Medical Device Coatings Market: Biocompatibility Advances and Surface Performance Needs, 2025–2033

Market Overview

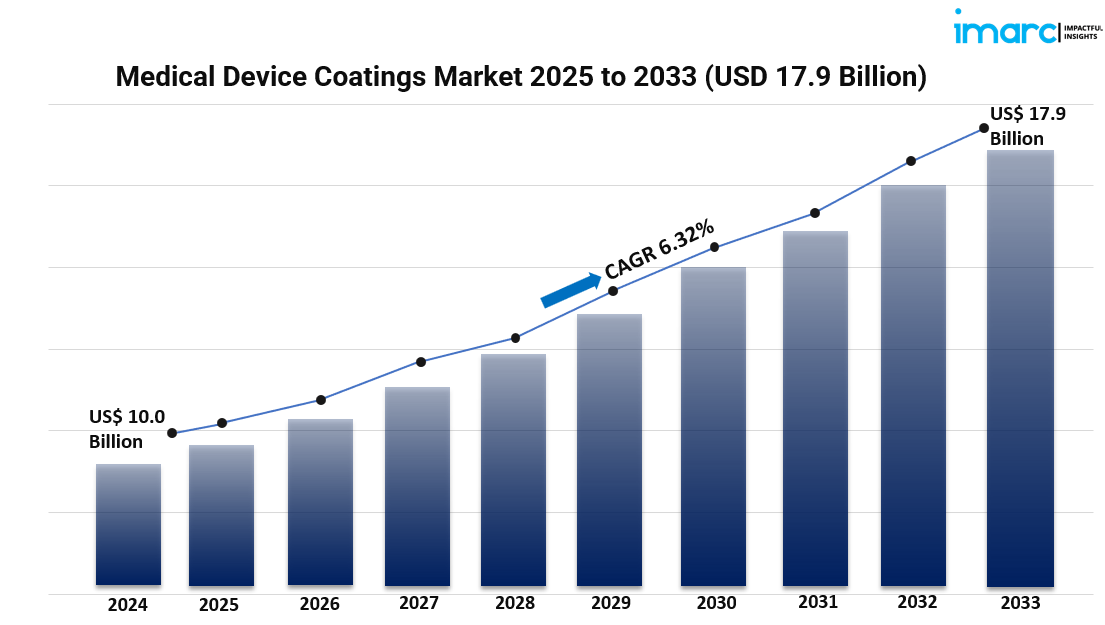

The global medical device coatings market was valued at USD 10.0 Billion in 2024 and is projected to reach USD 17.9 Billion by 2033, growing at a CAGR of 6.32% during 2025-2033. The market growth is driven by increasing demand for minimally invasive procedures and technological advancements enhancing device performance and patient outcomes.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

Medical Device Coatings Market Key Takeaways

- The global medical device coatings market size reached USD 10.0 Billion in 2024.

- The market is growing at a CAGR of 6.32% during the forecast period 2025-2033.

- The forecast period for the market is 2025-2033.

- The aging population and rising frequency of chronic conditions such as cardiovascular disease and diabetes are significant market drivers.

- The prevalence of hospital-acquired infections (HAIs) caused by contaminated medical instruments is a key growth factor.

- North America leads the market with technological breakthroughs improving device performance and patient outcomes.

- Ongoing research in nanotechnology and biodegradable materials for coatings enhances safety and performance.

Sample Request Link: https://www.imarcgroup.com/medical-device-coatings-market/requestsample

Market Growth Factors

The global medical device coatings market growth is primarily driven by the aging population and the increasing incidence of chronic diseases such as cardiovascular disease and diabetes. These health trends are creating higher demands for advanced medical devices that require specialized coatings to improve performance and patient safety.

An increased prevalence of hospital-acquired infections (HAIs) also plays a critical role in market expansion. Contaminated medical instruments have heightened the need for antimicrobial coatings to reduce bacterial growth and infection risks. This concern is driving innovation and the widespread adoption of antimicrobial coatings in devices such as catheters, wound dressings, and surgical equipment.

Technological advancements continue to propel the market in North America, where innovations improve device safety and performance, especially for cardiovascular, orthopedic, and surgical applications. Research focusing on nanotechnology and biodegradable coating materials further stimulates the market by enhancing biocompatibility, durability, and patient outcomes while meeting stringent regulatory standards.

Market Segmentation

By Product:

- Hydrophilic Coatings: Used in cardiovascular and urological devices to improve mobility and reduce friction, aiding minimally invasive procedures.

- Antimicrobial Coatings: Hold the largest market share, crucial for minimizing infections associated with medical devices, exemplified by coatings that reduce bacterial colonization on catheters.

- Drug-Eluting Coatings: Slowly release therapeutic substances to aid healing, especially in stents and implants, reducing restenosis and infections.

- Anti-Thrombogenic Coatings

- Others

By Material:

- Metals (Silver, Titanium, Others): Metals dominate the market with silver used for antimicrobial effects in catheter and wound dressing coatings, and titanium offering corrosion resistance and bone integration in orthopedic implants.

- Ceramics

- Polymers (Silicone, Parylene, Fluoropolymers)

By Application:

- Neurology

- Orthopedics

- General Surgery

- Cardiovascular: Largest market segment where coatings improve safety and efficacy of stents, pacemakers, and catheters.

- Dentistry

- Gynecology

- Others

Regional Insights

North America currently dominates the global medical device coatings market, driven by advancements in healthcare infrastructure, increasing demand for minimally invasive surgeries, and the prevalence of chronic diseases. Leading companies like Abbott Laboratories and Boston Scientific are investing in innovative coatings for cardiovascular, orthopedic, and surgical devices, enhancing market penetration and growth.

Recent Developments & News

- May 2024: Abbott launched the XIENCE Sierra Everolimus drug-eluting coronary stent system in India.

- May 2024: Hydromer Inc., a global supplier of hydrophilic coatings, introduced HydroThrombX, an enhanced product to prevent restenosis.

- April 2024: Onkos Surgical received U.S. FDA De Novo approval for its novel antibacterial coated implants addressing bone loss challenges from tumor, trauma, and revision surgery.

Key Players

- AST Products Inc.

- Biocoat Incorporated

- Coatings2go LLC

- Covalon Technologies Ltd.

- Harland Medical Systems Inc.

- Hydromer Inc.

- Kisco Ltd.

- Koninklijke DSM N.V.

- Merit Medical Systems Inc.

- Precision Coating Co Inc. (Katahdin Industries Inc.)

- Sono-Tek Corporation

- Surmodics Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5431&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness