Europe Private Equity Market 2025 | Size, Share, Demand, Key Players, Growth and Forecast Till 2033

Europe Private Equity Market Overview

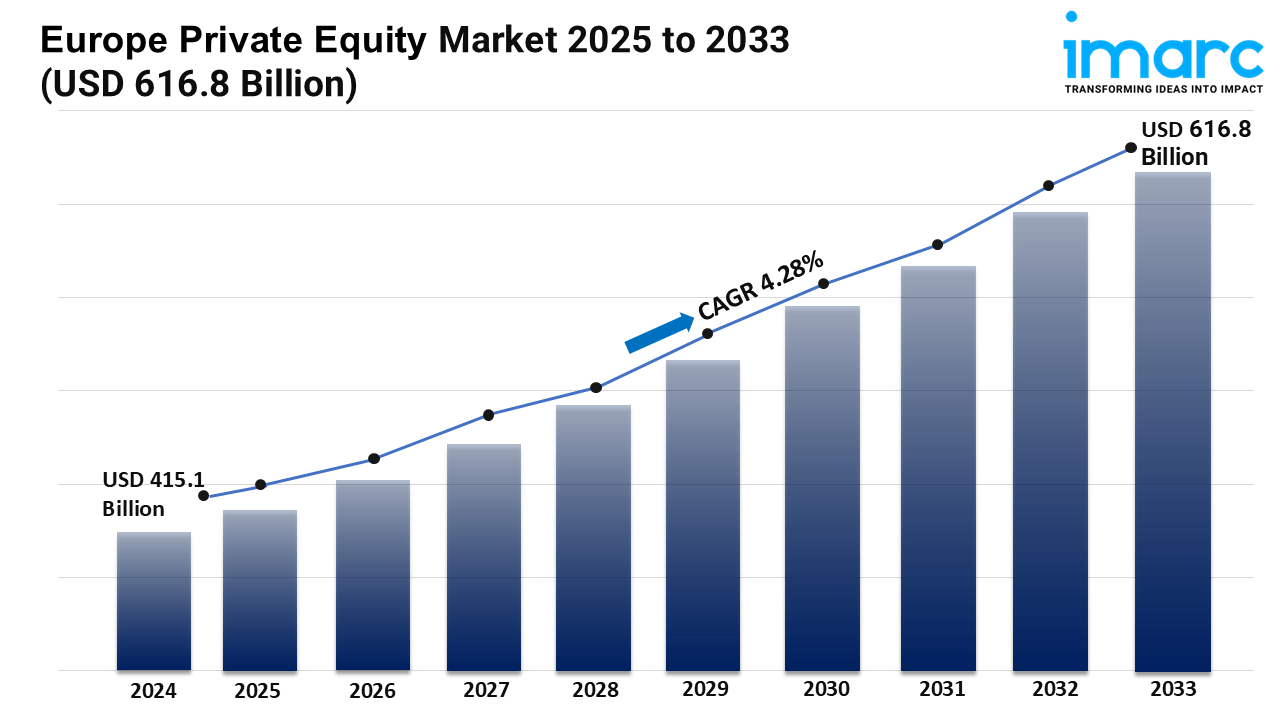

Market Size in 2024: USD 415.1 Billion

Market Forecast in 2033: USD 616.8 Billion

Market Growth Rate: 4.28% (2025-2033)

According to the latest report by IMARC Group, the Europe private equity market size was valued at USD 415.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 616.8 Billion by 2033, exhibiting a CAGR of 4.28% from 2025-2033.

Europe Private Equity Industry Trends and Drivers:

Investors are taking advantage of structural changes, industry transformation, and available funding all throughout Europe's private equity market, which is steadily growing. Focusing on resilient industries like technology, healthcare, infrastructure, and consumer services, asset managers are using a range of approaches. This wise reallocation is opening up fresh growth avenues and producing greater value. Investment companies are giving ideas driven by innovation top priority and using the area's huge talent base and digital maturity to support scalable projects. Rising investor interest in mid-market buyouts is simultaneously stimulating rivalry and facilitating operational value improvements throughout portfolio firms. Institutional investors are showing increased interest in alternative assets, while family offices and sovereign wealth funds are strengthening long-term commitments and thereby raising transaction flow and liquidity.

Additionally simplifying cross-border activities, regulatory coordination across EU nations is generating an integrated investment environment appealing to both local and foreign funds. Faster concentration on environmental, social, and governance (ESG) issues is altering fund placement and investment strategies. Reflecting more general changes in stakeholder expectations, private equity companies are integrating sustainability requirements into portfolio management and transactions. Differentiating value proposals, lowering risk, and maximizing long-term returns, ESG-compliant solutions are proving quite helpful. As investors match cash with climate goals and ethical behavior, green technologies, clean energy, and impact-driven corporate models are getting increasing interest. Concurrently, digital transformation is becoming a main facilitator of operational scaling as private equity funds actively encourage data-driven decision-making and technology integration across sectors. This dual focus on sustainability and innovation is positioning the Europe private equity market as a leader in future-forward investment. Fund managers are raising the standards for post-investment monitoring and due diligence by using AI-powered analytics and real-time risk modeling to enhance strategic oversight and performance optimization.

Country-specific investment patterns are supporting regional development and strengthening the European private equity network. In the UK, a mature financial market is helping complex fund arrangements and significant sector specialization, especially in healthtech and fintech. Strong institutional support and mid-cap strength are helping Germany encourage industrial invention and sustainability-related investment. By means of robust institutional support and government-backed co-investment initiatives, France is stressing ESG integration and capital access facilitation as well as social entrepreneurship. Meanwhile, the Nordics are becoming well known for their transparency, digitalis, and investor-friendly policies, therefore speeding cross-border collaborations and thematic fund development. Southern European nations are unlocking latent capacity via privatization projects and tourism-related ventures, while Central and Eastern Europe is drawing growth capital into developing digital economies. These changing dynamics are creating a varied, resilient, and opportunity-rich private equity environment wherein regional strengths are meeting worldwide best practices to define the next phase of investment leadership in Europe.

Download sample copy of the Report: https://www.imarcgroup.com/europe-private-equity-market/requestsample

Europe Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Fund Type:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- In June 2024, KKR acquired Superstruct Entertainment from Providence Equity Partners for $1.4 billion (€1.3 billion), gaining ownership of over 80 music festivals across Europe and Australia.

- In April 2024, CVC Capital Partners, known for stakes in Six Nations rugby and Lipton Teas, plans to tactically sell over 100 million shares as it prepares to go public on the Amsterdam Stock Exchange. The firm seeks a valuation between €13 billion and €15 billion, marking a significant milestone after years of strategic planning.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=10190&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness