Data Center Market Size, Share & Growth Analysis 2025-2033

Market Overview:

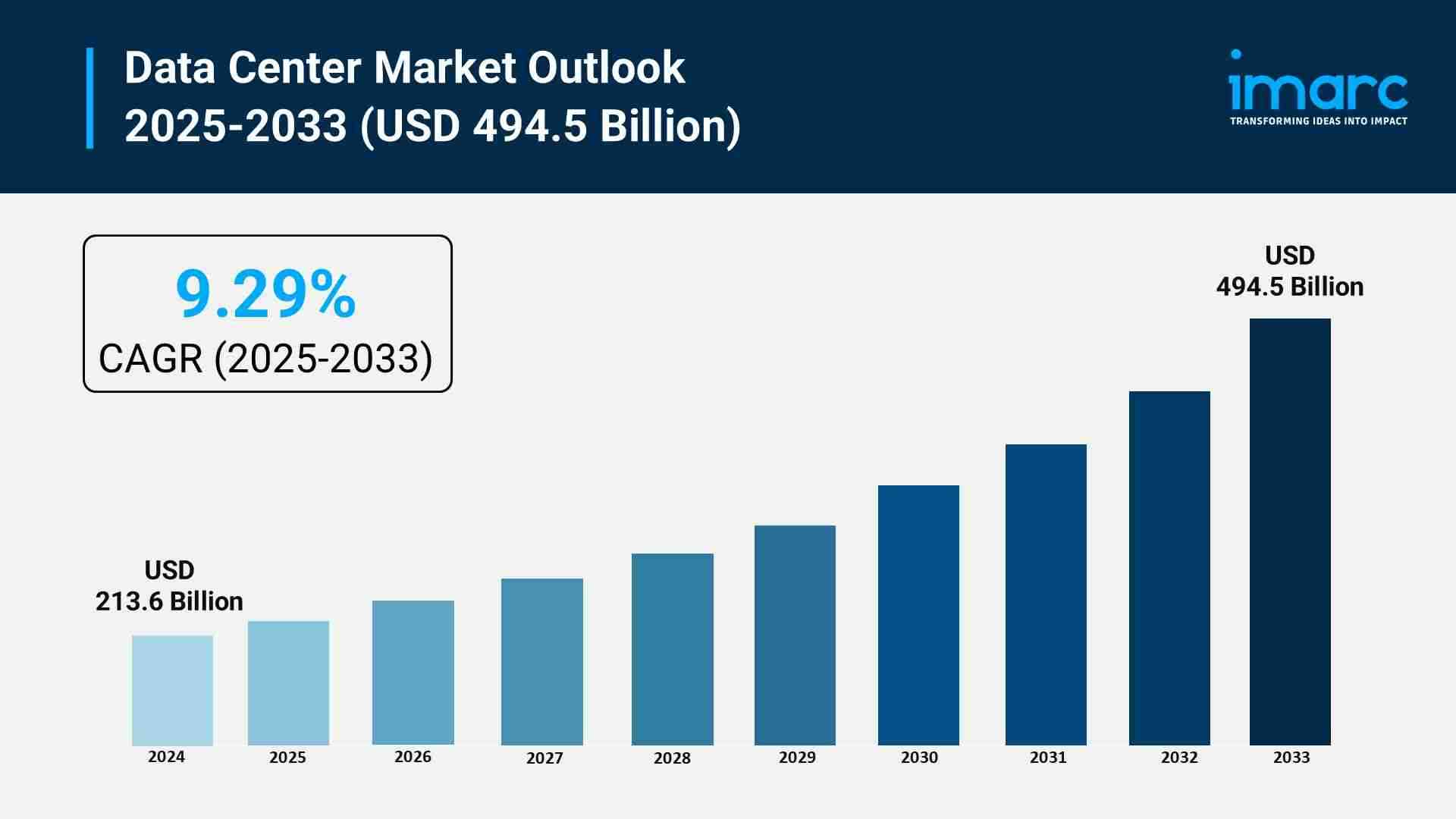

The data center market is experiencing rapid growth, driven by exponential expansion of ai infrastructure, and national data sovereignty and localization mandates, and critical infrastructure modernization and modular construction. According to IMARC Group's latest research publication, "Data Center Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global data center market size reached USD 213.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 494.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.29% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/data-center-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Data Center Market

- Exponential Expansion of AI Infrastructure

The global data center market is experiencing a massive surge in capacity requirements, primarily driven by the transition from general-purpose computing to intensive Artificial Intelligence (AI) workloads. As of 2026, AI-specific workloads have reached a critical threshold, now accounting for 44 GW of global power demand, surpassing the 38 GW required for non-AI tasks. This shift is compelling hyperscalers to redesign facilities from the ground up, as a single AI server rack can consume five to six times more power than a conventional one. In response, companies like Microsoft and Google are making unprecedented capital commitments, with total industry investment expected to reach nearly $7 trillion by the end of the decade. Major projects, such as OpenAI’s multi-site Stargate initiative, aim to deploy up to 7 GW of new capacity, reflecting a strategic race to secure the high-density infrastructure necessary for large-scale model training and real-time inference.

- National Data Sovereignty and Localization Mandates

Government-led regulatory frameworks are increasingly dictating the geographic expansion of data centers, with a strong emphasis on data sovereignty. In India, the enactment of the Digital Personal Data Protection Act and specific mandates for financial data localization have transformed the country into a top-tier strategic hub. National installed power capacity in India is projected to reach 2,000 MW by the end of 2026, doubling from its 2024 levels. Similarly, the European Union's stringent privacy standards and various regional "sovereign cloud" initiatives are forcing global providers to establish localized facilities rather than relying on centralized international hubs. These initiatives are supported by significant government incentives; for instance, India has granted "infrastructure status" to data centers, enabling operators to access low-cost financing and streamlined regulatory clearances, which has already catalyzed major developments in cities like Mumbai, Chennai, and Delhi-NCR.

- Critical Infrastructure Modernization and Modular Construction

To overcome the physical bottlenecks of traditional building methods, the industry is rapidly adopting modular construction and advanced hardware retrofitting. Speed to market has become the primary competitive advantage, leading to a shift toward factory-built power blocks and containerized white spaces that can bring new capacity online in months rather than years. This trend is supported by massive investments in hardware, which currently accounts for over 67% of total market revenue. Operators are also aggressively retrofitting "legacy" sites with next-generation electrical architectures, such as medium-voltage systems, to handle the escalating power densities that now average 17 kW per rack. Companies like Foxconn and Schneider Electric are leading this transition by providing pre-configured, rack-scale systems and AI-ready power distribution tools. These modernization efforts are essential as vacancy rates in mature hubs fall below 1%, leaving no room for traditional, slow-paced construction.

Key Trends in the Data Center Market

- The Rise of Liquid Cooling and Thermal Management

As rack densities approach and exceed 100 kW per unit, air-based cooling systems are proving insufficient for the extreme heat generated by modern GPU clusters. This has led to the mainstream adoption of liquid cooling technologies, including direct-to-chip cold plates and immersion cooling tanks. By 2026, these solutions are no longer viewed as experimental upgrades but as standard architectural requirements for any high-performance facility. Real-world applications are visible in new hyperscale campuses where liquid-to-chip cooling is integrated directly into the server chassis to maintain thermal stability during multi-megawatt workloads. For example, STT GDC India and other global providers are utilizing AI-driven cooling management to optimize energy use, successfully lowering Power Usage Effectiveness (PUE) values to as low as 1.4. This shift is critical for operational resilience, as efficient heat dissipation directly correlates with the longevity and performance of high-cost AI hardware.

- Behind-the-Meter Energy and On-Site Generation

A significant trend in 2026 is the decoupling of data centers from strained public electricity grids through "behind-the-meter" energy solutions. With grid connection timelines for large-scale projects stretching up to seven years in some regions, operators are transforming their facilities into part-time power plants. Many new developments now incorporate on-site renewable energy sources, such as dedicated solar parks and wind installations, paired with large-scale Battery Energy Storage Systems (BESS). In India, companies like AdaniConneX have secured green loans exceeding $1.4 billion to fund these sustainable infrastructures. Additionally, natural gas is seeing a resurgence as a reliable bridge fuel, often used in hybrid configurations with renewables to ensure "always-on" availability. This move toward energy self-sufficiency allows developers to bypass grid congestion and meet strict environmental, social, and governance (ESG) mandates while securing the massive power volumes required for modern computing.

- Decentralization via Edge Data Centers

The proliferation of 5G, autonomous systems, and real-time IoT applications is driving the rapid growth of edge data centers located close to urban and industrial hubs. Unlike massive hyperscale sites, these are smaller, modular facilities designed to process data at the "edge" of the network to minimize latency. In 2026, this trend is particularly evident in Tier-2 and Tier-3 cities, where decentralized infrastructure is being built to support 4K streaming, online gaming, and remote healthcare diagnostics. In India, cities like Coimbatore, Jaipur, and Patna are emerging as new edge hubs, reducing the burden on primary markets like Mumbai. These facilities often utilize standardized, prefabricated designs that can be deployed quickly in varied environments. By moving inference workloads—the process of running trained AI models—closer to the end-user, operators can deliver the sub-millisecond response times required for the next generation of digital services and smart city infrastructure.

Leading Companies Operating in the Global Data Center Industry:

- Amazon Web Services Inc. (Amazon.com Inc.)

- Cisco Systems Inc.

- Dell Inc. (Dell Technologies Inc.)

- Digital Realty Trust Inc.

- DXC Technology Company

- Equinix Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- NTT Communications Corporation (Nippon Telegraph and Telephone Corporation)

- Oracle Corporation

Data Center Market Report Segmentation:

By Component:

- Solution

- Services

Solution accounts for the majority of the market share, being the largest segment.

By Type:

- Colocation

- Hyperscale

- Edge

- Others

Hyperscale holds the largest share of the industry among colocation, hyperscale, edge, and others.

By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

The market is segmented into large enterprises and small and medium enterprises.

By End User:

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

BFSI exhibits clear dominance in the market, representing the largest share among various end users.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the market, accounting for the largest data center market share due to factors like digital data growth and cloud computing adoption.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness