Mexico Private Equity Market Report, Size, Growth & Forecast 2033

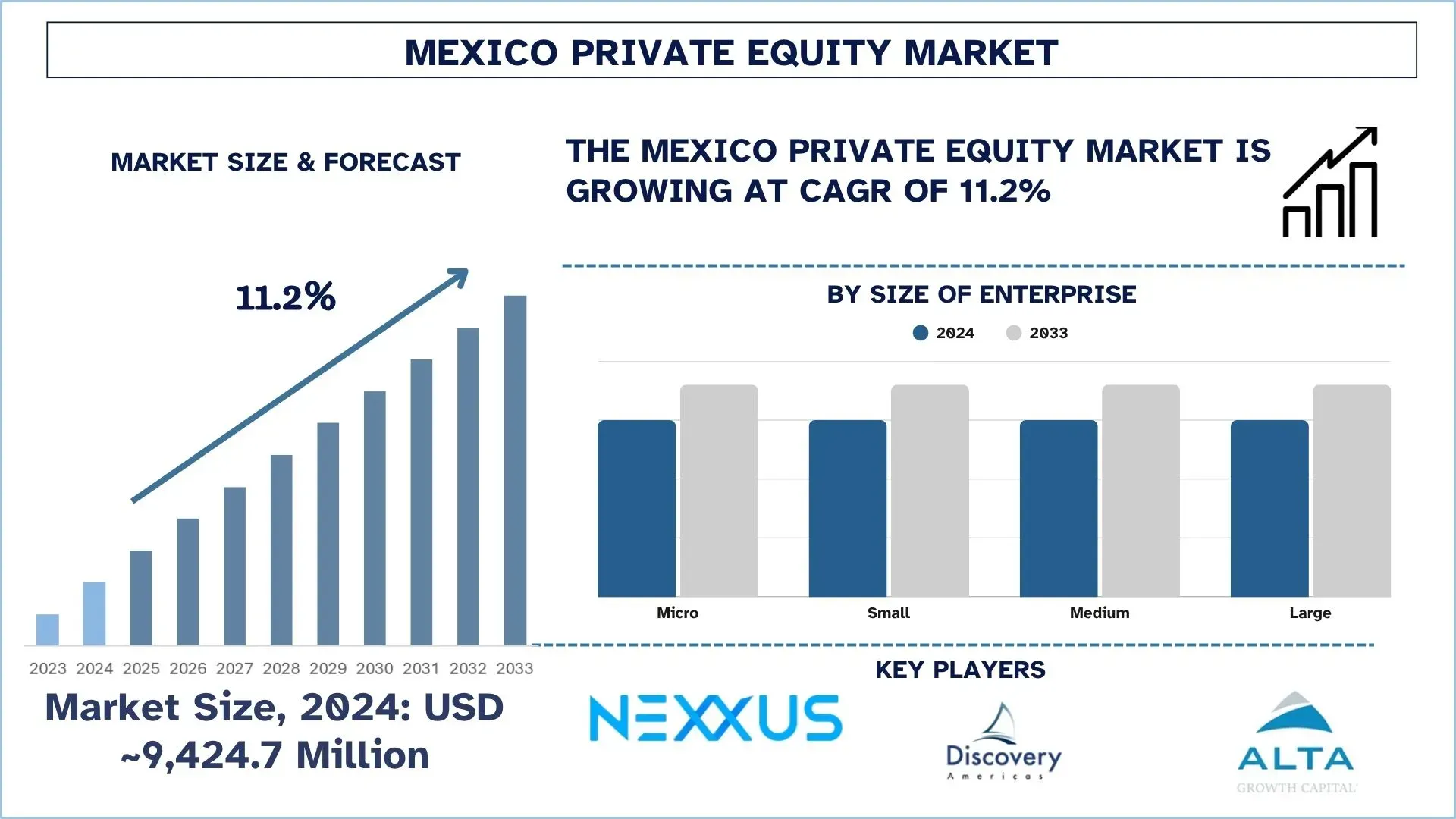

The Mexico Private Equity Market was valued at USD ~9,424.7 million in 2024 and is expected to grow to a strong CAGR of around 11.2% during the forecast period 2025-2033

Primary Driver: The boom in nearshoring is seeing extensive interest in manufacturing, logistics, and industrial real estate by private equity players.

The largest segment: The largest segment of the market is technology, consisting of fintech, SaaS, and digital platforms.

The region that Grows Fastest: Central Mexico, having its industrial hubs, infrastructure, and geographic position to the U.S trade frontiers.

The best sector Opportunities in PE: Fintech, healthcare, logistics, and SMEs growth.

Increasing Investor Activity: Cross-border activity, private credit, and mid-point trading.

The Mexican private equity (PE) market forms an important part of the Latin American investment ecosystem; it has a strong mix of local and international investment potential to offer to investors. The market mainly consists of investments in non-publicly traded companies in sectors, which include industrial manufacturing, logistics, fintech, healthcare, real estate, and consumer goods. The PE firms located in Mexico usually work on buyouts, growth equity, venture capital, and private credit transactions. The market is maturing gradually, and this has been enabled by, among other things, the economic diversification of the country, the young, expanding population, and the evolution of the local institutional investors, including pension funds (AFORES).

Mexico’s private equity (PE) market is a vital part of Latin America’s investment ecosystem, offering robust opportunities for domestic and international investors. The market is primarily defined by investments in non-publicly traded companies across sectors such as industrial manufacturing, logistics, fintech, healthcare, real estate, and consumer goods. PE firms in Mexico typically engage in buyouts, growth equity, venture capital, and private credit deals. The market has been steadily maturing, supported by the country’s economic diversification, young and growing population, and the development of local institutional investors such as pension funds (AFORES).

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/mexico-private-equity-market?popup=report-enquiry

In Mexico, digital financial services and fintech represent the fastest-growing category in the overall private equity setting, as the number of underbanked individuals, mobile-first businesses, and an investor base to front financial inclusion approaches is huge. Such fast-growing platforms still command a lot of investment money as they are vastly expanding and exploiting the regulatory exposure and changes in technology acceptance.

Segments that transform the industry

Based on Size of Enterprise, the market is segmented into Micro, Small, Medium, and Large. Among these, the Medium segment is leading the market. The main push behind the medium-sized enterprise within the Mexican sphere of private equity is that they have a high growth DP and augmented formalization. Such companies are not in the early risk period and have consistent cash flows and scalable models, which is why they become good targets to invest in. Besides, the medium enterprises are also getting increasingly high standards of governance, digital applications, and financial reporting, which improves their external capital potential. These companies are considered by the private equity firms as the best platforms to expand into new markets or verticals, as Mexico undergoes the process of economic decentralization and diversification in sectors. Maturity due to an established operation with the potential to maintain and grow is also a desirable feature that makes medium-sized companies a key target for the local and cross-border PE investors.

Click here to view the Report Description & TOC: https://univdatos.com/reports/mexico-private-equity-market

According to the report, the impact of Mexico Private Equity has been identified to be high for the Central Mexico area:

Central Mexico is a crucial part of the region in terms of the private equity of Mexico, as it is the place that is being driven towards investments in subjects of the industrial and manufacturing sector, the logistics industry, and technology. The strategic position of the region, which links the export centers in the north with the supply chains of the south, offers the region a high appeal to the domestic and international private equity firms. Important states that provide modern infrastructure, industrial parks, and a skilled labor force are Queretaro, Guanajuato, and Mexico City, and it is these states that have seen their businesses develop rapidly. This has contributed to the increasing trend of medium-sized companies that require growth capital, particularly in the automotive, aerospace, and technology services. Moreover, Central Mexico is a region of a relatively stable business environment and access to regulatory bodies, and is located near capital markets, hence being a prime region when it comes to deal flow within the emerging Mexican private equity landscape.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Size of Enterprise, by Sector, by Region

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness