Europe Self Storage Market Report 2025-2033, Industry Trends, Share, Size, Demand and Future Scope

Europe Self Storage Market Overview

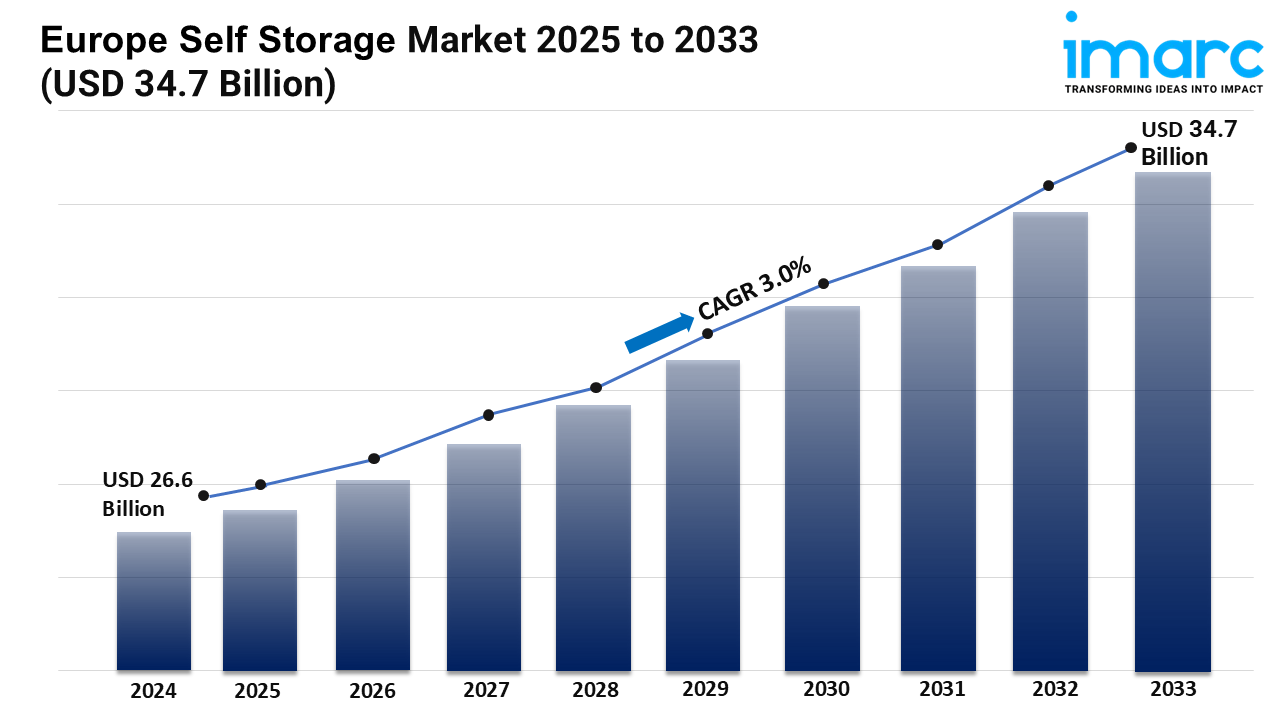

Market Size in 2024: USD 26.6 Billion

Market Forecast in 2033: USD 34.7 Billion

Market Growth Rate: 3.0% (2025-2033)

According to the latest report by IMARC Group, the Europe self storage market size was valued at USD 26.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.7 Billion by 2033, exhibiting a CAGR of 3.0% from 2025-2033.

Europe Self Storage Industry Trends and Drivers:

Driven by changing consumer habits, growing urban density, and changing space use patterns across both residential and commercial sectors, the Europe self storage sector is now growing. People and companies are constantly looking for affordable, flexible storage solutions that fit transient living and operational needs as cities become more and more congested. Among younger segments embracing minimalist living and among families downsizing to fit to housing market pressures, this growing demand is most clear. Self storage companies are also providing better security and accessibility, therefore drawing long-term consumers looking for ease of mind and comfort. Particularly small and medium-sized companies, companies are increasingly using self storage for inventory control, document archiving, and seasonal storage. Self storage is increasingly seen as a vital part of contemporary spatial planning and property maximization techniques in metropolitan areas across Europe rather than just as a supplementary service.

Rapid urban growth and the requirement for more room in densely populated settings are affecting steady demand in the United Kingdom, the regional leader right now. Often limited by small home area, urban dwellers are increasingly using self storage units as useful expansions of their houses. At the same time, the dynamic e-commerce scene of the nation is driving expansion in the commercial storage sector as online retailers are increasingly dependent on these facilities to expedite distribution and fulfill orders. Self storage's flexibility is also fitting shifting work environments as startups and freelancers use these areas for temporary office solutions or secure equipment storage. With buildings using automated entry systems, mobile access platforms, and real-time inventory monitoring, the move toward digital integration inside the industry is also improving user experience. While strengthening operational efficiency and service scalability, these developments are helping operators to distinguish their products and meet the growing expectations of a digitally aware consumer base.

The self storage industry is picking up speed throughout other European countries including Germany, France, and the Netherlands as knowledge of the concept grows and space management becomes a strategic need in metropolitan planning. To maximize land use and alleviate urban sprawl, local governments are encouraging development by including self storage into mixed-use developments—especially close transit corridors and commercial centers. As demand for end uses—including personal items and sporting goods to commercial stock and event equipment—operators are enlarging their facility footprints and customizing unit sizes to satisfy different client requirements. Standard amenities are becoming climate-controlled units, 24/7 access, and flexible rental options that improve service appeal. Cross-border relocations, changes in lifestyle, and the growth of mobile life are all contributing to a consistent rise in utilization rates among all groups. Providing strong growth potential backed by consumer behavior changes, real estate restrictions, and a growing emphasis on lifestyle-driven spatial efficiency, the Europe self storage sector is still showing resiliency and flexibility.

Download sample copy of the Report: https://www.imarcgroup.com/europe-self-storage-market/requestsample

Europe Self Storage Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Storage Unit Size:

- Small Storage Unit

- Medium Storage Unit

- Large Storage Unit

Analysis by End Use:

- Personal

- Business

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Self Storage Group ASA

- WP Carey Inc.

- SureStore Ltd

- Big Yellow Group PLC

- Access Self Storage

- Lok'nStore Limited

- Lagerboks

- 24Storage

- Casaforte

- Pelican Self Storage

Latest News and Developments:

- April 2025: Shurgard opened its first self-storage facility in Stuttgart, with 1,000 units ranging from 1.5 to 22.5 sqm. The EUR 17.1 million facility addressed the growing demand for premium storage. Shurgard also expanded its German presence, with several new projects reportedly planned in major cities.

- February 2025: Heitman acquired a majority stake in Servistore, a Swedish self-storage operator, which operates 31 sites across 14 cities. The acquisition aimed to enhance Servistore's technology-led, unmanned operations and expand its market leadership. Heitman manages over 600 self-storage assets globally.

- December 2024: PGIM Real Estate and Pithos Capital launched a joint venture in France to acquire and reposition self-storage assets. The venture, operating under the Zebrabox brand, aimed to develop and convert properties, and secured six assets as of December 2024.

- April 2024: SpaceGenie, a German self-storage company, opened its first facility in Hassloch, Germany. The company planned to expand with six more locations in the near-term and acquire 11 additional sites.

- April 2024: Shurgard acquired a UK-based Lok'nStore in a GBP 378 million deal, effectively doubling its presence in the UK. Lok'nStore operated 43 self-storage centers in England and Wales.

- January 2024: Ardian acquired a majority stake in Costockage, the leading self-storage marketplace in France. Costockage operates 10 centers and a digital platform enabling storage rentals from professionals and individuals. This acquisition supports Ardian's strategy to diversify into self-storage, a growing sector in France. Ardian will leverage its expertise to expand Costockage’s footprint, focusing on real estate acquisitions and transforming distressed properties. The deal aims to enhance Costockage’s offerings and capitalize on the growing demand for self-storage in France.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=6270&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness