Germany Fintech Market 2025-2033 | Size, Share, Demand, Key Players, Growth and Forecast

Germany Fintech Market Overview

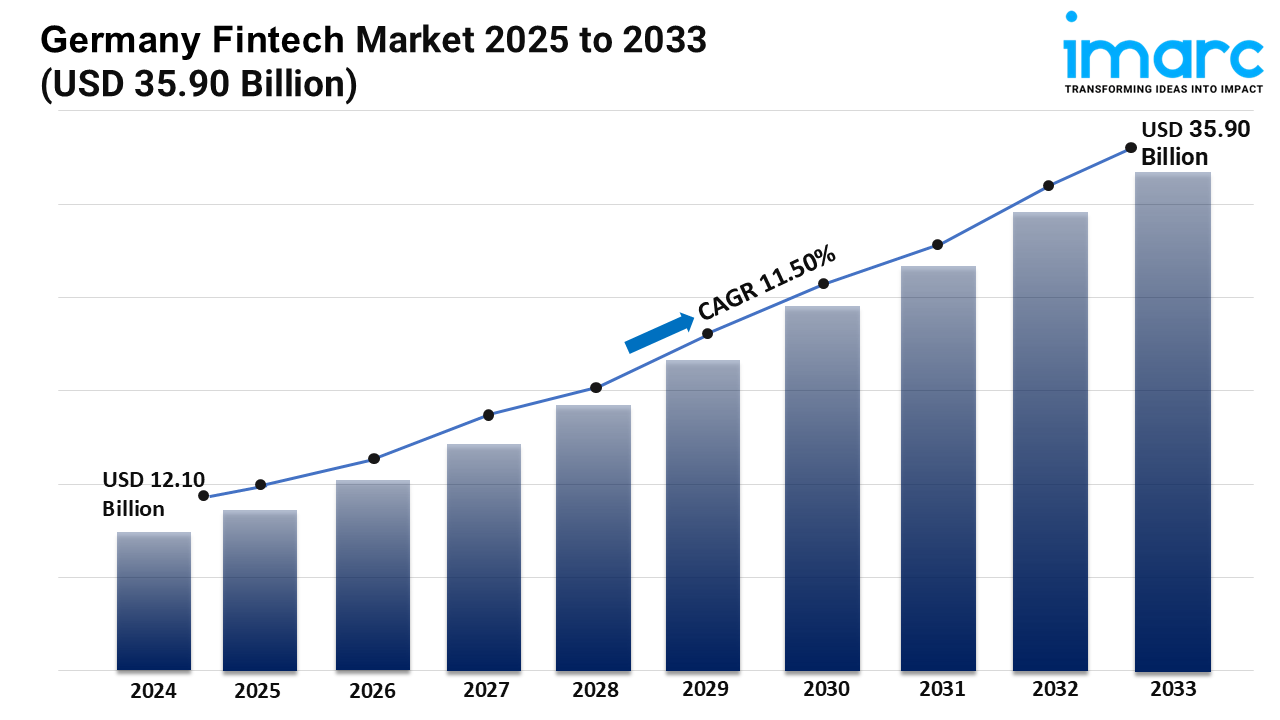

Market Size in 2024: USD 12.10 Billion

Market Forecast in 2033: USD 35.90 Billion

Market Growth Rate: 11.50% (2025-2033)

According to the latest report by IMARC Group, the Germany fintech market size was valued at USD 12.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.90 Billion by 2033, exhibiting a CAGR of 11.50% from 2025-2033.

Germany Fintech Industry Trends and Drivers:

As the financial services environment embraces digitalization, legislative modernization, and consumer-centric innovation, the Germany fintech market is quickly changing. Advanced technologies are being used by fintech firms to provide agile, scalable, and safe solutions that are changing conventional banking systems. Faster integration, flexible scaling, and lower operational expenses are made possible by cloud-based distribution across the financial system. At the same time, mobile-first techniques are changing how customers engage financial platforms, with simple user interfaces and tailored digital experiences promoting client loyalty. Combining artificial intelligence and machine learning is improving credit scoring, fraud detection, and robo-advisory services, therefore allowing for better decision-making and real-time insights. Financial firms are partnering with startups to speed digital transformation, lessen reliance on legacy infrastructure, and meet the rising demand for frictionless, contactless financial services throughout the population as these technologies mature.

While guaranteeing consumer protection and market integrity, Germany's friendly regulatory environment is helping to grow fintech innovation. Open banking methods are being encouraged by forward-thinking legislation, hence enabling safe data-sharing and promoting ecosystem-wide cooperation. Empowerment of fintech companies to test products under directed supervision through regulatory sandboxes and innovation centers motivates experimentation without sacrificing compliance. This regulatory flexibility is spurring investment in several emerging fintech sectors including insurtech, regtech, and wealthtech, which financial consumers are seeking customized, transparent, and automated solutions. Applications including embedded finance, blockchain-based payment systems, and peer-to-peer lending are growing in retail and corporate use cases, altering the competitive scene and opening up new revenue streams. As companies and customers alike embrace fintech solutions for anything from real-time payments and financial planning to invoice automation and integrated credit, the end-user spectrum is growing.

Different adoption patterns are emerging in Germany locally to reflect demographic, economic, and infrastructural differences. Rising fintech powerhouses, urban centers like Berlin and Frankfurt are propelled by startup concentration, worldwide investor interest, and closeness to established financial institutions. Frankfurt is concentrating on enterprise-grade financial technologies matched with institutional needs; Berlin is creating a lively ecosystem of neobanks, payment platforms, and digital asset companies. Building on a solid Mittelstand economy, Southern areas including Bavaria are highlighting digital SME finance and industrial fintech. Financial literacy initiatives and public-private alliances in the North and West are hastening underbanked populations' use of mobile banking and digital wallets. Germany is positioning itself as a core engine in the digital finance development of Europe, where innovation, trust, and inclusion are propelling long-term market resilience and possibility as regional ecosystems are matching national fintech goals.

Download sample copy of the Report: https://www.imarcgroup.com/germany-fintech-market/requestsample

Germany Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Germany Fintech Market News:

- May 3, 2024: The business finance platform Tide has partnered with payments company Adyen to offer Tide business accounts to small and medium-sized businesses (SMBs) in Germany and Europe. It has already set up operations in the German and Indian markets and aims to improve finance and administration solutions for SMBs in Germany further in 2024. Adyen's banking-as-a-service (BaaS) solution will be used commercially in Germany for the first time to support Tide's customer-centric approach, providing local IBANs for German customers. The partnership aims to offer cost-effective and efficient business accounts and localized payment experiences for SMBs in Germany.

- December 5, 2023: Major European bank UniCredit announced a strategic investment in Berlin-based FinTech startup Banxware, which specializes in integrated lending solutions. The UCG Strategic Investment Team at UniCredit has made its first investment with this. The partnership aims to expand UniCredit’s lending offerings to current business clients and tap into new customer bases, especially in the German market. Banxware facilitates financing for SMEs through partnerships with various platforms, and UniCredit's investment aligns with their 'UniCredit Unlocked' strategy to enhance digital capabilities.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=29399&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness