Global Consumer Credit Market: Risk Modeling Advances and Financial Access Expansion Trends, 2025–2033

Market Overview

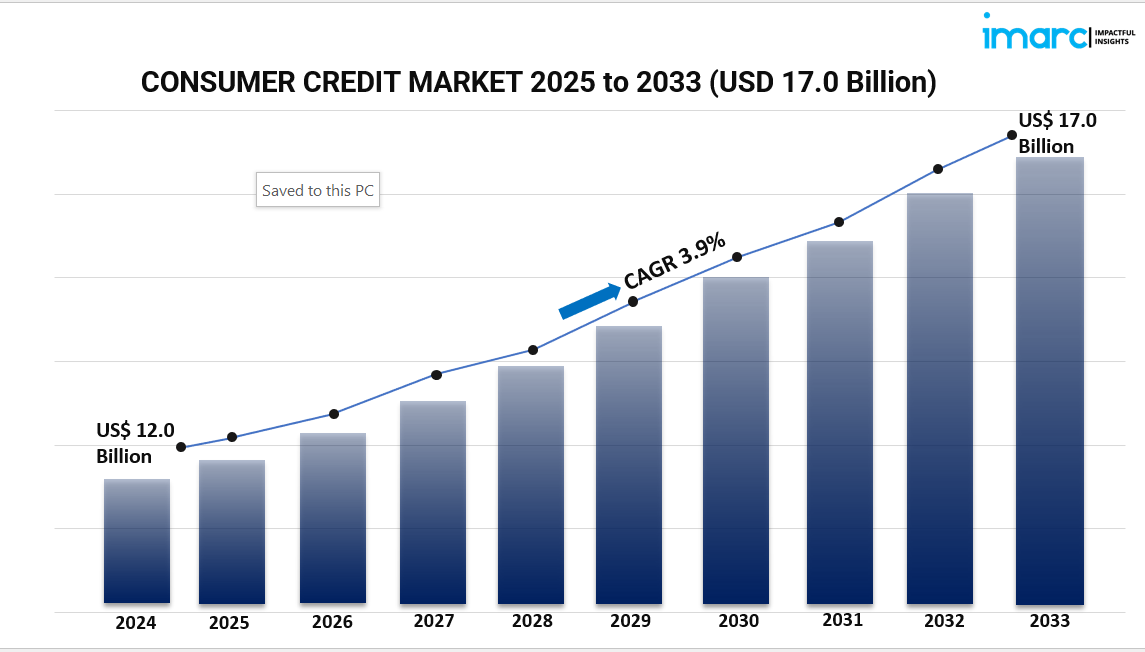

The global consumer credit market was valued at USD 12.0 Billion in 2024 and is projected to reach USD 17.0 Billion by 2033, growing at a CAGR of 3.9% during 2025-2033. The market growth is driven by a rise in digital financial services, expanding middle-class populations in emerging markets, and innovations such as AI-driven credit scoring and Buy Now, Pay Later services. North America dominates with over 35% market share in 2024.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Consumer Credit Market Key Takeaways

- The global consumer credit market size was USD 12.0 Billion in 2024.

- The market is expected to grow at a CAGR of 3.9% from 2025 to 2033.

- North America held a market share of over 35% in 2024.

- Innovations like Buy Now, Pay Later services and AI-driven credit scoring are fueling market expansion.

- Increasing digital payment adoption and financial inclusion are key growth drivers.

- MSMEs and startups contribute significantly to market growth in developing countries.

- Social media engagement enhances consumer credit market penetration and awareness.

Sample Request Link: https://www.imarcgroup.com/consumer-credit-market/requestsample

Market Growth Factors

The growth of the global consumer credit market is stimulated by economic growth, urbanization, and the digital transformation of financial services. Expanding middle-class populations in emerging markets drive demand for credit products that support higher living standards. For example, the launch of Visa's Flexible Credential with Affirm Card in November 2024 offers enhanced payment flexibility via debit and Buy Now, Pay Later services.

The proliferation of micro, small, and medium enterprises (MSMEs) also propels market growth. MSMEs generated 120 million jobs in India, accounting for about 33% of the country's GDP. India’s startup ecosystem has shown rapid expansion, with approximately 10,000 startups sanctioned in 156 days compared to 808 days previously. This reflects the increased credit demand among entrepreneurs and small businesses.

Digitalization advances lending accessibility and efficiency. The Reserve Bank of India’s formation of a working group on digital credit in January 2023 shows regulatory efforts to oversee digital lending platforms. Integration of AI, machine learning, and cloud computing in banking has optimized credit risk management and customer experience, further supporting market expansion.

Market Segmentation

Analysis by Credit Type

- Non-revolving Credits: The largest segment in 2024, including fixed-amount installment loans for cars, education, and home improvements. Vehicle loans in India increased 137% over three years, while Americans averaged USD 55.0 Billion in new auto loans monthly in Q4 2023.

- Revolving Credits: Includes credit cards where the credit limit replenishes as payments are made.

Analysis by Service Type

- Credit Services: Leading segment in 2024, involving loans and credit-related information for individuals and businesses. In 2020, 9.43 million people in Great Britain had loans, and 58% of American adults aged 18-29 have student loan debt.

- Software and IT Support Services: Supports digital credit systems and platforms.

Analysis by Issuer

- Banks and Finance Companies: Leading market segment in 2024, providing lending, borrowing, and investment facilities.

- Credit Unions and Others: Included but specific data not detailed.

Analysis by Payment Method

- Debit Card: Holds around 60.0% market share in 2024. Banks offer easy EMI services with low or no-cost interest options. HDFC Bank’s EASYEMI allows installment payments via debit cards usable for online and physical purchases.

- Direct Deposit and Others: Included but specific data not detailed.

Regional Insights

In 2024, North America dominated the consumer credit market with over 35% share. Growth is driven by extensive adoption of consumer credit in small and medium enterprises ensuring efficient financial operations. The United States saw total loans amounting to USD 12,305.379 billion as of March 2024. The presence and expansion of prominent banks like Citi Bank, Bank of America, Goldman Sachs, and Morgan Stanley further strengthen this dominance.

Recent Developments & News

- December 2024: Axis Bank launched 'Primus,' a super-premium credit card in collaboration with Visa for ultra-high-net-worth clients in India.

- December 2024: Times Internet and ICICI Bank introduced the super-premium 'Times Black ICICI Bank Credit Card' for high-net-worth individuals, offering global lounge access and exclusive rewards.

- October 2024: General Motors and Barclays U.S. Consumer Bank agreed on Barclays exclusively issuing GM Rewards Mastercard and GM Business Mastercard in the U.S., enhancing loyalty programs.

- September 2024: CARD91 launched a 3-in-1 card platform integrating ID, access, and prepaid functions.

- August 2024: Visa showcased payment innovations at Global Fintech Fest 2024, including collaborations with HDFC Bank, Paytm, Axis Bank, PayU, and IDFC First Bank.

Key Players

- Bank of America

- Barclays

- BNP Paribas

- China Construction Bank

- Citigroup

- Deutsche Bank

- HSBC

- Industrial and Commercial Bank of China (ICBC)

- JPMorgan Chase

- Mitsubishi UFJ Financial

- Wells Fargo

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=2291&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness