Global Soft Skills Training Market: Corporate Reskilling Priorities and Behavioral Competency Focus, 2025–2033

Market Overview

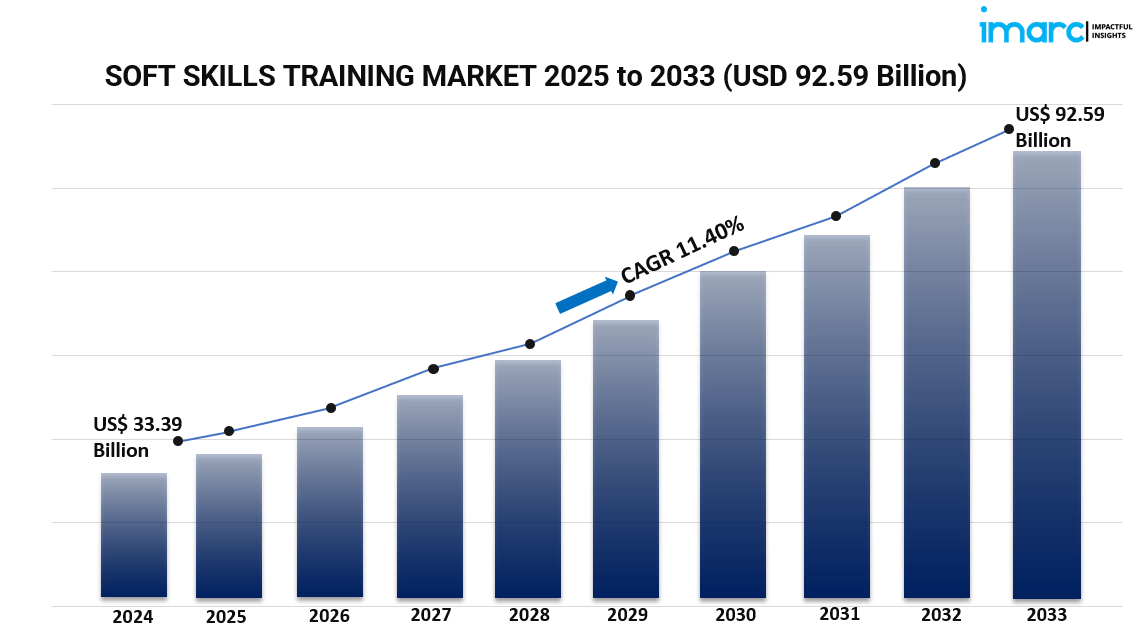

The global soft skills training market was valued at USD 33.39 Billion in 2024 and is projected to reach USD 92.59 Billion by 2033, growing at a CAGR of 11.40% during the forecast period from 2025 to 2033. The market growth is driven primarily by increasing demand for leadership development, effective communication, and workforce adaptability across various industries. North America leads with over 32.9% market share in 2024, supported by strong corporate training ecosystems and technological advancements.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Soft Skills Training Market Key Takeaways

- Current Market Size: USD 33.39 Billion in 2024

- CAGR: 11.40% during 2025-2033

- Forecast Period: 2025-2033

- North America dominates the market with a share of over 32.9% in 2024, driven by strong demand for leadership and communication skills.

- Communication and Productivity segment holds the largest market share of approximately 41.2% in 2024.

- Corporate/Enterprise is the leading channel provider with around 58% market share in 2024.

- Outsourced sourcing leads with about 66.2% share, enabling efficient delivery of specialized training.

- Offline delivery mode holds the majority of 54.6% market share in 2024, emphasizing the importance of in-person training.

Sample Request Link: https://www.imarcgroup.com/soft-skills-training-market/requestsample

Market Growth Factors

The soft skills training market is propelled by a rising demand for workforce development and employability enhancement across diverse industries. Employers increasingly focus on improving communication, leadership, teamwork, and adaptability to enhance workplace efficiency and collaboration. For example, only 35% of organizations offer soft skills training despite its benefits; of the employees trained, 63% report a positive impact on their work, highlighting underutilized growth potential. The rise of automation and AI has underscored the importance of human-centric skills for career advancement, pushing organizations to invest heavily in corporate training programs that boost employee engagement and productivity.

The expansion of e-learning platforms and virtual training solutions is another significant factor contributing to market growth. These technologies allow businesses to deliver flexible and scalable training to geographically dispersed workforces, improving access to skill development remotely. Companies like UPS, Walmart, and Volvo Group have implemented VR-based training for both technical and soft skills, demonstrating the integration of advanced technologies into soft skills training. Furthermore, government-backed workforce development initiatives alongside private-sector collaborations strengthen the availability of skilled and adaptable employees across sectors such as technology, healthcare, finance, and manufacturing.

Evolving global workforce dynamics and the increasing globalization of business have created a pressing need for soft skills training. In 2023, the EU had approximately 195.7 million employed individuals aged 20-64, about 75.3% of that group, indicating a large workforce requiring soft skills for multicultural collaboration. Soft skills training enables effective communication and cultural competence, reducing miscommunication and fostering better working relationships. The demand for attributes like creativity, critical thinking, and emotional intelligence grows as automation intensifies. The rise of remote and hybrid work models has also emphasized the need for virtual communication skills, self-motivation, and adaptability to maintain productivity and teamwork in dispersed environments. Soft skills training equips individuals to excel in these evolving work scenarios, supporting long-term organizational success.

Analysis by Soft Skill Type:

- Management and Leadership

- Administration and Secretarial

- Communication and Productivity

- Personal Development

- Teamwork

- Others

Communication and productivity represent the largest segment in 2024, comprising around 41.2% of the market. Communication involves effective idea and emotion conveyance between individuals, while productivity relates to efficient task and resource management. These skills enhance collaboration and organizational output, supporting market growth.

Analysis by Channel Provider:

- Corporate/Enterprise

- Academic/Education

- Government

Corporate/enterprise is the dominant channel provider with approximately 58% market share in 2024. This sector facilitates the distribution and implementation of tailored soft skills training within large organizations, fostering continuous employee development and organizational success.

Analysis by Sourcing:

- In-house

- Outsourced

Outsourced sourcing leads at around 66.2% share in 2024. Outsourcing allows organizations to engage specialized external providers to deliver comprehensive and cost-effective soft skills training, enabling focus on core activities while ensuring employee skill enhancement.

Analysis by Delivery Mode:

- Online

- Offline

Offline delivery holds about 54.6% of the market share in 2024. Offline training offers personalized, interactive learning through face-to-face sessions that foster active communication and experiential learning, crucial for interpersonal skills like negotiation and conflict resolution.

Analysis by End Use Industry:

- BFSI

- Hospitality

- Healthcare

- Retail

- Media and Entertainment

- Others

BFSI leads the end-use industry segment with around 19.1% market share in 2024. The sector prioritizes interpersonal skills critical for client interaction, compliance, and risk management, boosting targeted demand for soft skills training.

Regional Insights

North America leads the soft skills training market with a share exceeding 32.9% in 2024. The region benefits from a dynamic business environment, advanced technology adoption, and focus on employee well-being and continuous skill development. The US holds a dominant position within North America, accounting for about 90.8% of the regional market. The growth is supported by increasing demand due to workforce expansion and the proliferation of remote and hybrid work models, necessitating leadership, emotional intelligence, and adaptability training to enhance productivity and virtual collaboration.

Recent Developments & News

- January 2025: The Tourism and Hospitality Skill Council (THSC) initiated a program to train and place 150 women in tourism and hospitality, focusing on technical and soft skills like communication and teamwork.

- December 2024: The Overseas Employment Corporation (OEC) and ICMPD launched a Soft Skills Training Module and web portal under the EU-funded PROTECT programme to enhance communication and leadership skills among outgoing migrants.

- December 2024: University of Phoenix introduced a soft skills pathway focusing on problem-solving, decision-making, and empathetic communication to improve workplace collaboration.

- June 2024: IIT Madras Pravartak Technologies Foundation rolled out a free three-month IT training program including soft skills for students in Karur and Coimbatore.

- May 2024: Bengaluru-based Kairos launched India's first game-based training platform to enhance corporate soft skills, emphasizing engagement and resilience.

Key Players

- Articulate Global, LLC

- Blanchard

- CEGOS

- Coursera Inc.

- Dale Carnegie & Associates Global, Inc.

- edX LLC.

- Hemsley Fraser Group Ltd

- LinkedIn Corporation

- NIIT (USA) Inc

- QA Limited

- Skillsoft

- Udemy, Inc.

Customization Note

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=2598&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness