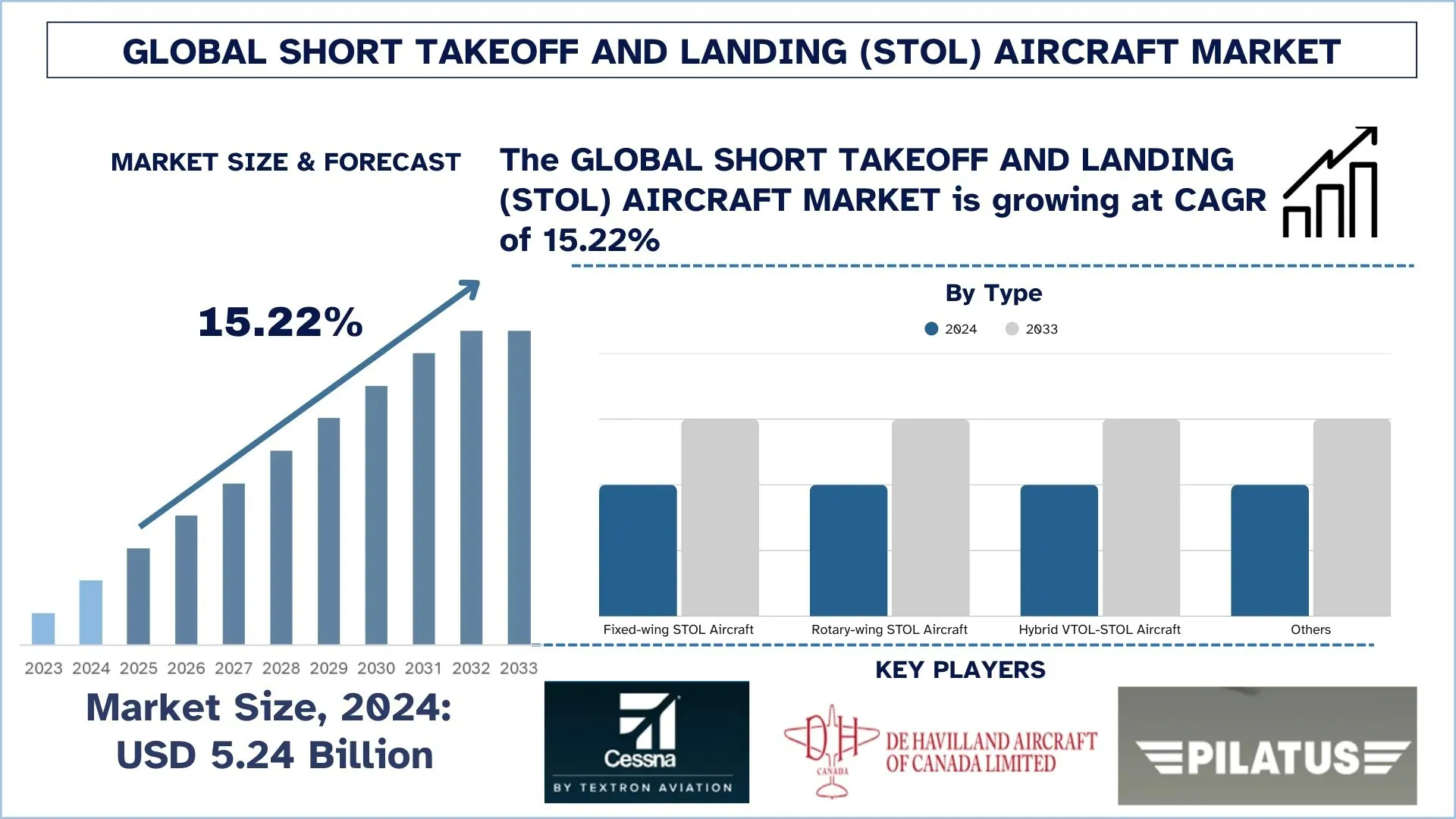

According to a new report by UnivDatos, the Short Takeoff and Landing (STOL) Aircraft Market is expected to reach USD 21.28 billion in 2033 by growing at a CAGR of 15.22% during the forecast period (2025- 2033F). The demand for STOL aircraft has increased due to the enhanced regional connectivity schemes, military applications, and upcoming advances in hybrid propulsion systems. Governments as well as private operators are steadily investing in subsidized STOL aircraft for improved reach within tough access for remote areas, tactical military operations, and contributions toward sustainable aviation solutions. With the growing advancements in the STOL sector, the next generation aircraft is going to incorporate vectored thrust, lift-plus-cruise mechanisms, and fuel-efficient turboprop engines for better operational efficiency, lower emissions, and longer ranges. For instance, in July 2022, Daher recently launched the Kodiak 900, a larger and faster variant of the Kodiak 100, at the AirVenture Oshkosh 2022 Japanese event. The body is extended by 3.9 feet, has a cruise speed of 210 KTAS, and offers a maximum range of 1,129 nm. In addition to improved fuel economy, the Kodiak 900 allows for greater passenger and cargo capacity and features flexible interior configurations.

Segments that transform the industry

· The fixed-wing STOL aircraft market dominated the market and is expected to maintain its leading position throughout the forecast period. Fixed-wing aircraft are widely used as these aircraft can take off and land on short runways and can be used in regional connectivity, military operations, and emergency response. Thus, the demand for air mobility- that is being defined by the lead times from land to air in regions where access has been an issue- is driving demand, especially in countries investing in developing the small airstrips for better accessibility. Additionally, Military forces also upgrade STOL airlift fleets for quick deployment of personnel, reconnaissance, and cargo delivery into particularly rough environments. There is an enhanced procurement stream for countries like the U.S. and Canada in support of these defense and humanitarian missions. For instance, in November 2024, General Atomics, one of the prominent players in aerospace and defense, tested its Gray Eagle STOL for the first time over the ship-to-land.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/short-takeoff-and-landing-aircraft-market?popup=report-enquiry

According to the report, the impact of Short Takeoff and Landing (STOL) Aircraft has been identified to be high for the Asia-Pacific area. Some of how this impact has been felt include:

The Asia Pacific region shows the highest growth due to several competing factors. With economic growth in the Asia Pacific Region, specifically in China and India, there has been high demand for quick transport solutions into the remote and underserved regions. The varied applications of adventure tourism, humanitarian aid, and environmental monitoring can greatly enhance the prospects of STOL aircraft within the Asia Pacific Region. The rugged terrains and the presence of several islands necessitate the demand for quick air operations through short-runway aircraft. The other factors smoothly driving market growth involve government programs intended to enhance regional connectivity with infrastructure development. For instance, in 2022, the Indian government launched an initiative called the UDAN (Ude Desh Ka Aam Nagrik), which seeks to enhance air connectivity to far-flung areas, thereby providing a beneficial atmosphere for the acceptance of STOL aircraft. The growing middle class and the rising disposable income have increased air travel in the region, contributing to the growth of the STOL aircraft market. Moreover, a lot of advancements have been happening in the sector; companies operating in the market are trying to design futuristic models to grab the market share. For instance, in May 2023, Chengdu Aircraft Research & Design Institute (CADI), under the Aviation Industry Corporation of China (AVIC), approved a patent for a Vertical and/or Short Take-Off and Landing (V/STOL) fighter aircraft.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Type, By Lift Technology, By Application, By Region/Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - https://univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness