Europe Fintech Market Report 2025-2033, Industry Trends, Share, Size, Demand and Future Scope

Europe Fintech Market Overview

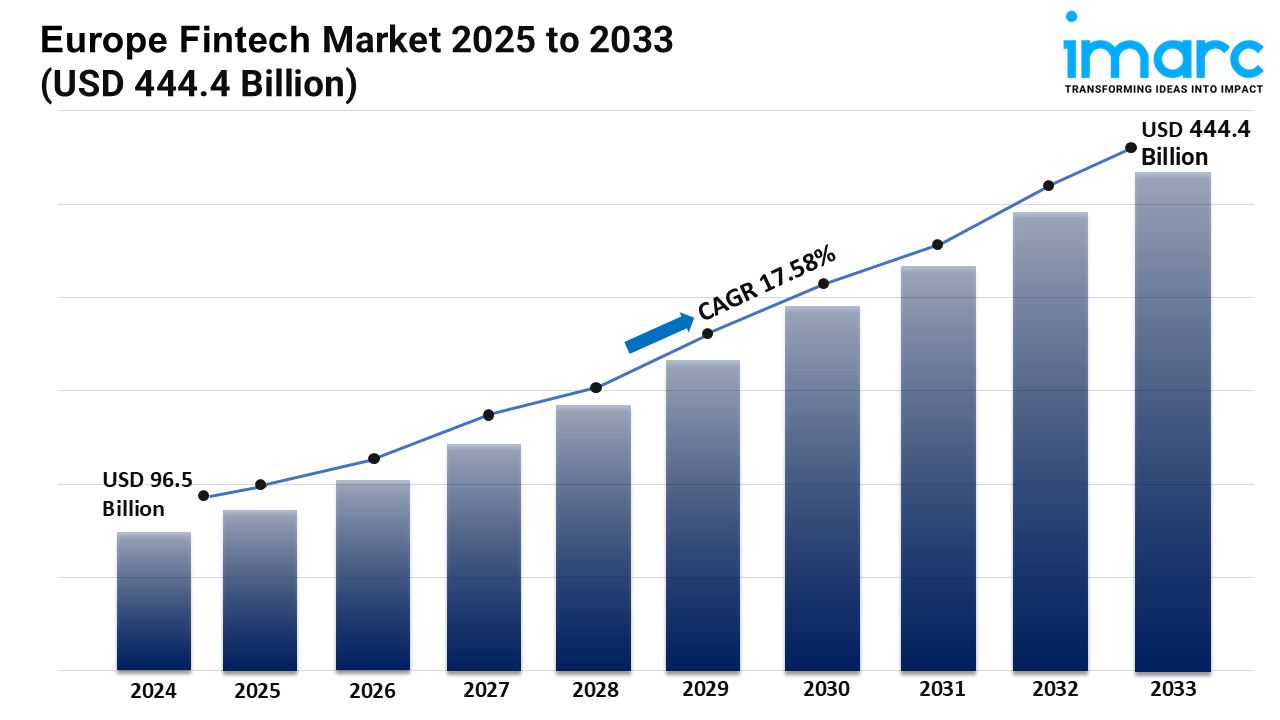

Market Size in 2024: USD 96.5 Billion

Market Forecast in 2033: USD 444.4 Billion

Market Growth Rate: 17.58% (2025-2033)

According to the latest report by IMARC Group, the Europe fintech market size was valued at USD 96.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 444.4 Billion by 2033, exhibiting a CAGR of 17.58% from 2025-2033.

Europe Fintech Industry Trends and Drivers:

The European fintech sector is changing quickly as technology companies and financial institutions converge more and more to transform operational efficiency and consumer experience. Rising digital reach throughout consumer and business sectors is hastening the adoption of fintech solutions, especially through mobile and web-based interfaces. From immediate fund transfers to artificial intelligence-enabled wealth advice, as smartphones, tablets, and linked devices grow ever-present, users want frictionless, real-time financial interactions. While on-premises systems keep supporting legacy infrastructure in heavily regulated sectors, cloud-based deployment is taking over the market scene because of its scalability, cost effectiveness, and fast integration possibilities. Advanced technologies including data analytics, artificial intelligence, and blockchain are facilitating process automation, fraud detection, and precision-driven personalization, hence laying a solid basis for ongoing innovation. Through APIs, institutions are adopting open banking to guarantee more user power and transparency. This change is setting fintech as a fundamental facilitator of next-generation financial ecosystems across Europe rather than merely as a supporting service.

With Western Europe—led by Germany, the United Kingdom, and France—pioneering adoption through well-established financial institutions and legislative frameworks encouraging digital transformation, regional dynamics are bolstering market strength. Strong public-private cooperation, particularly in the areas of blockchain applications and decentralized finance (DeFi), helps Germany propel fintech expansion. By supporting businesses and expanding fintech accelerators especially in wealth management, regtech, and cross-border payments, the UK is using its position as a global financial hub. France is encouraging digital lending systems and AI-powered credit risk instruments to improve financial inclusion and SME support. Through targeted investments in cross-industry partnerships, open data projects, and cybersecurity, these countries are also extending their market reach. Western Europe is establishing itself as a sustainable fintech powerhouse by means of legislative sandboxes, incentives from the government, and innovation-friendly laws. Rising consumer demand for customized, omnichannel services that fit flawlessly with their digital lives is being taken advantage of by institutions as well.

With affordability, inclusion, and agile infrastructure front and center, countries such as Spain, Italy, and Poland are increasingly expanding their fintech capabilities in Southern and Eastern Europe. Driven by contactless technology and real-time banking experiences, Spain is pioneering payment and fund transfer systems. Italy is adopting personal financial apps and robo-advisory solutions targeting tech-savvy younger populations and improving access for underbanked segments. Open API creation, cloud-first methods, and enabling governmental policies that encourage entrepreneurship are helping Poland become a competitive fintech center. Local banks are partnering with fintech companies to promote embedded finance and automate claims processing and loan approval. Rising financial literacy, strong mobile use, and the incorporation of biometric identification verification systems are helping these nations to guarantee trust and legal compliance. Local initiatives are also improving digital onboarding systems, widening credit access, and deepening user participation by means of gamification and behavioral analytics. Southern and Eastern Europe are helping to create a larger, inclusive, innovation-driven fintech environment all around the continent as they keep changing.

Download sample copy of the Report: https://www.imarcgroup.com/europe-fintech-market/requestsample

Europe Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=10527&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness