Europe Meat Market Size, Share, Demand, Trends, Key Players Analysis and Forecast 2025-2033

Europe Meat Market Overview

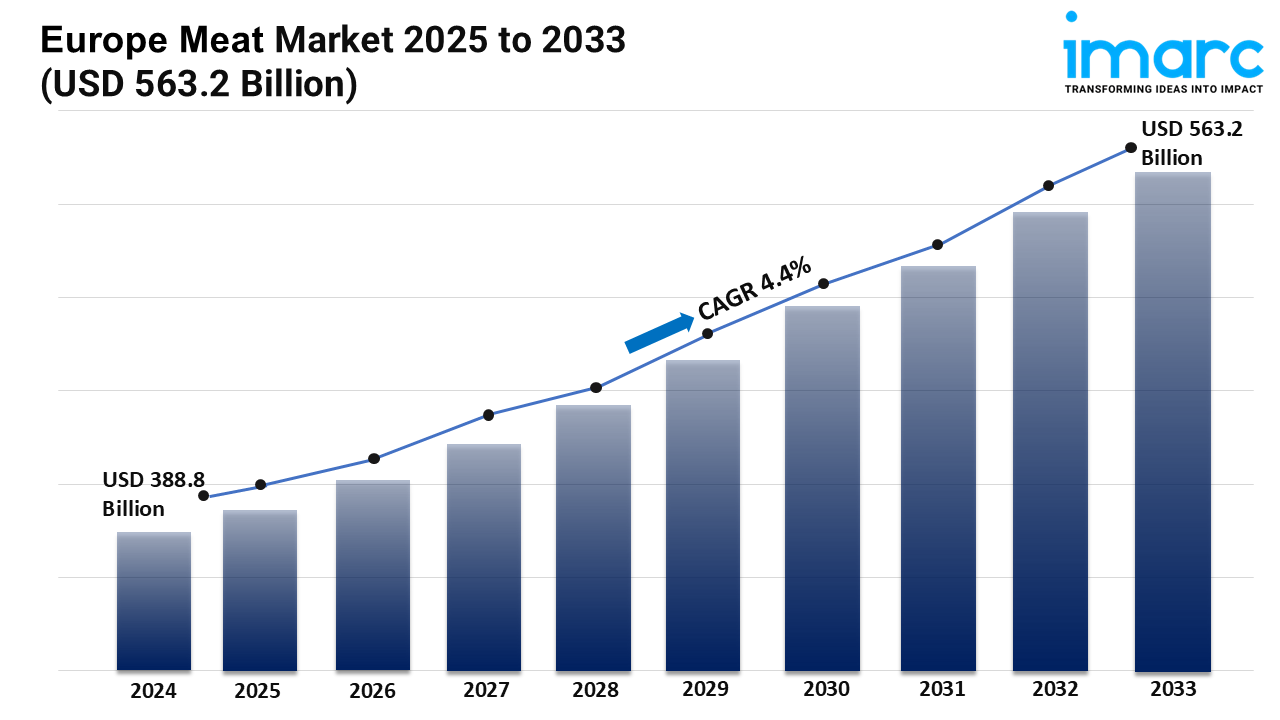

Market Size in 2024: USD 388.8 Billion

Market Forecast in 2033: USD 563.2 Billion

Market Growth Rate: 4.4% (2025-2033)

According to the latest report by IMARC Group, the Europe meat market size was valued at USD 388.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 563.2 Billion by 2033, exhibiting a CAGR of 4.4% from 2025-2033.

Europe Meat Industry Trends and Drivers:

As changing dietary habits, technical developments, and varied product options transform consumption throughout Europe, the meat market is slowly growing. Rising demand for protein-rich meals is driving consistent consumption in all meat segments including poultry, beef, pig, and seafood. Consumers are actively looking for premium, nutrient-rich choices consistent with health-conscious lifestyles, which motivates producers to improve production levels and nutrient transparency. Further driving demand for ready-to-cook and processed meat goods, especially among younger urban segments, is the growing popularity of quick-service restaurants and food delivery companies. Concurrent with this, growing interest in organic and ethically sourced meats is affecting purchasing choices since environmentally conscious consumers give traceability and ethical farming practices top priority. Companies are taking advantage of this change by offering grass-fed, eco-labeled, antibiotic-free choices to strengthen brand position in a cutthroat retail landscape.

Technological developments in meat processing are changing operational efficiency and product development. Automation, cold chain logistics, and precision cutting tools are enabling faster throughput and consistent quality control, therefore meeting the growing volume of retail and foodservice orders. Extending shelf life and matching sustainability objectives, packaging inventions including vacuum sealing, modified atmosphere systems, and recyclable materials are also helping to further meet these aims. The market is also seeing an inflow of plant-based and hybrid meat items that will entice flexitarians who are alternating their traditional meat consumption with other sources of protein. Food scientists and RandD teams are creating cleaner ingredient profiles and refining texture and flavor to replicate the culinary experience of traditional meat. Consequently, grocery store chains and specialty retailers are giving more shelf space to both traditional and alternative products, therefore meeting a wider customer base. Cross-segment market expansion is being helped by this multi-tiered approach, which also stimulates innovation across the value chain.

Serving as main growth centers in the European meat market regionally, Germany, France, and the United Kingdom each bring distinctive supply chain strengths and consumer behavior trends. Germany is pushing traceable, welfare-certified items backed by strong domestic demand and sophisticated processing infrastructure. France is using its culinary past to keep demand for premium cuts and gourmet goods afloat, while the UK is leading private-label development and retail innovation. Countries like Spain and Italy are exhibiting great local preferences for cured and gourmet meats in Southern Europe, which is boosting small-scale and export-driven manufacturing. The Nordic nations are pushing sustainable farming methods and actively include organic meats into national dietary guidelines at the same time. Increasing production capacity and exporting competitively across the continent are Eastern European countries like Poland and Romania. The Europe meat market is strengthening its place as a varied, resilient, forward-looking industry inside the world food economy as each area scales operations to match shifting consumer expectations.

Download sample copy of the Report: https://www.imarcgroup.com/europe-meat-market/requestsample

Europe Meat Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Type:

- Raw

- Processed

Analysis by Product:

- Chicken

- Beef

- Pork

- Mutton

- Others

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- In July 2024, Meatly announced it had received regulatory clearance to sell cultivated meat for pet food in the UK, making it the first in the world to get authorization for cultivated pet food. A huge leap forward for the cultivated meat industry, gaining regulatory approval also makes Meatly the first-ever cultivated meat company approved for sale in any European country.

- In November 2024, Dutch startup Meatable, focused on cultivated meat technology, secured strategic investment from Betagro Ventures, the venture capital arm of Thailand’s Betagro food group. Although the funding amount remains undisclosed, the deal marks Betagro’s first venture into the cultivated meat space, highlighting their interest in Meatable’s cell-based technology that mimics traditional pork and beef.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=9107&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness