Online Trading Platform Market Size, Share & Growth Analysis 2025-2033

Market Overview:

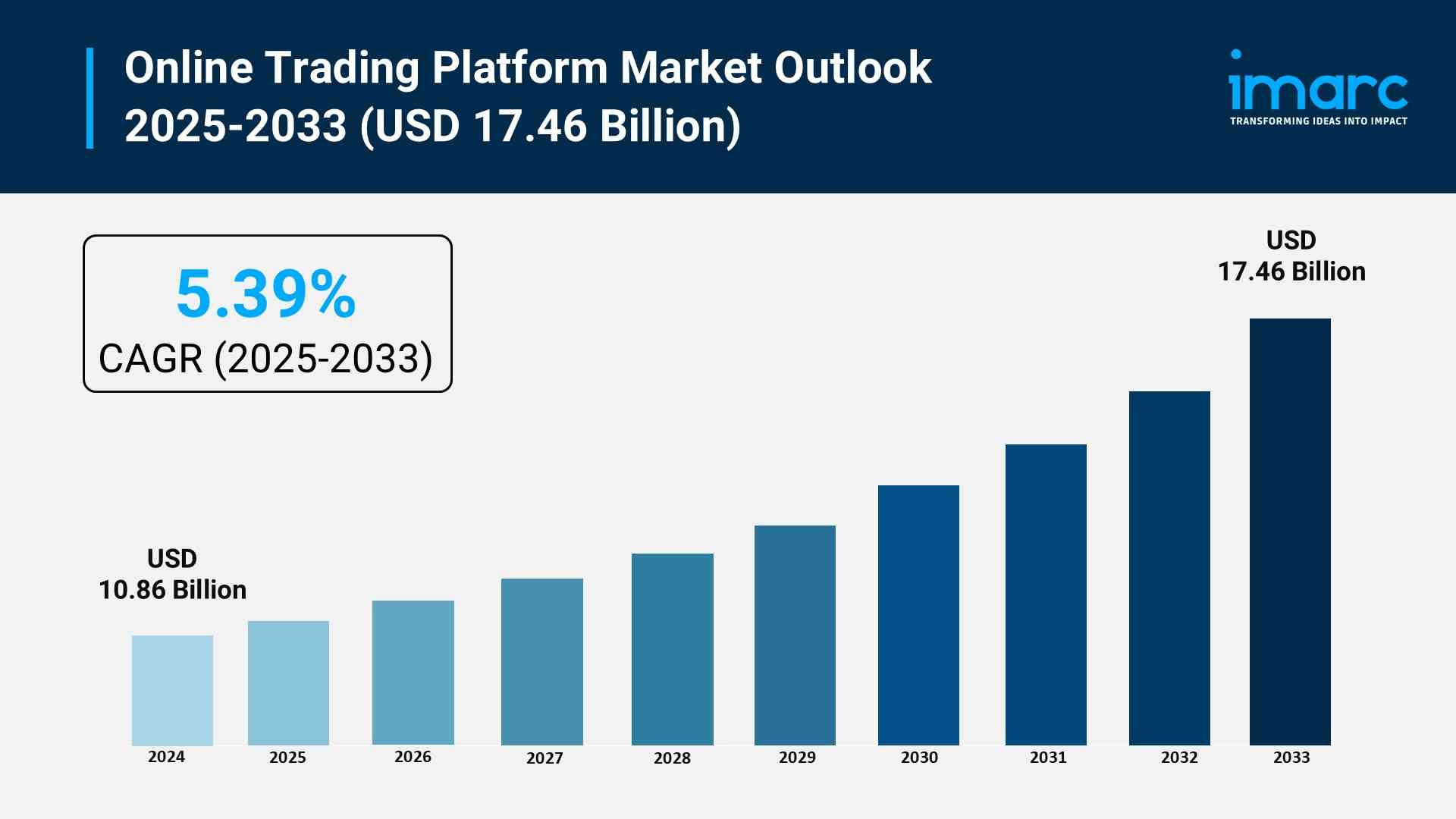

The online trading platform market is experiencing rapid growth, driven by widespread zero- and low-commission trading models, surge in mobile-first retail investor participation, and integration of artificial intelligence and advanced analytics. According to IMARC Group’s latest research publication, “Online Trading Platform Market Size, Share, Trends and Forecast by Component, Type, Deployment Mode, Application, and Region, 2025-2033”, The global online trading platform market size was valued at USD 10.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.46 Billion by 2033, exhibiting a CAGR of 5.39% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/online-trading-platform-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Online Trading Platform Market

- Widespread Zero- and Low-Commission Trading Models

The structural shift by major platform providers toward commission-free or extremely low-cost transaction models has significantly lowered the entry barrier for retail investors globally. This affordability has driven a massive surge in market participation, particularly among younger, tech-savvy demographics. For instance, transaction fees still account for a substantial majority of revenue for the online trading platform market, indicating the robust volume generated by this increased user base, despite the perceived "free" cost per trade. This revenue stream's resilience, even with the abolition of many trading fees, underscores the high-volume model's success. Government financial inclusion initiatives in various countries also complement this trend by promoting accessible investing tools, making self-directed wealth management a reality for millions previously excluded by high traditional brokerage costs.

- Surge in Mobile-First Retail Investor Participation

The proliferation of high-speed internet and the universal adoption of smartphones are fueling a global explosion in retail investor activity, with mobile applications becoming the primary conduit for market access. Mobile-based trading platforms have become the default choice, evidenced by the high number of global active trading accounts accessing markets through their phones. The Asian-Pacific region, in particular, is witnessing a monumental rise, driven by its rapidly expanding middle class and high mobile penetration rates. Platforms cater to this demand by offering highly intuitive, user-friendly interfaces, real-time push notifications, and biometric log-ins. This mobile convenience democratizes trading, allowing people to execute trades, check charts, and manage portfolios on the go, resulting in billions of transactions executed on mobile apps recently.

- Integration of Artificial Intelligence and Advanced Analytics

The incorporation of sophisticated technologies like Artificial Intelligence (AI) and Machine Learning (ML) is transforming the functionality and appeal of online trading platforms. AI-driven algorithms and tools are moving beyond just institutional trading to offer services like robo-advisory, personalized portfolio recommendations, and automated risk management for retail users. This technological leap enables platforms to process vast datasets—including market trends and news sentiment—to provide real-time, actionable insights that help users make more informed decisions. Furthermore, the adoption of AI-based tools for portfolio management across the financial services sector is becoming standard practice, enhancing both the precision of trading strategies and the overall user experience, thereby building greater trust and reliance on digital platforms.

Key Trends in the Online Trading Platform Market

- The Rise of Social and Copy Trading

A dominant emerging trend is the integration of social networking features, fundamentally changing trading from a solitary activity to a community-driven one. Social trading platforms allow users to follow, interact with, and even automatically replicate the trades of top-performing investors, often referred to as "gurus" or "signal providers." One concrete example is how platforms are implementing transparent performance dashboards that display win/loss ratios and risk scores for leading traders, offering newcomers clear, data-driven criteria for choosing mentors. The rapid user adoption of these features is evident as the social trading market has grown substantially, with leading companies collectively holding a significant market share. This blend of financial services with social media fosters engagement and lowers the perceived complexity for novice investors.

- Tokenization and Multi-Asset Digital Integration

The increasing market readiness to incorporate digital assets is driving a trend toward multi-asset digital integration and the tokenization of traditional securities. Platforms are expanding their offerings far beyond stocks and forex to include a vast array of cryptocurrencies and digital asset derivatives. A prime example is the tokenization of stocks, where blockchain representations of traditional shares allow for programmable ownership, near-instant settlement, and the ability to trade fractional portions of high-priced equities. This move is supported by regulators in certain financial centers creating frameworks for blockchain-backed securities. The creation of millions of new digital wallets recently highlights the tangible surge in users engaging with these digital assets, pushing platforms to offer enhanced security and integrated wallet functionality.

- Cloud-Native Architecture and API-Enabled Brokerage

The shift towards cloud-native, microservice architectures is a critical infrastructural trend that enhances platform agility and scalability. By deploying services on the cloud, platforms gain unparalleled adaptability to handle massive, volatile trading volumes—a necessity during periods of market stress. This migration also facilitates Brokerage-as-a-Service (BaaS), where platforms use Application Programming Interfaces (APIs) to allow third-party fintechs and banks to embed trading functionalities directly into their own applications. For instance, the use of cloud-based solutions now accounts for a large majority of the platform deployment market, reflecting its cost-effectiveness and scalability. This API-enabled approach is vital for rapid product launches and for expanding services into emerging markets that demand customized, locally compliant trading solutions.

Leading Companies Operating in the Global Online Trading Platform Industry:

- Ally Financial Inc.

- Cboe Global Markets Inc.

- Charles Schwab & Co. Inc.

- Chetu Inc.

- Devexperts LLC

- E-Trade Financial Corporation (Morgan Stanley)

- FMR LLC

- Interactive Brokers LLC

- MarketAxess Holdings Inc.

- Plus500 Ltd

- Tradestation Group Inc. (Monex Group Inc.)

Online Trading Platform Market Report Segmentation:

By Component:

- Platform

- Services

Platform leads the market with 65.8% share in 2024, driven by its essential role in providing user-friendly trading experiences and advanced features.

By Type:

- Commissions

- Transaction Fees

Commissions is the largest segment, essential for revenue models, offering scalable pricing structures that enhance service quality and user engagement.

By Deployment Mode:

- On-Premises

- Cloud

Cloud dominates the market due to its flexibility, scalability, and cost-effectiveness, enabling users to trade from anywhere with robust security and analytics.

By Application:

- Institutional Investors

- Retail Investors

Institutional Investors hold a 37.6% market share in 2024, leveraging advanced platforms for high-volume trading and sophisticated risk management.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America accounts for 36.8% of the market share in 2024, driven by technological innovation and a strong financial sector that supports online trading growth.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness