Germany Logistics and Supply Chain Market Benefits from Growing Cross-Border Trade in 2025

Germany Logistics & Supply Chain Market Overview:

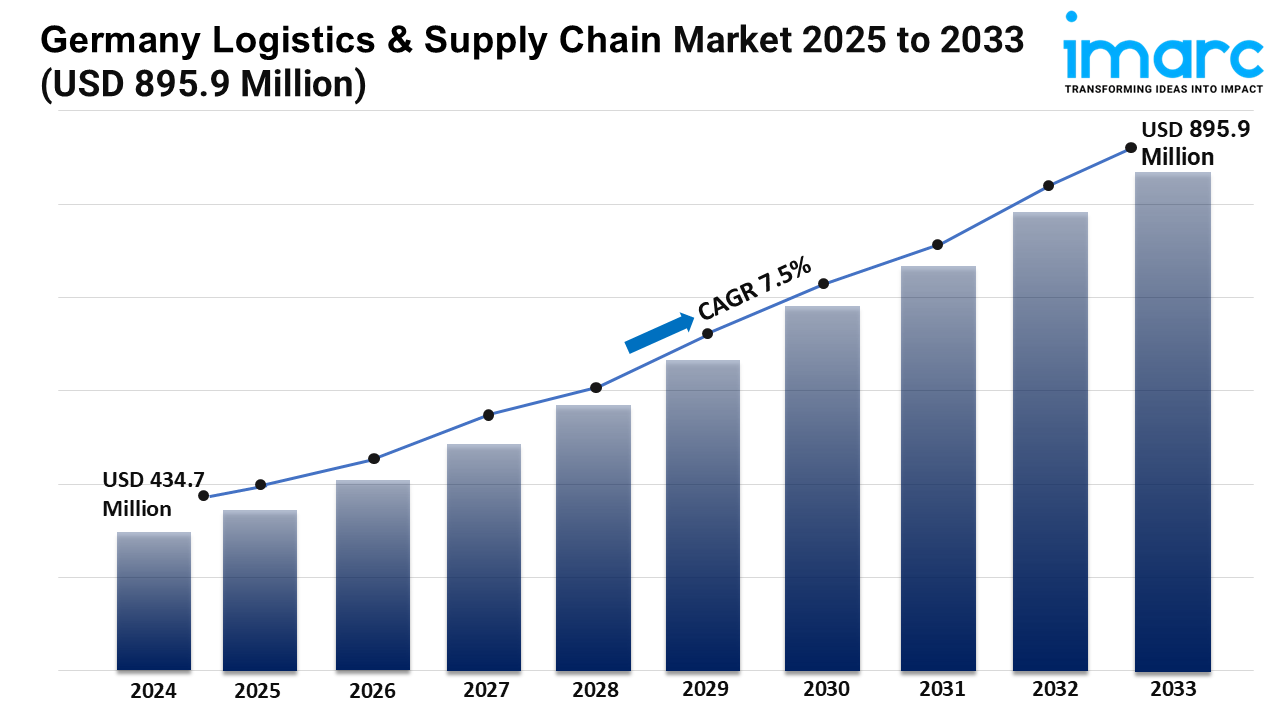

Market Size in 2024: USD 434.7 Million

Market Forecast in 2033: USD 895.9 Million

Market Growth Rate 2025-2033: 7.5%

The German logistics & supply chain market size reached USD 434.7 million in 2024, and it is expected to reach USD 895.9 million by 2033, exhibiting a growth rate (CAGR) of 7.5% during 2025-2033.

Germany Logistics & Supply Chain Industry Trend Factors:

The Unstoppable Drive for Sustainability and Green Logistics

The German logistics & supply chain market is undergoing a significant shift, with sustainability moving from a niche concern to a core business imperative. This transformation is driven by both governmental policy and consumer pressure. The German Supply Chain Due Diligence Act, for example, holds companies accountable for human rights and environmental standards across their entire supply chains, compelling a re-evaluation of sourcing and transport methods. In response, businesses are investing heavily in green solutions. EDEKA Nord, a major player in the Germany logistics market, launched its first green hydrogen-fueled trucks for store deliveries in early 2025, signaling a commitment to decarbonization. This trend is not just about compliance; it’s about a fundamental change in the way logistics in Germany operates, with a focus on a more sustainable future.

AI-Powered Automation and the Digital Future

Artificial intelligence is at the heart of the ongoing digitalization of the German logistics & supply chain market. Companies are leveraging AI to optimize a wide range of processes, from warehouse management to last-mile delivery. AI-driven systems are used to analyze vast amounts of data to predict demand, leading to more accurate inventory management and less waste. Furthermore, AI is a crucial tool for improving efficiency in transport planning. It can calculate optimal delivery routes, reducing fuel consumption and operational costs. According to a 2025 report, the Port of Hamburg, a vital hub in the German logistics & supply chain, uses AI to guide automated vehicles and optimize container stacking, demonstrating how this technology is becoming integral to the nation’s infrastructure. The push for AI-powered solutions is a key factor in strengthening Germany's position as a global logistics leader.

The E-commerce Boom and Evolution of Last-Mile Delivery

The rapid growth of the e-commerce sector continues to be a major driver of the Germany logistics market. As online retail expands, so does the demand for fast, efficient, and flexible last-mile delivery services. This has created a highly competitive environment for logistics providers, who are now focusing on innovative solutions to meet consumer expectations for same-day and next-day deliveries. A 2025 report noted that a significant portion of all parcels in Germany are now handled by e-commerce, forcing companies to rethink their entire delivery network. This trend has also spurred a move toward more automated and strategically located micro-fulfillment centers within urban areas, a key development for logistics in Germany. Companies are investing in robotics and advanced sorting systems to handle the increased volume and complexity of individual package deliveries.

Download a sample copy of the report: https://www.imarcgroup.com/germany-logistics-supply-chain-market/requestsample

Germany Logistics & Supply Chain Market Segmentation:

Transportation Mode Insights:

- Railways

- Roadways

- Airways

- Waterways

Application Insights:

- Transportation

- Warehousing

- Sourcing and Procurement

- Others

End User Insights:

- Industry and Manufacturing

- Retail

- Healthcare

- Aerospace

- BFSI

- Government and Public Utilities

- Media and Entertainment

- Food and Beverages

- Others

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Germany Logistics & Supply Chain Market News

- May 2025: German logistics firm Jungheinrich launched a corporate venture capital unit, Uplift Ventures, to invest in startups focused on robotics and AI-based supply chain optimization.

- January 2025: A new report from Prologis revealed a major acquisition of seven logistics facilities in Germany, underscoring the country's importance as a logistics cornerstone for global supply chains.

- August 2025: A global logistics report forecasts that worldwide transportation and logistics activity will expand by 4.1% in 2025, but with Germany's output expected to grow by only 1.1% due to weak industrial production.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness