Europe Core Banking Market Analysis and Forecast 2026-2032 – The Report Cube

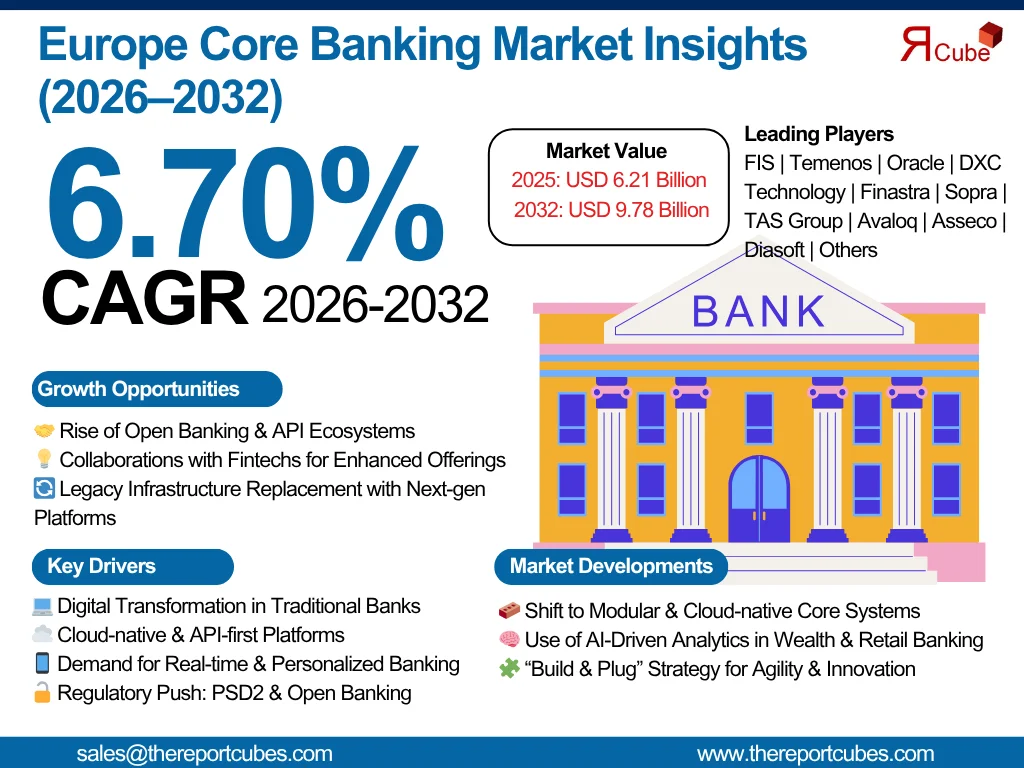

The Report Cube which is one of the leading market research company in UAE expects the Europe Core Banking Market to grow at a CAGR of around 6.70% through 2032, as highlighted in their latest research report. The study provides an in-depth analysis of the emerging trends shaping the Europe Core Banking Market and offers detailed forecasts for its potential growth during 2025–2032. The report also presents a comprehensive assessment of the competitive landscape, including profiles of leading players, their performance metrics, and recent strategic developments. Additionally, it explores the key market drivers, challenges, opportunities, and provides insights into historical and future revenue trends at the global, regional, and country levels.

Europe Core Banking Market Overview:

Market Size (2025): USD 6.21 Billion

Market Size (2032): USD 9.78 Billion

CAGR (2025–2032): 6.70%

Top Companies in Europe Core Banking Market: FIS, DXC Technology, TAS Group, Finastra, Sopra, Temenos, Oracle, Asseco, Diasoft, and Avaloq

Request a Free Sample PDF of This Report - https://www.thereportcubes.com/request-sample/europe-core-banking-market

Europe Core Banking Industry Recent News and Developments:

FIS introduced its new "Modern Banking Platform - Europe Edition", optimized for agreement with EU digital finance regulations & assimilating AI-based fraud detection for improved financial services.

Temenos launched its "Temenos Core for Wealth", a devoted core banking solution designed for private banks & wealth managers, presenting AI-driven advisory tools & cloud-native deployment options.

Key Growth Drivers of the Europe Core Banking Market:

The major driver for the Europe Core Banking Market is the prevalent digital revolution within traditional banks. Also, as individuals’ expectations alter towards real-time, seamless, and custom-made banking services, institutions are drifting from legacy systems to up-to-date core banking platforms. Moreover, these platforms empower banks to operate in a fully digital environment, decreased manual intervention, and incorporate services through APIs & microservices. Further, the application of cloud-native systems further permits for scalability, speed, and cost-efficiency. For instance, top banks in the UK & Italy have migrated to SaaS-based core platforms to decrease CAPEX & enhance consumer experience.

Europe Core Banking Market Segmentation

The market is segmented across multiple dimensions to provide a comprehensive understanding of industry dynamics. By solution, it includes deposits, loans, enterprise customer solutions, and others, catering to diverse financial needs. End-users range from financial institutions and retail banking to treasury, corporate banking, and wealth management. The market is also analyzed by component, covering both solutions and services, as well as by deployment mode, including on-premises and cloud. Further segmentation considers organization size, distinguishing between SMEs and large enterprises, and by geography, highlighting key countries such as Germany, the UK, France, Russia, Italy, Spain, and the rest of Europe. This structured segmentation enables stakeholders to identify growth opportunities and strategic focus areas.

By Solution:

· Deposits

· Loans

· Enterprise Customer Solutions

· Others

By End-User:

· Financial Institutions

· Retail Banking

· Treasury

· Corporate Banking

· Wealth Management

· Others

By Component:

· Solutions

· Services

By Deployment:

· On-Premises

· Cloud

By Organization Size:

· SMEs

· Large Enterprises

Gain complete insights into market segmentation, key trends, and forecasts by accessing the full report - https://www.thereportcubes.com/report-store/europe-core-banking-market

By Country:

· Germany

· United Kingdom

· France

· Russia

· Italy

· Spain

· Rest of Europe

Note:

If you need additional data points, insights, or specific information not covered within the current scope of this report, we are pleased to offer customized research support. Through our tailored customization service, we can gather and deliver the exact information you require aligned with your unique objectives and business needs. Simply share your requirements, and our team will ensure the report is updated accordingly to meet your expectations with precision and accuracy.

Contact Us - https://www.thereportcubes.com/contact-us

About The Report Cube

The Report Cube is a leading provider of market research and business intelligence solutions in UAE, dedicated to helping organizations make smarter, data-driven decisions. With a comprehensive library of over 900,000 industry reports covering 800+ sectors worldwide, the company delivers precise insights, actionable forecasts, and strategic recommendations tailored to client objectives.

Backed by a team of 1,700+ experienced analysts and researchers, The Report Cube empowers businesses with the knowledge they need to navigate evolving markets, identify opportunities, and sustain growth in an ever-changing global landscape.

The company specializes in syndicated research, customized studies, competitive analysis, company profiling, and industry forecasting, serving clients across industries including energy, technology, healthcare, manufacturing, and more.

For more information, visit www.thereportcubes.com.

Burjuman Business Tower, Burjuman, Dubai

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness